Connecticut homeowners are overpaying for insurance by an average of $400 annually. With rates ranging from $811 to $2,737 per year, depending on your insurer and location, finding cheap home insurance in CT has never been more critical.

The Problem: Connecticut Home Insurance Costs Are Rising Fast

Connecticut homeowners face a perfect storm of rising insurance costs. The average annual premium has climbed to $1,676 statewide, with some cities like New Haven seeing rates as high as $2,370 per year. Inflation, severe weather events, and increased rebuilding costs have pushed many insurers to raise rates by 15-20% in recent years.

Many Connecticut residents don’t realize they’re paying premium prices for basic coverage. The difference between the most expensive and cheapest insurers can be over $1,400 annually for identical coverage, money that could stay in your pocket with proper comparison shopping.

What Makes Home Insurance Expensive in Connecticut?

Understanding the factors that drive up insurance costs in the Constitution State can help you make smarter choices:

Geographic Risk Factors

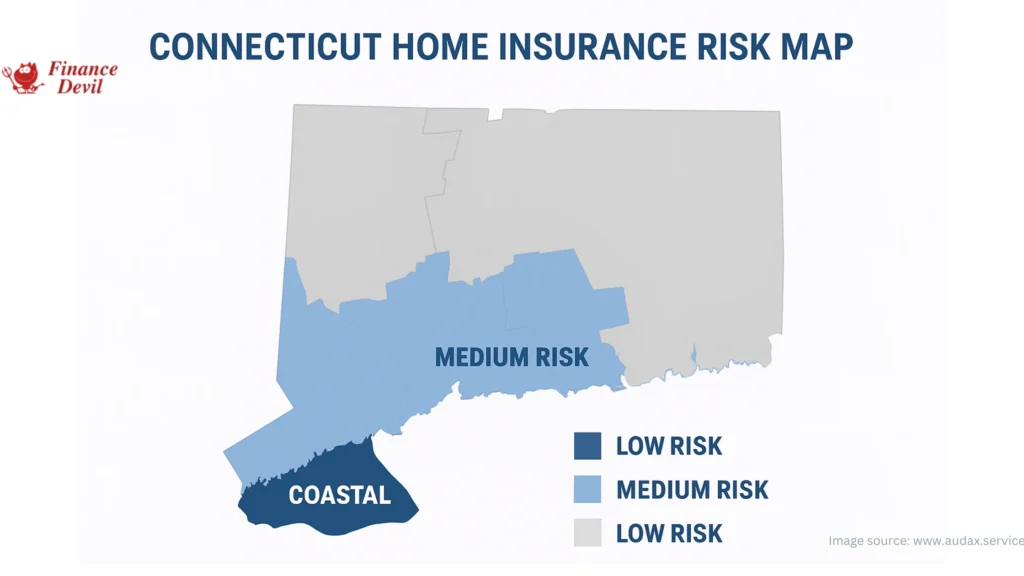

- Coastal exposure: 60% of Connecticut residents live within 20 miles of the coast, increasing flood and wind damage risks

- Winter weather: Heavy snow loads and ice dams cause millions in annual claims

- Dense population: Higher property values in areas like Fairfield County drive up replacement costs

Market Conditions

- Reduced competition: Some national insurers have pulled back from coastal markets

- Inflation impact: Building materials costs increased 35% between 2020-2024

- Climate change: Increased frequency of severe weather events

The Cheapest Home Insurance Companies in Connecticut (2025)

Based on comprehensive rate analysis from multiple sources, here are the most affordable options for Connecticut homeowners:

| Insurance Company | Average Annual Premium | Monthly Cost | Savings vs. State Average |

| Vermont Mutual | $811 | $68 | -$865 |

| USAA* | $944 | $79 | -$732 |

| Narragansett Bay | $1,357 | $113 | -$319 |

| Amica | $1,504 | $125 | -$172 |

| State Farm | $1,817 | $151 | +$141 |

*USAA is available only to military members, veterans, and their families

Top Budget-Friendly Insurers Detailed

1. Vermont Mutual – Best Overall Value

- Average rate: $811/year ($68/month)

