Introduction: Starting Your Investment Journey

Making your first investment can feel like stepping into unknown territory. Whether you’re fresh out of college, mid-career, or simply ready to grow your wealth, understanding where to begin is crucial. This comprehensive guide will walk you through the best investment options for beginners in 2025, helping you make informed decisions about your financial future.

Why Investment Matters: Building Your Financial Future

Before diving into specific investment options, it’s essential to understand why investing matters. Simply keeping your money in a basic savings account won’t help you build long-term wealth. Here’s why:

- The Power of Compound Interest: When you invest, your money generates returns that can be reinvested, creating a snowball effect. For example, a $10,000 investment earning 7% annually would grow to approximately $19,672 after 10 years through compound interest.

- Beating Inflation: With average inflation rates historically around 2-3% annually, your money loses purchasing power over time if it’s not growing at least at that rate.

- Building Long-term Wealth: Investing is one of the most reliable ways to build wealth over time and achieve financial goals like retirement, homeownership, or funding education.

Top 8 Investment Options for Beginners

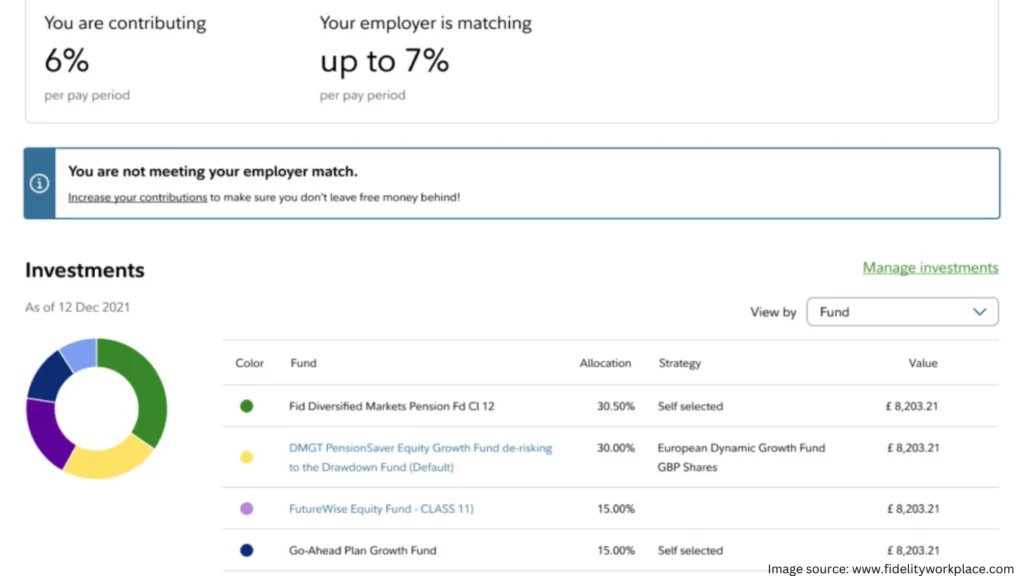

1. Employer-Sponsored Retirement Plans (401(k)s)

Why It’s Great for Beginners:

- Automatic payroll deductions make saving effortless

- Employer matching provides immediate returns (typically 50-100% of your contributions up to a certain percentage)

- Tax advantages: contributions reduce your taxable income

- Limited investment choices simplify decision-making

How to Get Started:

- Contact your HR department about enrollment

- Start with at least enough to get full employer match

- Consider target-date funds for automatic rebalancing

- Typical minimum: Often no minimum, can start with 1% of salary

2. High-Yield Savings Accounts

Perfect for:

- Emergency funds

- Short-term savings goals

- Risk-averse beginners

Key Benefits:

- FDIC insurance up to $250,000

- Higher interest rates than traditional savings accounts (currently 4-5% APY in 2025)

- Easy access to funds

- No market risk

Best Practices:

- Compare online banks for highest rates

- Watch for minimum balance requirements

- Consider linking to your primary checking account

- Use for savings you might need within 2 years

3. Robo-Advisors

Why Choose a Robo-Advisor:

- Professional portfolio management

- Low fees (typically 0.25-0.50% annually)

- Automatic rebalancing

- Easy to start with small amounts

Popular Features:

- Tax-loss harvesting

- Goal-based investing

- Regular rebalancing

- Educational resources

Getting Started:

- Research top platforms (Betterment, Wealthfront, etc.)

