Private mortgage insurance (PMI) represents one of the most significant additional costs homebuyers face when purchasing a home with less than 20% down. For millions of Americans entering the housing market, understanding PMI isn’t just beneficial, it’s essential for making informed financial decisions that could save thousands of dollars over the life of a mortgage.

In today’s challenging real estate market, where the median home price hovers near $400,000 according to recent data, many first-time buyers find themselves unable to meet the traditional 20% down payment threshold. This reality makes private mortgage insurance (PMI) a critical factor in homeownership accessibility, affecting monthly budgets and long-term financial planning for countless American families.

This comprehensive guide will walk you through every aspect of private mortgage insurance (PMI), from understanding its fundamental purpose to mastering strategies for elimination. Whether you’re a first-time homebuyer trying to navigate mortgage requirements or an existing homeowner looking to remove PMI, this article provides the detailed insights you need to make confident decisions about your mortgage insurance obligations.

What Is Private Mortgage Insurance (PMI) and Why Does It Exist?

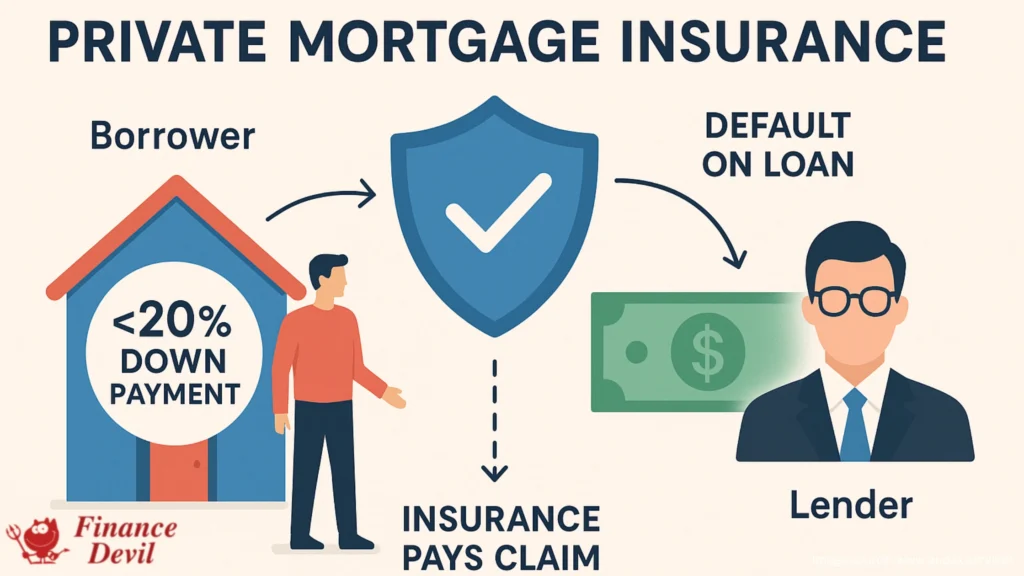

Private mortgage insurance (PMI) serves as a financial safety net for lenders when borrowers make down payments of less than 20% on conventional mortgages. Unlike government-backed loans such as FHA or VA mortgages, conventional loans rely on private insurance companies to mitigate the increased risk associated with smaller down payments.

The fundamental purpose of private mortgage insurance (PMI) centers on risk management. When borrowers put down less than 20%, lenders face higher potential losses if foreclosure occurs. PMI compensates lenders for a portion of these losses, enabling them to offer mortgages to buyers who haven’t accumulated substantial down payments.

It’s crucial to understand that PMI protects the lender, not the borrower. If you default on your mortgage, PMI won’t prevent foreclosure or protect your credit score. Instead, it ensures the lender recovers part of their loss, making them more willing to approve loans for buyers with smaller down payments.

The mortgage industry’s reliance on private mortgage insurance (PMI) has evolved significantly since the 2008 financial crisis. Today’s PMI requirements reflect stricter underwriting standards while still maintaining accessibility for qualified borrowers. This balance has helped stabilize the mortgage market while continuing to support homeownership opportunities for Americans across various income levels.

Understanding PMI Costs: What You’ll Actually Pay

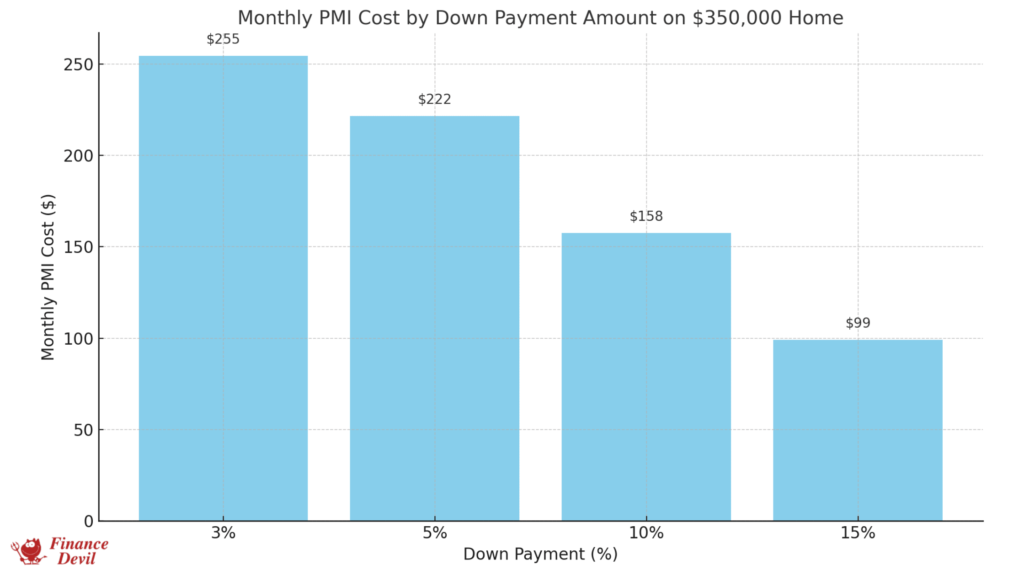

The cost of private mortgage insurance (PMI) varies considerably based on multiple factors, making it essential to understand how premiums are calculated. According to current industry data, PMI typically costs between 0.46% and 1.5% of the loan amount annually, translating to $30 to $70 per month for every $100,000 borrowed.

