Stop Overpaying for Home Insurance – Here’s How Smart Homeowners Save Thousands

Are you among the 54% of American homeowners who’ve watched their insurance premiums skyrocket in the past year? While the national average for homeowners insurance has climbed to $2,397 annually, savvy homeowners are finding ways to cut costs by up to 30% without sacrificing coverage.

The secret? Choosing the right insurance company and knowing exactly what to look for.

The Problem: Why Home Insurance Costs Are Through the Roof

Home insurance premiums have surged dramatically due to several converging factors:

- Inflation Impact: Labor and building materials costs have increased by 55% between 2020 and 2022

- Climate Change: Natural disaster losses have increased 10x since the 1980s

- Supply Chain Issues: Ongoing post-pandemic material shortages drive up reconstruction costs

- Legal System Abuse: Fraudulent claims, particularly in disaster-prone areas, increase costs for all consumers

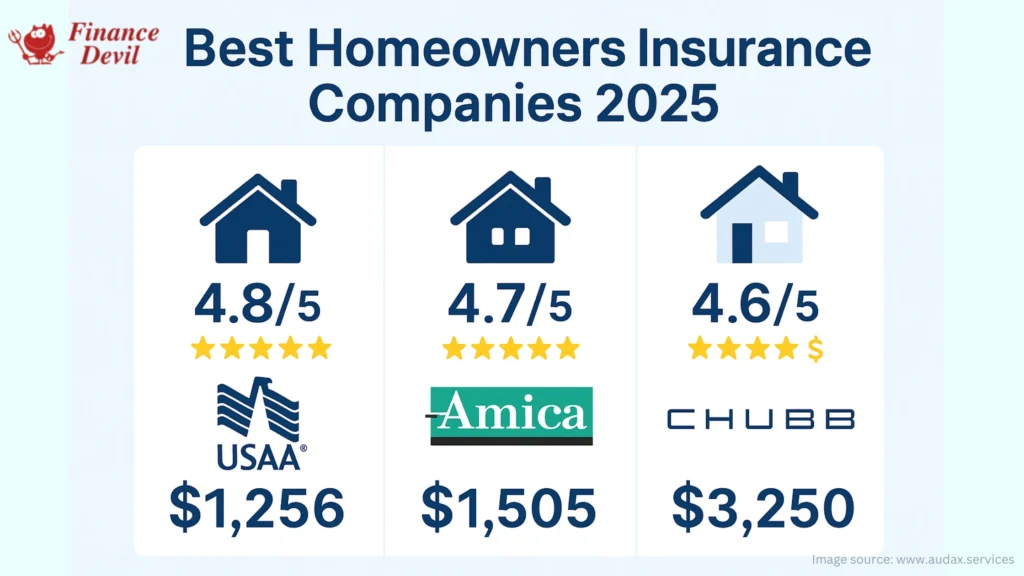

Best Homeowners Insurance Companies: 2025 Rankings

Based on a comprehensive analysis of customer satisfaction, financial strength, coverage options, and pricing, here are the top homeowners insurance companies:

1. USAA – Best Overall Homeowners Insurance

Bankrate Score: 4.8/5 | U.S. News Rating: 4.9/5

- Average Annual Premium: $1,256

- Customer Satisfaction: 746/1,000 (J.D. Power)

- Availability: All 50 states (military members, veterans, and families only)

Why USAA Leads:

- Consistently highest customer satisfaction scores for four consecutive years

- Military-focused coverage options (uniforms covered with no deductible)

- Replacement cost value and identity theft coverage included standard

- Below-average NAIC complaint index

Pros:

- Lowest average premiums among top-rated insurers

- Military-specific benefits and discounts

- Superior customer service ratings

Cons:

- Limited to military community eligibility

- Fewer discount options than some competitors

2. Amica – Best for Customer Satisfaction

Bankrate Score: 4.7/5 | U.S. News Rating: 4.8/5

- Average Annual Premium: $1,505

- Customer Satisfaction: 745/1,000 (J.D. Power)