- Best for: Rural and suburban homeowners seeking basic coverage

- Pros: Excellent regional reputation, competitive rates, solid customer service

- Cons: Limited to the New England region, fewer digital tools

2. USAA – Best for Military Families

- Average rate: $944/year ($79/month)

- Best for: Active military, veterans, and military families

- Pros: Exceptional customer service, military-specific coverage options, low rates

- Cons: Restricted eligibility, no local agents

3. Narragansett Bay – Best Regional Option

- Average rate: $1,357/year ($113/month)

- Best for: Homeowners prioritizing customer service and regional expertise

- Pros: Well below the national average, excellent local knowledge

- Cons: No auto insurance bundling, limited geographic availability

Cheap Home Insurance CT Rates by City

Insurance costs vary significantly across Connecticut. Here’s what homeowners pay in major cities:

Most Affordable Cities

| City | Average Annual Rate | Best Insurer |

| Hartford | $1,450-$1,845 | Farmers |

| Waterbury | $1,612-$1,985 | Farmers |

| Stamford | $1,458-$2,180 | Farmers |

Most Expensive Cities

| City | Average Annual Rate | Cheapest Option |

| New Haven | $1,824-$2,737 | Allstate |

| Bridgeport | $1,708-$2,532 | State Farm |

| Norwalk | $2,010+ | Amica |

Pro Tip: Urban areas typically cost 20-40% more than rural locations due to higher property values and crime rates.

How to Find the Cheapest Home Insurance in Connecticut

Step 1: Determine Your Coverage Needs

Before shopping, establish your baseline requirements:

- Dwelling coverage: Should equal your home’s replacement cost (not market value)

- Personal property: Typically 50-70% of dwelling coverage

- Liability coverage: Minimum $300,000 recommended in Connecticut

- Deductible: Higher deductibles (1-2% of dwelling value) lower premiums

Step 2: Compare Apples to Apples

When getting quotes, ensure identical coverage limits:

- Same dwelling amount

- Same deductible

- Same liability limits

- Same optional coverages

Step 3: Shop Multiple Channels

- Direct insurers: Often offer lower rates by cutting out agent commissions

- Independent agents: Can compare multiple companies quickly

- Online comparison sites: Convenient but may not include all insurers

- Captive agents: Represent single companies but offer personalized service

Step 4: Ask About Every Available Discount

Connecticut insurers offer numerous discounts that can reduce your premium by 5-25%:

Security Discounts

- Burglar alarm: 5-10% savings

- Fire/smoke detection: 3-7% savings

- Sprinkler system: 5-15% savings

- Gated community: 2-5% savings

Home Characteristics

- New home: 8-15% for homes under 5 years old

- Claims-free: 5-12% for 3-5 years without claims

- Roof age: 5-10% for roofs under 10 years old

- Impact-resistant materials: 5-15% in some areas

Lifestyle Discounts

- Non-smoker: 2-5% savings

- Senior citizen: 5-10% for age 55+

- Professional affiliation: Various group discounts available

Bundle and Save: Home + Auto Insurance in Connecticut

Bundling home and auto insurance can save Connecticut residents an average of $99-$400 annually. The best bundling options include:

Top Bundling Companies

- State Farm: Up to 25% discount on both policies

- Allstate: Average 16% savings on home insurance when bundled

- Farmers: Competitive bundling discounts plus loyalty rewards

- Travelers: Good bundling options with solid coverage

Important: Always compare bundled vs. separate policies – sometimes mixing insurers provides better overall value.