For a practical example, consider a $350,000 mortgage with PMI. Depending on your specific circumstances, you might pay between $160 and $440 monthly for private mortgage insurance (PMI). Over the course of several years, this represents a substantial financial commitment that directly impacts your housing budget.

Primary factors affecting PMI costs include:

Credit Score Impact: Your credit score plays the most significant role in determining PMI costs. Borrowers with scores above 760 typically qualify for the lowest rates, while those between 620-639 may pay premium rates up to 1.5% of the loan amount.

Down Payment Amount: The closer your down payment approaches 20%, the lower your PMI premium. A 15% down payment results in significantly lower PMI costs compared to a 5% down payment.

Loan-to-Value Ratio (LTV): This metric, calculated by dividing your loan amount by the home’s value, directly correlates with PMI costs. Higher LTV ratios mean higher premiums.

Mortgage Type: Adjustable-rate mortgages (ARMs) typically carry higher PMI costs than fixed-rate mortgages due to their inherent risk profile.

Understanding these cost factors helps you strategize your home purchase and potentially reduce PMI expenses through improved credit scores or larger down payments.

The Five Types of Private Mortgage Insurance (PMI)

Private mortgage insurance (PMI) isn’t a one-size-fits-all product. Understanding the different types available helps you choose the option that best aligns with your financial situation and homeownership goals.

1. Borrower-Paid Mortgage Insurance (BPMI)

Borrower-paid mortgage insurance represents the most common type of PMI. With BPMI, your monthly mortgage payment includes the insurance premium, typically added to your principal, interest, taxes, and insurance (PITI) payment.

Advantages of BPMI:

- Predictable monthly costs

- Can be canceled when you reach 20% equity

- No large upfront payment required

- Easier to track and budget for

Disadvantages of BPMI:

- Increases monthly housing costs

- Continues until equity threshold is met

- Subject to annual premium adjustments

2. Single-Premium Mortgage Insurance

Single-premium PMI requires payment of the entire insurance cost upfront, either at closing or rolled into the loan amount. This option appeals to buyers with available cash who want to minimize monthly payments.

Benefits of single-premium PMI:

- Lower overall insurance costs

- Reduced monthly payments

- Immediate equity building

Drawbacks to consider:

- Large upfront expense

- No refund if you sell or refinance early

- Requires significant cash reserves

3. Lender-Paid Mortgage Insurance (LPMI)

With lender-paid mortgage insurance, the lender covers PMI costs in exchange for a slightly higher interest rate throughout the loan term. This option, sometimes marketed as “no-PMI loans,” can be attractive for buyers prioritizing lower upfront costs.

LPMI advantages:

- No monthly PMI payments

- Lower initial monthly payments

- Simplified loan structure

LPMI considerations:

- Higher interest rate increases total loan cost

- Cannot be removed like traditional PMI

- May cost more over time than BPMI

4. Split-Premium Mortgage Insurance

Split-premium PMI combines upfront and monthly payments, offering a middle ground between single-premium and borrower-paid options. You pay a portion upfront at closing, reducing your monthly PMI payments.

Split-premium benefits:

- Lower monthly payments than BPMI

- Less cash needed upfront than single-premium

- Flexible payment structure

Potential drawbacks:

- Still requires upfront payment

- More complex than standard BPMI

- Limited availability with some lenders

5. Federal Housing Administration Mortgage Insurance Premium (MIP)

While technically not private mortgage insurance (PMI), FHA mortgage insurance premium (MIP) serves a similar function for government-backed loans. Understanding MIP helps you compare conventional loans with PMI against FHA alternatives.

MIP characteristics:

- Required regardless of down payment amount

- Includes upfront (1.75% of loan) and annual premiums (0.15% to 0.75%)

- May remain for the loan’s entire term

- Cannot be removed like conventional PMI

Comparison of Mortgage Insurance Types

| Type | Costs | Benefits | Cancellation Policy |

| Borrower-Paid PMI (BPMI) | 0.3% – 1.5% annually of loan amount, paid monthly | Lower monthly cost over time; cancellable | Can cancel at 20% equity or 78% loan-to-value (LTV) |

| Lender-Paid PMI (LPMI) | Higher interest rate instead of monthly premium | No monthly PMI payments | Not cancellable; requires refinancing |

| Single-Premium PMI | One-time upfront payment | No monthly payments; can be financed | Non-refundable; not cancellable |

| Split-Premium PMI | Upfront + lower monthly premiums | Reduced monthly burden compared to BPMI | May be cancellable depending on structure |

| FHA Mortgage Insurance | 1.75% upfront + 0.45% – 1.05% annually | Low down payment options | Cannot be canceled (unless refinancing out of FHA) |

READ ALSO: The Top Mortgage Lenders in October 2023: Finding the Ideal Mortgage

PMI Requirements Across Different Loan Types

Understanding how private mortgage insurance (PMI) requirements vary across loan types helps you make informed decisions about your mortgage options. Each loan category has distinct insurance requirements that significantly impact your overall borrowing costs.

