Building credit in the United States can feel like navigating a financial maze, especially when you’re starting from scratch or recovering from past credit challenges. The good news? The right credit card can be your most powerful tool for establishing a strong credit foundation. With over 200 million Americans holding at least one credit card, choosing the best credit cards for building credit has never been more crucial for your financial future.

Whether you’re a college student getting your first taste of financial independence, someone who’s new to the U.S. credit system, or working to rebuild after financial setbacks, this comprehensive guide will help you navigate the landscape of credit-building cards available in 2025. We’ll explore everything from secured cards that require deposits to innovative alternatives that don’t require traditional credit checks.

Understanding Credit Building: Your Foundation for Financial Success

Before diving into specific card recommendations, it’s essential to understand what “building credit” actually means in the American financial system. Building credit is the process of establishing a positive payment history and demonstrating your ability to manage borrowed money responsibly. This history is compiled by three major credit bureaus: Experian, Equifax, and TransUnion.

Your credit journey typically falls into one of three categories:

No Credit History: You’re starting completely fresh with no previous credit accounts or payment history. This affects approximately 26 million Americans, according to recent Consumer Financial Protection Bureau data.

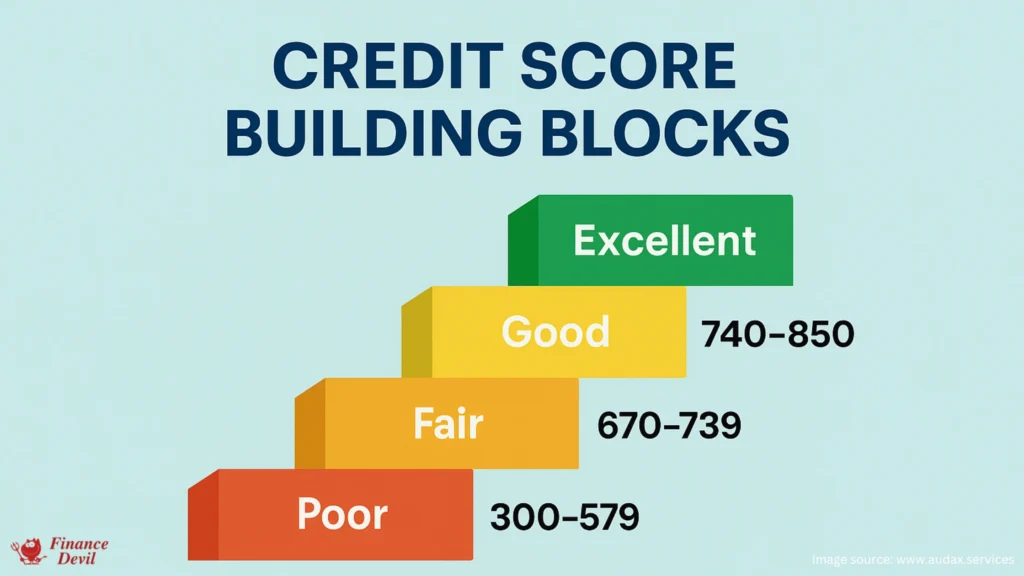

Fair Credit (580-669 FICO Score): You have some credit history but may have had late payments, high utilization, or limited credit accounts. About 17% of Americans fall into this range.

Poor Credit (Below 580 FICO Score): Previous financial difficulties have resulted in missed payments, defaults, or other negative marks. Roughly 16% of the U.S. population has poor credit.

The Credit Score Impact

Your credit score affects nearly every aspect of your financial life in America. Beyond qualifying for better credit cards, a strong credit score can:

- Save you thousands on mortgage interest rates (a 100-point score difference can mean $50,000+ in lifetime savings)

- Reduce auto loan rates by 2-5 percentage points

- Eliminate security deposits for utilities and cell phone plans

- Improve your chances of apartment approval

- Potentially influence employment opportunities in certain industries

Top Credit Cards for Building Credit in 2025

Secured Credit Cards: The Foundation Builders

Secured credit cards require a cash deposit that typically serves as your credit limit. They’re designed specifically for people building or rebuilding credit and offer the highest approval rates.