- Answer risk tolerance questionnaire

- Link bank account

- Start with as little as $500 or less

4. Index Funds

Benefits for Beginners:

- Broad market exposure

- Low costs (many under 0.1% expense ratio)

- Built-in diversification

- Passive management reduces errors

Popular Index Funds for Beginners:

- S&P 500 index funds

- Total market index funds

- International market index funds

- Bond index funds

Investment Strategy:

- Start with broad market funds

- Consider dollar-cost averaging

- Reinvest dividends automatically

- Hold for long-term growth

5. Exchange-Traded Funds (ETFs)

Advantages:

- Trade like stocks

- Often lower costs than mutual funds

- Flexible purchase options

- Tax efficiency

Best ETFs for Beginners:

- Broad market ETFs

- Sector-specific ETFs

- Bond ETFs

- Dividend ETFs

Investment Tips:

- Use commission-free platforms

- Consider liquidity when selecting ETFs

- Start with broad market exposure

- Understand bid-ask spreads

6. Certificates of Deposit (CDs)

Key Features:

- Fixed interest rates

- FDIC insurance

- Terms from 3 months to 5+ years

- Higher rates than savings accounts

Strategy Tips:

- CD laddering for flexibility

- Compare online banks for best rates

- Understand early withdrawal penalties

- Use for medium-term goals

7. Individual Stocks

When to Consider:

- After understanding market basics

- With money you can afford to risk

- As part of a diversified portfolio

- For long-term holding

Getting Started:

- Research fundamentals

- Start with established companies

- Use dollar-cost averaging

- Consider fractional shares

8. Target-Date Funds

Benefits:

- Automatic rebalancing

- Professional management

- Age-appropriate asset allocation

- Simple one-fund solution

Selection Criteria:

- Expense ratios

- Fund family reputation

- Asset allocation strategy

- Glide path details

Investment Strategies for Beginners

Building a Balanced Portfolio

Asset Allocation Guidelines:

- Stocks: Higher risk, higher potential return

- Bonds: Lower risk, steady income

- Cash: Emergency funds and short-term needs

Age-Based Allocation:

- 20s-30s: 80-90% stocks, 10-20% bonds

- 40s-50s: 70-80% stocks, 20-30% bonds

- 60s+: 50-60% stocks, 40-50% bonds

Risk Management

Key Principles:

- Diversification across asset classes

- Regular portfolio rebalancing

- Emergency fund maintenance

- Long-term perspective

Getting Started: Step-by-Step Guide

- Assess Your Financial Situation

- Calculate monthly income

- Track expenses

- Identify investment capital

- Set financial goals

- Choose Your Investment Platform

- Traditional brokers

- Online platforms

- Robo-advisors

- Employee benefits

- Create Your Investment Plan

- Set clear goals

- Determine time horizon

- Assess risk tolerance

- Choose investment mix

- Make Your First Investment

- Start small

- Use dollar-cost averaging

- Monitor and adjust

- Continue learning

Common Investment Mistakes to Avoid

- Investing without an emergency fund

- Chasing past performance

- Timing the market

- Neglecting diversification

- Emotional decision-making

- Forgetting about fees

- Investing without research

Conclusion: Taking Your First Steps

Starting your investment journey doesn’t have to be complicated. Begin with one or two investment types that match your goals and risk tolerance. Consider starting with your employer’s retirement plan if available, or open a robo-advisor account for automated management. As you learn more and gain confidence, you can expand your investment portfolio.

Remember: successful investing is about consistency, patience, and taking a long-term view. Start small, stay diversified, and keep learning as you go.

Ready to start investing? Open an account with a reputable broker or robo-advisor today and begin with a small monthly contribution to build your investment habit.

FAQ: Best Investments for Beginners

Q: How much money do I need to start investing?

A: You can start investing with as little as $25-50 through many robo-advisors or with fractional shares. Some workplace retirement plans allow you to begin with 1% of your salary.

Q: Should I pay off debt before investing?

A: Generally, prioritize high-interest debt (like credit cards) over investing, but consider investing while paying off lower-interest debt, especially if you have access to employer matching.

Q: How do I protect against market downturns?

A: Diversification, regular rebalancing, and maintaining a long-term perspective are key. Having an emergency fund can prevent forced selling during market dips.

Q: What’s the difference between saving and investing?

A: Saving typically involves putting money in low-risk, easily accessible accounts for short-term needs. Investing means putting money into assets with potential for higher returns over longer periods.

Q: How often should I check my investments?

A: For long-term investments, reviewing quarterly is usually sufficient. Avoid daily checking, which can lead to emotional decisions.

In another related article, The 10 Best Stocks to Buy for Growth in 2025