Conventional Loans and PMI

Conventional loans require private mortgage insurance (PMI) when your down payment falls below 20% of the home’s purchase price. This requirement applies to both purchase transactions and refinances where the new loan amount exceeds 80% of the home’s current value.

Key conventional loan PMI requirements:

- Mandatory for LTV ratios above 80%

- Can be canceled when LTV reaches 80%

- Must be automatically terminated at 78% LTV

- Removal requests may require appraisals

FHA Loans and Mortgage Insurance Premium

FHA loans include mortgage insurance premium (MIP) rather than traditional PMI. This government-backed insurance has different rules and costs compared to private mortgage insurance (PMI).

FHA MIP specifics:

- Upfront premium: 1.75% of loan amount

- Annual premium: 0.15% to 0.75% of loan amount

- Required for all borrowers regardless of down payment

- May be permanent with down payments under 10%

VA Loans and Funding Fees

VA loans don’t require private mortgage insurance (PMI) or MIP, but they do include a funding fee that serves a similar protective function for the government.

VA loan funding fee details:

- Ranges from 1.25% to 3.3% of loan amount

- Can be financed into the loan

- Waived for disabled veterans

- Lower for subsequent use

USDA Loans and Guarantee Fees

USDA rural development loans include guarantee fees instead of traditional private mortgage insurance (PMI).

USDA guarantee fee structure:

- Upfront fee: 0.60% to 0.65% of loan amount

- Annual fee: 0.25% to 0.35% of loan amount

- Required for all USDA borrowers

- Cannot be removed like conventional PMI

How to Calculate Your PMI Costs

Accurately calculating private mortgage insurance (PMI) costs requires understanding the various factors that influence premiums. While lenders provide specific calculations, knowing how to estimate PMI helps you budget effectively and compare loan options.

Basic PMI Calculation Formula

The fundamental formula for calculating annual PMI costs: Annual PMI = Loan Amount × PMI Rate

For monthly payments, divide the annual amount by 12. For example, with a $300,000 loan and 0.5% PMI rate:

- Annual PMI: $300,000 × 0.005 = $1,500

- Monthly PMI: $1,500 ÷ 12 = $125

Factors Affecting Your PMI Rate

Credit Score Tiers:

- 760+: 0.46% – 0.65%

- 680-759: 0.58% – 0.86%

- 620-679: 0.92% – 1.5%

Down Payment Impact:

- 15% down: Lower PMI rates

- 10% down: Moderate PMI rates

- 5% down: Higher PMI rates

Loan Type Considerations:

- Fixed-rate mortgages: Standard rates

- Adjustable-rate mortgages: Higher rates

Using PMI Calculators

Most major lenders and financial websites offer PMI calculators that provide more precise estimates based on current market rates and your specific situation. These tools typically require:

- Home purchase price

- Down payment amount

- Credit score range

- Loan type preference

Popular PMI calculator sources:

- Freddie Mac PMI calculator

- Bank and credit union websites

- Independent mortgage broker tools

Real-World PMI Calculation Example

Consider Sarah, purchasing a $400,000 home with a 10% down payment:

- Loan amount: $360,000

- Credit score: 720

- Estimated PMI rate: 0.65%

- Annual PMI: $360,000 × 0.0065 = $2,340

- Monthly PMI: $2,340 ÷ 12 = $195

Strategies to Avoid Private Mortgage Insurance (PMI)

While private mortgage insurance (PMI) enables homeownership with smaller down payments, several strategies can help you avoid this additional cost entirely. These approaches require different levels of financial preparation and market knowledge.

The 20% Down Payment Strategy

The most straightforward way to avoid private mortgage insurance (PMI) involves saving for a full 20% down payment. While challenging in today’s market, this approach eliminates PMI entirely and provides several additional benefits.

Advantages of 20% down:

- No PMI payments

- Lower monthly mortgage costs

- Immediate equity building

- Stronger purchase offers

- Better interest rates

Saving strategies for 20% down:

- Automate savings transfers

- Consider high-yield savings accounts

- Explore down payment assistance programs

- Evaluate investment account withdrawals

- Research gift funds from family

The Piggyback Loan Approach (80-10-10)

Piggyback loans, also known as 80-10-10 loans, involve taking two mortgages simultaneously to avoid private mortgage insurance (PMI). The first mortgage covers 80% of the home’s value, the second covers 10%, and you provide a 10% down payment.

How piggyback loans work:

- Primary mortgage: 80% of home value

- Second mortgage: 10% of home value

- Down payment: 10% of home value

- Result: No PMI required

Piggyback loan considerations:

- Two separate payments to manage

- Potentially higher combined interest costs

- Second mortgage often at higher rates

- More complex qualification requirements

Government-Backed Loan Alternatives

Exploring government-backed loans can help you avoid traditional private mortgage insurance (PMI) while still achieving homeownership with smaller down payments.