Discover it® Secured Credit Card

Best For: Secured card with rewards and upgrade path

This standout secured card offers something most competitors don’t: actual rewards. You’ll earn 2% cash back at gas stations and restaurants (up to $1,000 in combined purchases quarterly) and 1% on everything else. The annual fee is $0, and Discover automatically reviews your account after seven months for a potential upgrade to an unsecured card.

Key Features:

- No annual fee

- Rewards earning potential

- Automatic upgrade reviews starting at 7 months

- $200 minimum deposit

- Reports to all three credit bureaus

Capital One Platinum Secured Credit Card

Best For: Flexible deposit requirements

What sets this card apart is its deposit flexibility. While most secured cards require a deposit equal to your credit limit, Capital One may allow qualifying applicants to get a $200 credit line with just a $49 deposit. After six months of responsible use, you’ll be automatically considered for a credit limit increase without an additional deposit.

Key Features:

- Deposit as low as $49 for $200 credit line

- No annual fee

- Automatic credit limit increase consideration

- Free credit monitoring with CreditWise

- Fraud protection

Chime Secured Credit Builder Visa® Credit Card

Best For: No minimum deposit and automated payments

This unique card doesn’t require a minimum deposit. Instead, it uses money from your linked Chime checking account as collateral. The card charges no interest or fees and can automatically pay itself off each month, making it nearly impossible to miss payments.

Key Features:

- No minimum deposit required

- No interest charges

- Automatic payment capability

- Must have Chime checking account

- Reports to all three bureaus

| Credit Card | Minimum Deposit | Annual Fee | Key Features |

| Discover it® Secured Credit Card | $200 | $0 | 2% cash back at gas stations/restaurants, 1% on other purchases, upgrade path |

| Capital One Platinum Secured Credit Card | $49–$200 | $0 | Low minimum deposit, automatic credit limit increases, free credit monitoring |

| Chime Secured Credit Builder Visa® | No minimum | $0 | No interest charges, automatic payments, no credit check, linked to Chime account |

| OpenSky® Secured Visa® Credit Card | $200 | $35 | No credit check required, reports to all three bureaus, flexible approval |

| Citi® Secured Mastercard® | $200 | $0 | Reports to all three bureaus, access to Citi Identity Theft Solutions |

| Bank of America® Customized Cash Rewards Secured | $300 | $0 | 3% cash back in a chosen category, 2% at grocery stores/wholesale clubs, 1% base |

Student Credit Cards: Academic Advantage

Student credit cards are designed specifically for college students and often have more lenient approval requirements since issuers view students as valuable long-term customers.

Discover it® Student Chrome

Best For: Simple rewards structure for students

This student-focused card eliminates the complexity of rotating categories while still offering meaningful rewards. You’ll earn 2% cash back at gas stations and restaurants (up to $1,000 combined quarterly) and 1% on everything else. Plus, Discover matches all cash back earned in your first year.

Key Features:

- No annual fee

- Cashback Match for first year

- No FICO score required to apply

- Free first late payment forgiveness

- 0% intro APR on purchases for 6 months

Unsecured Cards for Credit Building

These cards don’t require a security deposit but typically have stricter approval requirements than secured cards.

Chase Freedom Rise®

Best For: No-deposit card with rewards and upgrade potential

This relatively new offering from Chase targets credit newcomers with a compelling value proposition. There’s no annual fee, no security deposit required, and you’ll earn 1.5% cash back on all purchases. Chase reviews accounts annually for potential upgrades to premium cards.

Key Features:

- No annual fee or security deposit

- 1.5% cash back on all purchases

- $25 statement credit for setting up autopay

- Automatic upgrade consideration

- Having a Chase bank account improves approval odds

Upgrade Cash Rewards Visa®

Best For: Flexible payment structure

This innovative card combines features of a credit card and personal loan. Any balance you carry is automatically converted to fixed monthly payments, helping you avoid the revolving debt trap that many credit builders fall into.

Key Features:

- 1.5% cash back on all purchases

- Fixed payment structure for balances

- No annual fee

- Prequalification available

- 14.99%-29.99% APR range

Alternative Credit Building Options

Current Build Card

Best For: No credit check required

This innovative card doesn’t require a credit check and has no minimum security deposit. Instead of traditional credit evaluation, Current focuses on your banking relationship and spending patterns.