- Availability: 48 states (excludes Alaska and Hawaii)

Why Amica Excels:

- Ranked 2nd in J.D. Power Property Claims Satisfaction Study

- Consistently top-two rankings in customer satisfaction for a decade

- “Superior” financial strength rating from AM Best

- Dividend policies may return 5-20% of premiums

Standout Features:

- Computer coverage available

- Credit card coverage included

- Special personal property insurance options

3. Chubb – Best for High-Value Homes

Bankrate Score: 4.6/5 | NerdWallet Rating: 5.0/5

- Average Annual Premium: $3,250

- Customer Satisfaction: 773/1,000 (J.D. Power) – #1 ranking

- Availability: All states (limited new policies in California)

Why Chubb Dominates Luxury Market:

- Risk consulting services for high-value properties

- HomeScan service identifies potential issues before claims

- Personal liability limits up to $100 million

- Standard extended replacement cost coverage

Premium Features:

- Wine and spirits coverage

- Complimentary home assessments

- Multiple valuables coverage options

- HO-5 all-risk coverage standard

Complete Rankings: Top 10 Best Homeowners Insurance Companies

| Rank | Company | Bankrate Score | Avg. Annual Premium | Best For |

| 1 | USAA | 4.8/5 | $1,256 | Military families |

| 2 | Amica | 4.7/5 | $1,505 | Customer satisfaction |

| 3 | Chubb | 4.6/5 | $3,250 | High-value homes |

| 4 | NJM | 4.5/5 | $836 | Discounts |

| 5 | Auto-Owners | 4.3/5 | $2,124 | Budget coverage |

| 6 | Erie | 4.3/5 | $2,565 | Customer service |

| 7 | Allstate | 4.2/5 | $2,508 | First-time homeowners |

| 8 | State Farm | 4.1/5 | $2,201 | Local agents |

| 9 | Travelers | 4.0/5 | $2,787 | Customizable coverage |

| 10 | American Family | 4.0/5 | $1,955 | Digital experience |

Based on $300K dwelling coverage policies

Regional Excellence: Best Companies by Coverage Area

Northeast Champions

- NJM: Serving CT, MD, NJ, OH, PA with premiums averaging just $836

- Concord Group: New England specialist with rates around $915

- Safety Insurance: Solid New England coverage at $1,515 average

Midwest/West Leaders

- Auto-Owners: 26-state coverage with competitive $2,124 average

- Country Financial: 19-state coverage with extensive discounts

- American Family: Strong digital experience across 19 states

National Powerhouses

- State Farm: Available in 47 states with extensive agent network

- Allstate: 49-state coverage with comprehensive digital tools

- Travelers: 45-state availability with customizable options

How to Choose the Best Homeowners Insurance Company for You

1. Assess Your Coverage Needs

Essential Calculations:

- Dwelling Coverage: Should equal 100% replacement cost (not market value)

- Personal Property: Typically 50-70% of dwelling coverage

- Liability Coverage: Minimum $300,000, but $500,000+ recommended

- Additional Living Expenses: 20-30% of dwelling coverage

Special Considerations:

- High-value items requiring scheduled coverage

- Home-based business equipment

- Geographic risks (earthquake, flood, hurricane)

2. Compare Rates Intelligently

Rate Factors That Matter Most:

- Location: Zip code can swing rates 200%+

- Home Age: Homes built after 2000 often get better rates

- Claims History: Even one claim can increase rates 20-40%

- Credit Score: Can impact rates by 50%+ in most states

- Deductible Amount: Higher deductibles = lower premiums

Smart Shopping Strategy:

- Get quotes from at least 3-5 companies

- Ensure identical coverage limits for fair comparison

- Ask about all available discounts

- Consider bundling with auto insurance

- Review and requote annually

3. Evaluate Customer Service Quality

Key Metrics to Check:

- J.D. Power Scores: Look for 700+ ratings

- NAIC Complaint Index: Under 1.0 is better than average

- AM Best Rating: A- or higher recommended

- Claims Satisfaction: How quickly and fairly claims are handled

Red Flags to Avoid:

- Companies limiting coverage in your state

- Complaint indexes above 1.5

- No local agent support when needed

- Limited digital claim filing options

Money-Saving Strategies: How to Cut Your Premium by 30%

Discount Stacking Opportunities

Universal Discounts (Most Insurers):

- Multi-policy Bundle: 5-25% savings

- Claims-free: 5-15% discount

- New Home: 5-10% savings

- Security Systems: 2-15% discount

- Smart Home Devices: 2-10% savings

Advanced Savings Tactics:

- Loyalty Programs: Some insurers reward long-term customers

- Payment Discounts: Annual vs. monthly payment savings

- Professional Discounts: Teachers, engineers, military often qualify

- Age-based Discounts: Senior citizen or mature homeowner rates

Geographic Discounts:

- Wind Mitigation (FL, TX, coastal): Up to 45% savings

- Earthquake Retrofitting (CA): Significant premium reductions

- Wildfire Defensible Space (Western states): Growing discount opportunity

Deductible Optimization

Strategic Deductible Selection:

| Deductible | Typical Savings | Best For |

| $500 | Baseline | Frequent small claims concern |

| $1,000 | 10-15% reduction | Balanced approach |

| $2,500 | 20-25% reduction | Emergency fund available |

| $5,000+ | 30%+ reduction | High net worth, self-insure mindset |

State-by-State Cost Analysis: Where You Live Matters

Most Expensive States (Annual Averages)

- Louisiana: $6,184 (hurricane risk)

- Nebraska: $6,425 (severe weather)

- Florida: $5,695 (hurricane, litigation)

- Oklahoma: $4,623 (tornado alley)

- Texas: $4,078 (weather, population)

Most Affordable States (Annual Averages)

- Vermont: $834 (low risk)

- Delaware: $964 (stable weather)

- New Hampshire: $1,036 (low claims)

- West Virginia: $1,040 (rural, stable)

- Nevada: $1,074 (desert climate)

Impact on Insurance Shopping:

- High-cost states require more aggressive rate shopping

- Regional insurers often beat nationals in expensive markets

- State-specific coverage requirements vary significantly

Critical Mistakes That Cost Homeowners Thousands

Mistake #1: Underinsuring Your Home

The Risk: 60% of homes are underinsured by an average of 22%

The Cost: Coinsurance penalties can leave you paying 30-50% of claims out-of-pocket

The Fix: Use replacement cost calculators, not market value

Mistake #2: Ignoring Policy Details

Common Oversights:

- Actual cash value vs. replacement cost coverage

- Coverage limits on high-value items

- Exclusions for home-based businesses

- Water damage coverage gaps

Mistake #3: Staying with the Same Insurer Too Long

The Problem: Loyalty rarely pays in insurance

The Data: Switchers save an average of $293 annually

The Solution: Shop rates every 1-2 years

Mistake #4: Focusing Only on Price

Why It Backfires: Cheap insurance often means poor claims service

Smart Approach: Balance cost with customer satisfaction ratings

Key Metric: Look for insurers with complaint indexes under 1.0

Expert Insights: What Industry Professionals Recommend

From Mark Friedlander, Insurance Information Institute:

“Ongoing factors impacting the home insurance market this year include escalating replacement costs, more costly severe weather events, and more people living in harm’s way of catastrophes. We project net written premium growth of 10.1% this year.”