VA Loans for Eligible Veterans:

- No PMI or down payment required

- Competitive interest rates

- One-time funding fee instead of ongoing PMI

- Available to active-duty, veterans, and spouses

USDA Rural Development Loans:

- No down payment required in eligible areas

- Lower guarantee fees than PMI

- Income restrictions apply

- Geographic limitations to rural/suburban areas

State and Local First-Time Buyer Programs:

- Down payment assistance grants

- Reduced PMI rates

- Below-market interest rates

- Income and purchase price limits

Creative Financing Solutions

Seller-Paid PMI: Some sellers may agree to pay PMI premiums as part of negotiations, particularly in buyer’s markets. This arrangement can be structured as:

- Upfront PMI payment at closing

- Higher purchase price to cover PMI costs

- Seller credits toward monthly PMI

Family Assistance Programs:

- Family gifts for down payments

- Shared equity arrangements

- Family-backed second mortgages

- Co-borrower arrangements

How to Remove Private Mortgage Insurance (PMI)

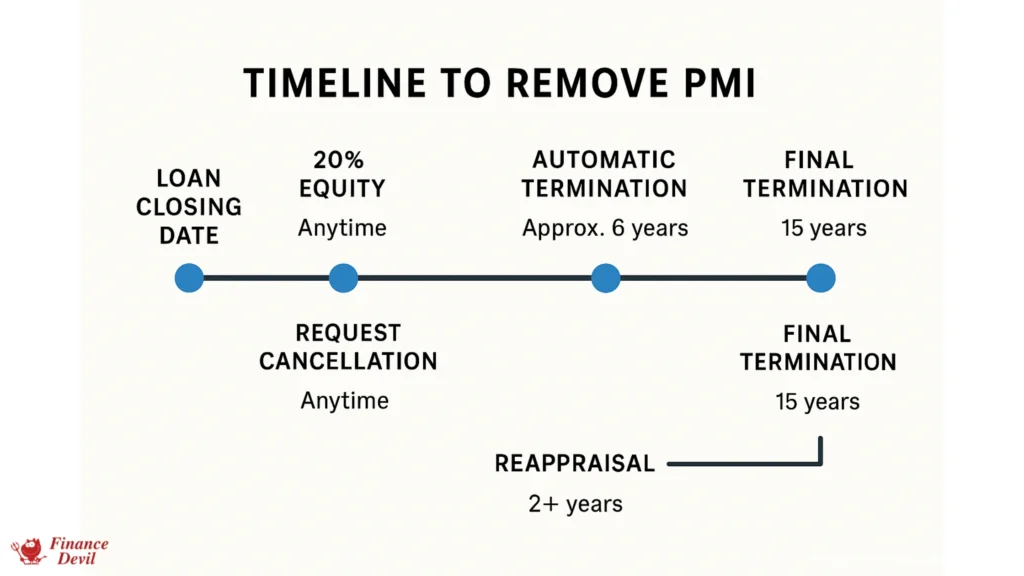

Removing private mortgage insurance (PMI) can save hundreds of dollars monthly, making understanding removal strategies crucial for homeowners. Federal law provides specific guidelines for PMI cancellation, while market conditions may offer additional opportunities for early removal.

Automatic PMI Termination

Federal law requires automatic PMI cancellation when your mortgage balance reaches 78% of the home’s original appraised value or the loan’s midpoint (15 years for a 30-year mortgage), whichever comes first.

Automatic termination requirements:

- LTV ratio must reach 78%

- Current on mortgage payments

- No second mortgages

- Lender handles cancellation automatically

Important notes about automatic termination:

- Based on original home value, not current market value

- Applies only to good payment history

- No action required from borrower

- Effective on the first day of the month following qualification

Requesting PMI Cancellation at 80% LTV

Homeowners can request PMI removal when their loan-to-value ratio reaches 80%, potentially saving money before automatic termination occurs.

Steps to request PMI cancellation:

- Calculate current LTV ratio

- Contact loan servicer in writing

- Provide payment history documentation

- May require professional appraisal

- Pay any associated fees

Lender requirements for 80% LTV cancellation:

- Good payment history (no 30-day late payments in past year)

- No 60-day late payments in past two years

- Current loan balance verification

- Possible home appraisal requirement

Reappraisal-Based PMI Removal

Rising property values may create opportunities for early PMI removal through home reappraisal, even if you haven’t reached 80% LTV through payments alone.

When to consider reappraisal:

- Home values increased significantly in your area

- Major home improvements completed

- Comparable sales show higher values

- Current LTV appears close to 80%

Reappraisal process:

- Order professional appraisal or broker price opinion

- Submit results to loan servicer

- Request PMI cancellation based on current value

- Pay appraisal costs (typically $300-600)

Reappraisal success factors:

- Recent comparable sales support higher values

- Well-maintained property condition

- Significant market appreciation

- No neighborhood depreciation factors

Refinancing to Eliminate PMI

Refinancing offers another path to PMI elimination, particularly beneficial when interest rates have dropped or home values have increased substantially.

Refinancing benefits:

- Potential interest rate reduction

- PMI elimination with 20% equity

- Simplified loan structure

- Fixed monthly payment clarity

Refinancing considerations:

- Closing costs typically 2-3% of loan amount

- New loan qualification requirements

- Current interest rate environment

- Break-even analysis essential

Home Improvement Impact on PMI Removal

Strategic home improvements can increase property value sufficiently to achieve 80% LTV and qualify for PMI removal through reappraisal.

High-value improvements:

- Kitchen renovations

- Bathroom upgrades

- Additional square footage

- Energy efficiency improvements

- Curb appeal enhancements

Documentation for improvement-based removal:

- Before and after appraisals

- Improvement cost documentation

- Contractor invoices and permits

- Comparable sales analysis

PMI vs. Alternative Mortgage Insurance Options

Understanding how private mortgage insurance (PMI) compares to other mortgage insurance types helps borrowers make informed decisions about loan products and overall costs. Each insurance type serves different borrower profiles and offers distinct advantages and limitations.

PMI vs. FHA Mortgage Insurance Premium (MIP)

The choice between conventional loans with PMI and FHA loans with MIP often depends on credit score, down payment capacity, and long-term financial goals.