Key Features:

- No credit check required

- No minimum security deposit

- Earns points on purchases

- Direct deposit gets paid 2 days early

- No APR (functions more like a charge card)

Grow Credit Mastercard

Best For: Building credit through subscriptions

This unique card allows you to build credit by paying for subscriptions like Netflix, Spotify, or your cell phone bill. While usage is limited, it’s an excellent option for people who want to build credit with expenses they’re already paying.

Key Features:

- No interest charges

- Limited to subscription payments

- Reports to all three bureaus

- Multiple membership tiers available

- No hard credit check

How to Choose the Best Credit Card for Your Situation

Assess Your Credit Starting Point

Before applying for any card, understand where you stand:

- Check your credit reports from all three bureaus for free at AnnualCreditReport.com

- Get your credit score through free services like Credit Karma or NerdWallet

- Identify any errors on your reports and dispute them

- Understand your credit category (no credit, fair credit, or poor credit)

Consider Your Financial Goals

Different cards serve different purposes in your credit-building journey:

Immediate Credit Building: Secured cards offer the fastest path to establishing credit history

Long-term Value: Look for cards with upgrade paths and rewards programs

Convenience: Consider features like mobile apps, automatic payments, and customer service quality

Cost Management: Factor in annual fees, interest rates, and additional charges

Evaluate Key Features

When comparing credit cards for building credit, prioritize these features:

Credit Bureau Reporting

Ensure any card you consider reports to all three major credit bureaus (Experian, Equifax, and TransUnion). This comprehensive reporting gives you the best chance of building a strong credit profile.

Prequalification Tools

Many issuers offer prequalification that lets you check your approval odds without a hard credit inquiry. This is especially valuable when you’re building credit and want to avoid unnecessary hits to your score.

Graduation Policies

Look for cards that offer clear paths to upgrade to better products. Some issuers automatically review accounts for upgrades, while others require you to apply for new cards.

Fee Structure

While some fees are acceptable for credit-building cards, avoid cards with excessive charges like monthly maintenance fees or high foreign transaction fees.

Strategies for Maximum Credit Building Success

The 30/10 Rule for Credit Utilization

One of the most crucial factors in your credit score is credit utilization – the percentage of available credit you’re using. Follow these guidelines:

- Keep total utilization below 30% of your available credit

- Aim for under 10% for optimal scoring

- Pay balances before statement closing dates to report lower utilization

For example, if you have a $500 credit limit, try to keep your balance below $50 when your statement closes.

Strategic Payment Timing

While you should always pay at least the minimum by the due date, strategic timing can boost your credit building:

- Pay before the statement closing date to report low utilization

- Set up automatic payments to never miss due dates

- Make multiple payments per month if you’re actively using the card

Building a Positive Payment History

Payment history accounts for 35% of your FICO score, making it the most important factor. Here’s how to build a strong payment history:

- Set up automatic payments for at least the minimum amount

- Use calendar reminders for manual payments

- Pay more than the minimum when possible

- Keep accounts active with small, regular purchases

The Path to Credit Graduation

Your credit-building card is a stepping stone, not a permanent solution. Plan your graduation strategy:

Months 1-6: Focus on establishing consistent payment history

Months 6-12: Request credit limit increases and monitor score improvements

Month 12+: Apply for better cards or request upgrades from your current issuer

Common Credit Building Mistakes to Avoid

Mistake 1: Applying for Too Many Cards

Each credit application generates a hard inquiry that can temporarily lower your score. When building credit, limit applications to 1-2 cards per year.

Mistake 2: Closing Your First Card Too Soon

Your credit history length matters for your score. Even after upgrading to better cards, consider keeping your first account open, especially if it has no annual fee.