READ ALSO: Homeowners Insurance: Protecting Your Home with Insurance

Connecticut-Specific Coverage Considerations

Hurricane and Wind Coverage

Connecticut homes face unique risks requiring special attention:

- Hurricane deductibles: Often 2-5% of dwelling coverage

- Wind/hail coverage: Essential for coastal properties

- Flood insurance: Required in FEMA flood zones, recommended for all coastal areas

Winter Weather Protection

- Ice dam coverage: Ensure your policy covers ice dam damage

- Frozen pipe protection: Verify coverage includes gradual leaks

- Snow load: Important for older homes with lower weight ratings

Common Mistakes That Cost Connecticut Homeowners Money

1. Underinsuring Your Home

Many homeowners base coverage on purchase price rather than replacement cost. With construction costs up 35% since 2020, this gap can be devastating.

2. Ignoring Credit Score Impact

In Connecticut, poor credit can increase premiums by up to 93%. Improving your credit score from poor to good can save over $1,800 annually.

3. Setting Deductibles Too Low

Raising your deductible from $500 to $2,000 can reduce premiums by 20-30%. For a $2,000 annual premium, that’s $400-$600 in savings.

4. Not Shopping Regularly

Insurance rates change frequently. Homeowners who don’t shop every 2-3 years often miss significant savings opportunities.

5. Overlooking Regional Insurers

National brands aren’t always the cheapest. Regional insurers like Vermont Mutual and Narragansett Bay often offer superior value in Connecticut.

Special Programs for High-Risk Properties

If you’re struggling to find affordable coverage, Connecticut offers assistance:

Connecticut FAIR Plan

The Connecticut FAIR (Fair Access to Insurance Requirements) Plan provides coverage for properties that can’t obtain insurance in the voluntary market:

- Eligibility: Properties denied by at least two insurers

- Coverage: Basic protection at regulated rates

- Application: Through licensed agents or directly

Coastal Property Considerations

For properties in high-risk coastal areas:

- Wind-only policies: Sometimes more affordable than full coverage

- Excess flood coverage: Beyond NFIP limits through private insurers

- Mitigation credits: Discounts for hurricane straps, impact windows, etc.

Expert Tips to Maximize Your Savings

Timing Your Purchase

- Shop in January-March: Insurers often introduce new rates and promotions

- Avoid summer months: Hurricane season can temporarily increase rates

- Don’t wait until renewal: Start shopping 45 days before your current policy expires

Negotiation Strategies

- Use competing quotes: Leverage lower offers from other insurers

- Ask about loyalty discounts: Long-term customers often qualify for additional savings

- Review annually: Life changes may qualify you for new discounts

Technology Advantages

- Smart home discounts: IoT devices can reduce premiums

- Paperless billing: Many insurers offer 3-5% discounts

- Auto-pay: Eliminates late fees and may qualify for discounts

Red Flags: When “Cheap” Isn’t Worth It

While finding affordable coverage is important, avoid insurers with:

- Poor financial ratings: A.M. Best rating below B++

- Excessive complaints: NAIC complaint ratio above 1.0

- Poor claims handling: Low J.D. Power satisfaction scores

- Coverage gaps: Policies that exclude common Connecticut risks

The Bottom Line: Your Next Steps

Connecticut homeowners have excellent options for finding cheap, quality home insurance. With potential savings of $400-$865 annually, the time invested in comparison shopping pays significant dividends.

Take action today:

- Calculate your coverage needs using replacement cost, not market value

- Gather quotes from at least 3-4 insurers, including regional options

- Document all discounts you qualify for

- Review your credit report and address any issues

- Consider bundling if it provides overall savings

Insurance rates change daily, and the best deals often have limited availability. The sooner you start shopping, the more you can save on your Connecticut home insurance.

Ready to start saving on your Connecticut home insurance? Compare personalized quotes from top-rated insurers in your area. Most homeowners save $400+ by switching to a better policy.

Sources: Quadrant Information Services, J.D. Power 2024 Home Insurance Study, Connecticut Insurance Department, NAIC Consumer Complaint Database, AM Best Financial Strength Ratings