PMI advantages over MIP:

- Can be removed at 80% LTV

- Lower costs for high-credit borrowers

- No upfront premium requirement

- More flexible cancellation options

MIP advantages over PMI:

- Available to lower credit score borrowers

- Lower down payment requirements (3.5%)

- Fixed premium structure

- Government backing provides stability

Cost comparison example: For a $300,000 loan:

- PMI (720 credit, 10% down): ~$125/month

- FHA MIP (620 credit, 3.5% down): ~$188/month + $5,250 upfront

Private Mortgage Insurance (PMI) vs. Lender-Paid Mortgage Insurance

Comparing borrower-paid PMI with lender-paid mortgage insurance reveals different cost structures and removal possibilities.

Long-term cost analysis:

- BPMI: Lower rate + removable = potentially less expensive

- LPMI: Higher rate + permanent = potentially more expensive over time

Cash flow considerations:

- BPMI: Higher monthly payments initially

- LPMI: Lower monthly payments throughout loan term

Flexibility factors:

- BPMI: Can be canceled with equity building

- LPMI: Requires refinancing for removal

Mortgage Insurance vs. Mortgage Life Insurance

It’s important to distinguish between mortgage insurance (which protects lenders) and mortgage life insurance (which protects borrowers and families).

Mortgage insurance characteristics:

- Protects lender from default losses

- Required by lender for high-LTV loans

- Decreases in benefit as loan balance decreases

- Cannot be removed without meeting specific criteria

Mortgage life insurance characteristics:

- Protects borrowers/families from payment inability

- Optional coverage chosen by borrower

- Pays off mortgage in event of death/disability

- Can be canceled at any time

International Perspective on Mortgage Insurance

Understanding how other countries handle mortgage insurance provides context for the U.S. system.

Canadian approach:

- CMHC insurance similar to U.S. FHA

- Private options available

- Higher minimum down payments

European models:

- Varied by country

- Often government-backed

- Different risk assessment approaches

Australian system:

- Lenders mortgage insurance (LMI)

- Borrower-paid but protects lender

- Single premium payment common

Tax Implications of Private Mortgage Insurance (PMI)

Understanding the tax treatment of private mortgage insurance (PMI) payments is crucial for accurate financial planning and maximizing potential deductions. The tax landscape for PMI has evolved significantly over recent years, with important implications for current and future homeowners.

Current PMI Tax Deductibility Status

As of the 2025 tax year, private mortgage insurance (PMI) premiums are not deductible for personal residences on federal tax returns. This represents a change from prior years when PMI deductibility was available for qualifying taxpayers.

Historical context:

- PMI was tax-deductible through 2021

- Deduction expired without congressional renewal

- Previous deduction had income limitations

- Investment properties maintain different rules

Current year implications:

- PMI payments are after-tax expenses

- No federal income tax relief for PMI costs

- State tax treatments may vary

- Increases effective cost of PMI for taxpayers

PMI Deductibility for Investment Properties

While personal residence PMI isn’t currently deductible, rental and investment property mortgage insurance may qualify as business expenses.

Investment property PMI deductions:

- Generally deductible as rental expenses

- Subject to passive activity loss rules

- Must be ordinary and necessary business expense

- Consult tax professional for specific situations

Documentation requirements:

- Maintain detailed PMI payment records

- Separate personal and investment property expenses

- Track annual PMI premium statements

- Coordinate with other rental property deductions

State Tax Considerations

Some states may offer different treatment of PMI payments, making it important to understand local tax implications.

State-specific considerations:

- Check individual state deduction rules

- Some states may not conform to federal changes

- Local property tax interactions

- Consider overall state tax burden

Planning for Future Tax Changes

Given the changing nature of PMI tax treatment, strategic planning can help homeowners adapt to potential future modifications.

Strategies for uncertainty:

- Track all PMI payments for potential retroactive deductions

- Maintain detailed records of PMI costs

- Consider timing of home purchases around tax law changes

- Explore alternative financing structures if beneficial

Comparing After-Tax Costs

Understanding the true after-tax cost of PMI helps in comparing it to alternatives like larger down payments or different loan products.

After-tax cost calculation: Since PMI isn’t currently deductible, the after-tax cost equals the actual PMI payment. However, consider:

- Opportunity cost of larger down payments

- Alternative investment returns

- Overall mortgage interest deductibility

- Total cost of homeownership

Regional Variations in PMI Costs Across the USA

Private mortgage insurance (PMI) costs can vary significantly across different regions of the United States, influenced by local housing markets, economic conditions, and regional risk factors. Understanding these variations helps homebuyers budget more accurately and compare markets effectively.

Factors Driving Regional PMI Variations

Several key factors contribute to regional differences in private mortgage insurance (PMI) costs across the United States.

Local Housing Market Conditions:

- Home price appreciation rates

- Inventory levels and competition

- Regional economic stability

- Employment market strength

Risk Assessment Factors:

- Historical foreclosure rates

- Natural disaster exposure

- Market volatility patterns

- Local lending competition

Insurance Company Presence:

- Number of PMI providers in region

- Regional underwriting guidelines

- Local market competition

- Regulatory environment variations

High-Cost PMI Markets

Certain markets typically experience higher private mortgage insurance (PMI) costs due to various risk and market factors.

Characteristics of high-cost PMI areas:

- High home price volatility

- Natural disaster exposure (hurricanes, earthquakes)

- Economic instability or declining industries

- Limited PMI provider competition

Examples of traditionally higher PMI cost regions:

- Coastal areas prone to hurricanes

- Earthquake-prone California regions

- Markets with boom-bust cycles

- Economically dependent single-industry areas

Low-Cost PMI Markets

Conversely, some regions offer more favorable private mortgage insurance (PMI) rates due to stable conditions and lower risk profiles.