Mistake 3: Ignoring Credit Monitoring

Regularly monitoring your credit helps you:

- Track your progress

- Spot errors or fraud quickly

- Understand which actions improve your score most

Mistake 4: Focusing Only on Credit Cards

While credit cards are excellent for building credit, also consider:

- Student loans (if applicable)

- Auto loans

- Secured personal loans

- Authorized user status on family members’ accounts

Regional Considerations for Credit Building in the USA

State-Specific Regulations

Some states have additional consumer protections for credit products:

California: Enhanced disclosure requirements for secured cards

New York: Additional cooling-off periods for certain credit products

Texas: Specific regulations on credit repair services and predatory lending

Local Credit Union Options

Many regions have credit unions offering specialized credit-building products:

- Navy Federal Credit Union: Serves military members nationwide

- State Employees’ Credit Union (NC): Offers innovative credit-building tools

- Local community credit unions: Often provide personalized credit counseling

The Future of Credit Building in America

Emerging Trends

The credit-building landscape continues to evolve with new technologies and approaches:

Alternative Data Usage: More lenders are considering rent payments, utility bills, and streaming subscriptions in credit decisions

Fintech Innovation: Companies like Chime and Current are reimagining how credit building works

AI-Powered Underwriting: Advanced algorithms are making credit more accessible to underserved populations

Legislative Changes

Recent and proposed changes affecting credit building include:

- Enhanced protections for secured cardholders

- Improved credit reporting accuracy requirements

- Potential changes to credit score calculation methods

Conclusion: Your Credit Building Journey Starts Now

Building credit in America is a marathon, not a sprint, but choosing the right credit card can accelerate your journey to financial success. The best credit cards for building credit in 2025 offer a combination of accessibility, reasonable costs, and features that support your long-term financial goals.

Whether you choose a secured card like the Discover it® Secured for its rewards and upgrade path, a student card like the Discover it® Student Chrome for its simplicity, or an innovative option like the Current Build Card for its accessibility, the key is to start building your credit history today.

Remember these essential principles:

- Always pay on time and in full when possible

- Keep credit utilization low (under 30%, ideally under 10%)

- Monitor your credit regularly to track progress

- Plan for graduation to better credit products

- Avoid common mistakes that can derail your progress

Your credit score will open doors to better interest rates, premium credit cards, and improved financial opportunities throughout your life. The sooner you start building credit responsibly, the sooner you’ll enjoy the benefits of a strong credit profile.

Ready to start building your credit? Compare the cards mentioned in this guide, check your current credit status, and apply for the option that best fits your situation. Your future financial self will thank you for taking this important step today.

Frequently Asked Questions About Building Credit

How long does it take to build credit from scratch?

Most people can establish a basic credit score within 3-6 months of responsible credit card use. However, building good to excellent credit (700+) typically takes 12-24 months of consistent positive payment history and low credit utilization.

Can I build credit without a Social Security number?

Yes, but it’s more challenging. Some options include:

- Individual Taxpayer Identification Number (ITIN) credit cards

- Secured credit cards that accept ITINs

- Becoming an authorized user on someone else’s account

- Using alternative credit-building services

Should I carry a balance to build credit faster?

No, this is a common myth. Carrying a balance doesn’t help your credit score and costs you money in interest. Always pay your full statement balance by the due date to avoid interest charges while building credit.

How many credit cards should I have when building credit?

Start with one card and focus on using it responsibly. After 6-12 months, you might consider adding a second card to increase your available credit and improve your credit mix. Most experts recommend having 2-4 credit cards total.

What’s the difference between a credit score and credit report?

Your credit report contains detailed information about your credit history, including accounts, payment history, and public records. Your credit score is a three-digit number (300-850) calculated from information in your credit report that represents your creditworthiness.

Can closing a credit card hurt my credit score?

Potentially, yes. Closing a card can:

- Reduce your available credit, increasing utilization ratios

- Shorten your average account age over time

- Reduce your total number of accounts

How often should I check my credit when building credit?

Check your credit report from each bureau at least once per year (free at AnnualCreditReport.com). For credit scores, monthly monitoring through free services can help you track your progress without impacting your score.

Is it better to get a secured card or student card?

It depends on your situation:

- Secured cards are available to anyone and offer guaranteed approval with a deposit

- Student cards are specifically for college students and don’t require deposits but have stricter eligibility requirements

Choose based on your current status and which option offers better long-term value.

For the most current rates, terms, and application requirements, always check directly with card issuers before applying. Credit approval is subject to individual creditworthiness and issuer criteria.