Industry Trend Analysis:

- AI Integration: 60% of insurers now use AI for underwriting and claims

- Climate Adaptation: Insurers increasingly using satellite data for risk assessment

- Direct-to-Consumer Growth: Online-first insurers gaining market share

- Coverage Innovation: New products for smart homes, climate risks emerging

Special Situations: Tailored Insurance Solutions

First-Time Homebuyers

Best Choice: Allstate

- Welcome discount for new homeowners

- Educational resources and tools

- Extensive agent network for guidance

- Recent homebuyer discounts available

High-Value Homes ($750K+)

Best Choice: Chubb

- Extended replacement cost standard

- Personal risk consulting included

- High liability limits available

- Specialized valuables coverage

Military Families

Best Choice: USAA

- Military-specific coverage benefits

- Deployment-related protections

- Uniform coverage without deductible

- Consistently highest satisfaction ratings

Rental Property Owners

Recommended Approach:

- Landlord policies differ from homeowner policies

- Consider USAA or Allstate’s specialized programs

- Higher liability limits essential

- Short-term rental endorsements if needed

The Future of Homeowners Insurance: 2025 Trends

Technology Integration

- Smart Home Discounts: Expanding beyond basic security systems

- Drone Inspections: Faster, more accurate property assessments

- Predictive Analytics: Better risk assessment and pricing

- Digital Claims: Photo-based claim reporting becoming standard

Climate Adaptation

- Parametric Coverage: Automatic payouts based on weather data

- Resilience Incentives: Discounts for climate-resistant improvements

- Micro-Climate Pricing: Hyper-local risk assessment

Regulatory Changes

- Rate Filing Reforms: Some states streamlining approval processes

- Coverage Mandates: Increasing requirements for climate-related coverage

- Market Interventions: State-sponsored programs in high-risk areas

Take Action: Your Next Steps to Better Coverage

Immediate Actions (This Week):

- Inventory Your Home: Create/update your personal property inventory

- Review Current Policy: Check coverage limits and deductibles

- Get Three Quotes: Compare rates from top-rated insurers

Medium-Term Planning (Next Month):

- Evaluate Discounts: Audit all available savings opportunities

- Consider Bundling: Compare standalone vs. bundled rates

- Schedule Property Assessment: Ensure adequate dwelling coverage

Annual Maintenance:

- Market Rate Check: Shop rates every 12-24 months

- Coverage Review: Adjust limits for home improvements/purchases

- Claim History Impact: Monitor how claims affect your rates

Conclusion: Rates Change Daily – Lock in Your Savings Today

The homeowners insurance market is more competitive than ever, but it’s also more complex. With premiums rising 10% annually across most of the country, the cost of staying with an overpriced insurer compounds quickly.

The top-rated companies in our analysis – USAA, Amica, Chubb, and others – consistently deliver superior customer service while often providing competitive rates. However, the “best” company for you depends on your specific situation, location, and coverage needs.

Don’t wait until your renewal notice arrives. Insurance rates fluctuate frequently, and the quote you receive today might not be available next month. Take advantage of today’s competitive market to secure better coverage at a lower price.

Rates and information current as of August 2025. Individual rates may vary based on location, home characteristics, and personal factors. This article contains affiliate links that may provide compensation to help support our research and recommendations.

Frequently Asked Questions

Q: How much homeowners insurance do I need?

A: Your dwelling coverage should equal your home’s full replacement cost (not market value). Most experts recommend at least $300,000 in liability coverage, with $500,000+ for higher net worth individuals.

Q: Can I change insurance companies anytime?

A: Yes, but timing matters. You can cancel most policies with 30-60 days notice. Avoid gaps in coverage by starting your new policy before canceling the old one.

Q: What’s not covered by standard homeowners insurance?

A: Floods, earthquakes, maintenance issues, normal wear and tear, and damage from pests/rodents are typically excluded. Separate policies or endorsements are needed for flood and earthquake coverage.

Q: How often should I shop for homeowners insurance?

A: Review your rates annually and get quotes from 3-5 companies every 2-3 years, or whenever you have major life changes (marriage, home improvements, etc.).

Q: Do I need an agent or can I buy online?

A: Both work well. Online purchases often offer convenience and speed, while agents provide personalized service and can help with complex coverage needs. Choose based on your comfort level and situation complexity.

In another related article, Homeowners Insurance: Protecting Your Home with Insurance