Low-cost market characteristics:

- Stable home price appreciation

- Diverse economic base

- Low natural disaster risk

- Strong employment markets

Typical low-cost PMI regions:

- Midwest markets with stable economies

- Areas with consistent population growth

- Regions with diverse industries

- Markets with ample housing supply

Metropolitan vs. Rural PMI Costs

Urban and rural markets often show different PMI cost patterns based on distinct risk and market characteristics.

Metropolitan market factors:

- Higher competition among lenders

- More PMI provider options

- Greater market liquidity

- Higher home values and price volatility

Rural market considerations:

- Limited lender competition

- Fewer PMI provider options

- Lower home values but potentially higher LTV ratios

- Different risk assessment criteria

Impact of State Regulations

State-level regulations and policies can influence PMI costs and availability within their borders.

Regulatory factors affecting PMI:

- State insurance regulations

- Consumer protection laws

- Foreclosure procedures and timelines

- Property valuation requirements

State-specific considerations:

- Regulatory compliance costs

- Legal framework for PMI cancellation

- Consumer disclosure requirements

- Market entry barriers for providers

Impact of Credit Score on PMI Rates

Your credit score serves as one of the most significant factors determining private mortgage insurance (PMI) costs, often creating substantial differences in monthly premiums. Understanding this relationship empowers borrowers to make strategic decisions about credit improvement before applying for mortgages.

Credit Score Tiers and PMI Rates

PMI providers use credit score tiers to determine risk levels and corresponding premium rates, with each tier representing significantly different costs.

Excellent Credit (760+):

- PMI rates: 0.46% – 0.65% annually

- Monthly cost per $100K: $38 – $54

- Qualification for best available rates

- Maximum flexibility in loan terms

Good Credit (680-759):

- PMI rates: 0.58% – 0.86% annually

- Monthly cost per $100K: $48 – $72

- Access to competitive rates

- Good loan option availability

Fair Credit (620-679):

- PMI rates: 0.92% – 1.5% annually

- Monthly cost per $100K: $77 – $125

- Limited loan product options

- Higher overall borrowing costs

Below 620 Credit:

- May not qualify for conventional loans with PMI

- FHA loans might be necessary

- Significantly higher insurance costs

- Additional lender requirements

Real-World Credit Score Impact Example

Consider two borrowers purchasing identical $350,000 homes with 10% down payments ($315,000 loan amount):

Borrower A (780 credit score):

- PMI rate: 0.55%

- Annual PMI cost: $1,733

- Monthly PMI payment: $144

Borrower B (640 credit score):

- PMI rate: 1.25%

- Annual PMI cost: $3,938

- Monthly PMI payment: $328

Five-year cost difference: $13,200

This example demonstrates how credit scores can create dramatic differences in PMI costs over time.

Strategies for Credit Score Improvement

Improving your credit score before applying for a mortgage can result in significant PMI savings over the loan term.

Short-term credit improvement tactics:

- Pay down existing credit card balances

- Remove errors from credit reports

- Avoid new credit applications

- Pay all bills on time

- Keep existing accounts open

Long-term credit building strategies:

- Maintain low credit utilization ratios

- Diversify credit account types

- Build lengthy credit history

- Avoid frequent credit inquiries

- Monitor credit reports regularly

Timing Your Mortgage Application

Understanding how credit scores impact PMI rates helps determine optimal timing for mortgage applications.

Considerations for application timing:

- Recent credit improvements may take 30-60 days to reflect

- Avoid major credit changes during mortgage process

- Consider delaying application for significant credit repair

- Balance market conditions with credit improvement time

Pre-approval benefits:

- Understand current PMI rates based on credit score

- Identify specific improvement opportunities

- Lock in rates during credit improvement process

- Compare multiple lender offerings

Alternative Options for Lower Credit Scores

Borrowers with lower credit scores have several options beyond accepting high PMI rates.

Government-backed loan alternatives:

- FHA loans with lower credit requirements

- VA loans for eligible veterans

- USDA loans for rural properties

- State first-time buyer programs

Credit score improvement loans:

- Consider delaying home purchase for credit repair

- Explore rapid credit repair services

- Utilize credit monitoring and improvement apps

- Consult with credit counseling services

Private Mortgage Insurance (PMI) and Market Trends

The private mortgage insurance (PMI) industry continuously evolves in response to housing market conditions, regulatory changes, and economic factors. Understanding current trends and future projections helps homebuyers and homeowners make informed decisions about PMI strategies.

Current PMI Market Conditions

The PMI market in 2025 reflects several important trends affecting costs, availability, and policies.

Market consolidation effects:

- Fewer PMI providers leading to less competition

- Standardization of underwriting criteria

- Technology integration improving processing speed

- Enhanced risk assessment capabilities

Pricing trend patterns:

- Stable rates in low-risk markets

- Premium increases in high-volatility areas

- Better pricing for high-credit borrowers

- Increased scrutiny of high-LTV loans

Technology integration impacts:

- Automated underwriting systems

- Digital PMI application processes

- Real-time property valuation tools

- Enhanced fraud detection capabilities

Housing Market Impact on PMI

Broader housing market conditions significantly influence PMI pricing, availability, and policies.

Rising home prices effects:

- Increased loan amounts requiring PMI

- Faster equity building potentially reducing PMI duration

- Higher absolute PMI costs due to larger loans

- Regional variations in price appreciation impacts

Interest rate environment influence:

- Higher rates potentially reducing PMI demand

- Refinancing activity affecting PMI removal timing

- ARM vs. fixed-rate mortgage PMI pricing differences

- Overall affordability concerns affecting market

Inventory and competition factors:

- Limited inventory affecting PMI provider competition

- Seller markets influencing financing choices

- Builder incentives potentially including PMI payments

- Regional market variations in PMI availability

Regulatory and Legislative Trends

Government policies and regulations continue shaping the PMI landscape.

Consumer protection enhancements:

- Stricter disclosure requirements for PMI costs

- Enhanced cancellation rights and procedures

- Improved transparency in PMI removal processes

- Better protection against PMI overcharges

Industry regulation changes:

- Capital requirements for PMI providers

- Risk-based pricing guidelines

- Market competition preservation efforts

- Consumer education mandates

Potential future legislation:

- PMI tax deductibility restoration discussions

- Enhanced cancellation protections

- Price transparency requirements

- Alternative financing mechanism support

Emerging PMI Products and Services

Innovation in the PMI industry includes new products and services designed to meet evolving borrower needs.

Flexible PMI products:

- Split-premium options gaining popularity

- Lender-paid insurance variations

- Risk-based pricing refinements

- Technology-enabled rate adjustments

Digital transformation impacts:

- Online PMI management platforms

- Automated cancellation notifications

- Real-time equity tracking tools

- Mobile-friendly PMI services

Alternative risk transfer mechanisms:

- Capital market solutions for PMI providers

- Reinsurance market developments

- Government-sponsored enterprise changes

- International investment in U.S. PMI market

Future PMI Market Projections

Industry experts and analysts provide insights into likely PMI market developments.

Expected market evolution:

- Continued technology integration

- Enhanced risk assessment capabilities

- Greater customization of PMI products

- Improved customer service standards

Potential challenges:

- Economic volatility affecting PMI claims

- Climate change impact on risk assessments

- Regulatory compliance cost increases

- Market concentration concerns

Opportunities for borrowers:

- More competitive pricing environments

- Enhanced digital tools for PMI management

- Greater transparency in costs and processes

- Improved access to PMI alternatives

Common Mistakes to Avoid with Private Mortgage Insurance (PMI)

Understanding common pitfalls related to private mortgage insurance (PMI) helps borrowers save money and avoid unnecessary complications throughout their homeownership journey. These mistakes can cost thousands of dollars and create long-term financial burdens.

Mistake 1: Not Shopping Around for PMI Rates

Many borrowers assume all PMI rates are the same, missing opportunities for significant savings through rate comparison.

Why rate shopping matters:

- PMI rates can vary by 0.2% to 0.5% between providers

- Annual savings of $500-$1,500 possible on average loans

- Different providers offer varying cancellation policies

- Some lenders have preferred PMI relationships with better rates

How to shop effectively:

- Request PMI quotes from multiple lenders

- Compare annual percentage rates including PMI

- Evaluate cancellation policies and procedures

- Consider total cost over expected PMI payment period

Mistake 2: Forgetting to Request PMI Cancellation

Automatic PMI cancellation occurs at 78% LTV, but borrowers can request cancellation at 80% LTV, potentially saving months of unnecessary payments.

Common oversight scenarios:

- Borrowers unaware of 80% LTV option

- Assuming automatic cancellation is optimal

- Not tracking equity building progress

- Failing to account for property appreciation

Proactive cancellation strategies:

- Monitor loan-to-value ratio regularly

- Set calendar reminders for potential cancellation dates

- Maintain communication with loan servicer

- Consider property appreciation in calculations

Mistake 3: Ignoring Property Appreciation for Early Removal

Rapidly appreciating markets create opportunities for early PMI removal through reappraisal, which many homeowners overlook.

Appreciation-based removal benefits:

- Earlier PMI elimination than payment-based methods

- Significant monthly payment reductions

- Return on appraisal investment often substantial

- Improved cash flow for other purposes

When to consider reappraisal:

- Home values increased 10% or more since purchase

- Major home improvements completed

- Neighborhood shows strong appreciation trends

- Current LTV appears close to 80% threshold

Mistake 4: Choosing Wrong PMI Type for Financial Situation

Selecting inappropriate PMI structures can result in higher costs or reduced flexibility over the loan term.

Common mismatches:

- Choosing single-premium PMI without long-term commitment

- Selecting lender-paid PMI without understanding permanence

- Ignoring split-premium options when appropriate

- Not considering future financial changes

Decision-making framework:

- Evaluate available cash for upfront payments

- Consider expected homeownership duration

- Assess likelihood of refinancing or moving

- Project future equity building scenarios

Mistake 5: Not Understanding PMI Removal Requirements

Misunderstanding PMI cancellation requirements can delay removal and extend unnecessary payments.

Critical requirements often misunderstood:

- Payment history requirements (no late payments)

- Appraisal or BPO documentation needs

- Written cancellation request procedures

- Seasoning requirements for reappraisal-based removal

Best practices for removal preparation:

- Maintain excellent payment history

- Understand specific lender requirements

- Prepare documentation in advance

- Budget for appraisal costs if needed

Mistake 6: Overlooking Tax Planning Opportunities

While PMI isn’t currently tax-deductible for personal residences, proper planning can optimize overall tax situations.

Tax planning considerations:

- Timing of home purchases relative to tax law changes

- Investment property PMI deductibility opportunities

- Overall mortgage interest deduction optimization

- State tax treatment variations

Mistake 7: Failing to Factor PMI into Home Affordability

Not properly accounting for PMI costs in home affordability calculations can lead to budget strain or missed opportunities.

Affordability calculation errors:

- Only considering principal and interest payments

- Ignoring PMI duration in long-term budgeting

- Not comparing total costs across loan options

- Underestimating impact on debt-to-income ratios

Comprehensive affordability assessment:

- Include PMI in monthly payment calculations

- Project total PMI costs over payment period

- Compare scenarios with different down payments

- Factor in potential early removal opportunities

Conclusion: Making Informed Decisions About Private Mortgage Insurance (PMI)

Private mortgage insurance (PMI) represents both an opportunity and a challenge for American homebuyers. While it enables homeownership for millions who cannot make 20% down payments, it also adds significant costs to monthly mortgage payments. The key to successfully managing PMI lies in understanding its mechanics, costs, and removal strategies.

Throughout this comprehensive guide, we’ve explored the fundamental aspects of private mortgage insurance (PMI), from its basic definition and purpose to advanced strategies for elimination. The most important takeaways include understanding that PMI costs vary dramatically based on credit scores, down payment amounts, and loan characteristics, with potential monthly savings of hundreds of dollars for borrowers who optimize their approach.

The evolution of the PMI market continues to create new opportunities for borrowers. Technology improvements have streamlined application and management processes, while increased market competition has led to more favorable terms for qualified borrowers. However, the elimination of PMI tax deductibility has increased the effective cost for many homeowners, making strategic planning even more crucial.

For prospective homebuyers, the decision about PMI should be viewed as part of a comprehensive financing strategy rather than an unavoidable burden. Consider the total cost of homeownership, including PMI, against the benefits of earlier market entry and equity building. In many cases, paying PMI for several years while building equity proves more financially beneficial than waiting to save for a full 20% down payment.

Current homeowners with PMI should actively monitor their loan-to-value ratios and property values to identify removal opportunities. Whether through regular payment progression, property appreciation, or home improvements, most borrowers can eliminate PMI earlier than the automatic cancellation date. The potential savings often justify the costs of appraisals or other removal requirements.

Take Action Today:

- Calculate your current PMI costs and project when you might qualify for cancellation

- Monitor your local housing market for appreciation that could enable early PMI removal

- Review your credit score and take steps to improve it for better PMI rates if refinancing

- Contact your loan servicer if you believe you’re close to qualifying for PMI cancellation

- Consider consulting with a mortgage professional to evaluate refinancing options if your situation has significantly improved

The landscape of private mortgage insurance (PMI) will continue evolving, influenced by market conditions, regulatory changes, and technological advances. Staying informed about these developments, combined with proactive management of your PMI obligations, positions you to minimize costs and maximize the benefits of homeownership.

Remember that PMI is a temporary cost designed to facilitate homeownership, not a permanent burden. With proper planning, monitoring, and action, most homeowners can eliminate PMI within 5-7 years of purchase, often sooner in appreciating markets. The key is treating PMI as a manageable aspect of your overall mortgage strategy rather than an unchangeable expense.

For the most current information about PMI rates, requirements, and strategies specific to your situation, consider consulting with mortgage professionals or visiting authoritative sources such as the Consumer Financial Protection Bureau (CFPB) at consumerfinance.gov or Freddie Mac’s resource center at freddiemac.com.

Frequently Asked Questions About Private Mortgage Insurance (PMI)

What is private mortgage insurance (PMI) and when is it required?

Private mortgage insurance (PMI) is insurance that protects mortgage lenders when borrowers make down payments of less than 20% on conventional loans. PMI is required on conventional mortgages when the loan-to-value ratio exceeds 80%, meaning you’re borrowing more than 80% of the home’s value.

How much does private mortgage insurance (PMI) typically cost?

PMI costs typically range from 0.46% to 1.5% of the loan amount annually, or approximately $30 to $70 per month for every $100,000 borrowed. Your exact rate depends on factors including credit score, down payment amount, loan type, and loan-to-value ratio.

Can I cancel private mortgage insurance (PMI) before the automatic termination date?

Yes, you can request PMI cancellation when your loan-to-value ratio reaches 80% based on the original property value. You may also qualify for early removal through property reappraisal if your home has appreciated significantly in value, giving you 20% equity or more.

Is private mortgage insurance (PMI) tax-deductible in 2025?

No, PMI premiums are not currently tax-deductible for personal residences on federal tax returns as of 2025. However, PMI may be deductible for investment or rental properties as a business expense, and some states may have different rules.

What’s the difference between PMI and FHA mortgage insurance?

PMI applies to conventional loans and can be removed when you reach 20% equity, while FHA mortgage insurance premium (MIP) applies to FHA loans and may remain for the life of the loan depending on your down payment amount. FHA loans typically have lower credit score requirements but may cost more long-term.

How long do I have to pay private mortgage insurance (PMI)?

You’ll pay PMI until your loan-to-value ratio reaches 78% through regular payments (automatic cancellation) or when you request cancellation at 80% LTV. With home appreciation, you might be able to remove PMI earlier through reappraisal.

Are there ways to avoid private mortgage insurance (PMI) without 20% down?

Yes, alternatives include piggyback loans (80-10-10), VA loans for eligible veterans, USDA loans for rural properties, or lender-paid mortgage insurance (though this typically results in higher interest rates). Some state programs also offer reduced PMI or down payment assistance.

What happens to PMI if I refinance my mortgage?

When you refinance, your current PMI is canceled, and you’ll qualify for new PMI based on your current loan-to-value ratio and credit profile. If you have 20% or more equity in your home, you can avoid PMI on the new loan entirely.

Can my lender force me to keep PMI longer than required?

No, federal law requires automatic PMI cancellation when your loan reaches 78% of the original property value or the loan’s midpoint. However, you must be current on payments and meet other requirements. Lenders cannot legally extend PMI beyond these federally mandated termination points.

How do I know if I’m paying too much for private mortgage insurance (PMI)?

Compare your PMI rate to current market rates for borrowers with similar credit scores and loan characteristics. If rates have decreased since you obtained your loan, or if your credit has improved significantly, you might benefit from refinancing to get better PMI rates.

In another related article, Breaking Down Mortgage Loans – What Type of Credit is a Mortgage?