Could Your Smartphone Save You Hundreds on Car Insurance?

While most Americans overpay for car insurance by an average of 30%, safe drivers are discovering a different approach. Root Insurance uses your smartphone to track how you actually drive, not just who you are, to calculate your rates. But does this tech-forward model deliver real savings, or are there hidden catches?

With average full coverage costing $2,399 nationally in 2026, drivers who brake smoothly, avoid speeding, and limit nighttime driving could pay just $1,120 annually with Root, nearly half the national average. However, Root isn’t available everywhere, and risky drivers might see higher premiums.

Why Car Insurance Costs Keep Rising (And How Root Is Different)

The Traditional Insurance Problem

Standard insurers determine your rates using demographic factors that don’t always reflect your actual driving ability:

- Age discrimination: Young drivers under 25 pay $3,000+ annually

- Credit score penalties: Poor credit can double your premium

- Zip code charges: Urban residents pay significantly more

- Gender-based pricing: Men typically pay 7-14% more than women

Root flips this model by making your driving behavior the primary rating factor, potentially lowering costs for demographics that traditionally face sky-high premiums.

Root’s Telematics-First Approach

Founded in 2015, Root pioneered mobile app-based insurance evaluation. Here’s what makes it different:

- Driving data accounts for the majority of your rate calculation

- Factors like hard braking, phone distraction, speed, and time of day determine pricing

- Traditional factors (age, credit) play minimal roles

- Root only insures drivers who pass their initial evaluation

This selective approach keeps their insurance pool filled with safer drivers, theoretically benefiting everyone with lower premiums.

How Root Auto Insurance Works: The Test Drive Process

Option 1: Test Drive First (Maximum Savings)

Best for: Drivers who aren’t in a rush and want the lowest possible rate

- Download the Root app on iOS or Android

- Drive normally for 2-4 weeks while the app collects data

- Receive your personalized quote based on your driving performance

- Customize and purchase your policy if satisfied

Safe drivers using this method report savings up to $900 annually compared to traditional insurers.

Option 2: Instant Quote (Coverage Now, Discount Later)

Best for: Drivers who need immediate coverage

- Get an instant quote based on basic information

- Purchase coverage right away

- Complete test drive later to unlock safe driving discounts

- Watch your rate potentially decrease after evaluation

What the App Tracks

Root’s app monitors:

- Braking patterns: Smooth vs. hard stops

- Speed: Staying within limits

- Phone usage: Distracted driving detection

- Time of day: Nighttime driving carries higher risk

- Cornering: Sharp turns vs. gradual

- Mileage: Total distance driven

Important Note: Android users have reported occasional issues with the app mistakenly logging them as drivers when they’re passengers. Root’s customer service team actively addresses these concerns, but iOS users report a smoother experience (4.7 vs. 3.3 stars).

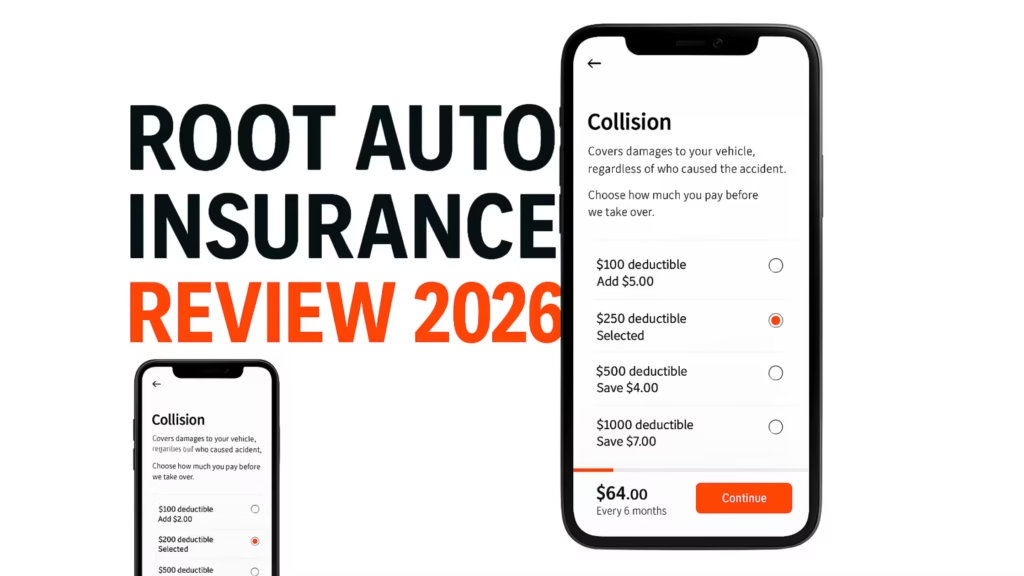

Root Insurance Coverage Options: What’s Included

Standard Coverage Available

Root offers all major auto insurance coverage types required and recommended in most states:

| Coverage Type | What It Covers | Availability |

| Bodily Injury Liability | Injuries you cause to others | All states |

| Property Damage Liability | Damage you cause to property | All states |

| Collision | Damage to your vehicle from accidents | Optional |

| Comprehensive | Non-collision damage (theft, weather, vandalism) | Optional |

| Uninsured/Underinsured Motorist | Protection from uninsured drivers | Optional/Required by state |

| Medical Payments (MedPay) | Medical costs regardless of fault | Optional |

| Personal Injury Protection (PIP) | Medical costs plus lost wages | Required in no-fault states |

| Roadside Assistance | Jump-starts, towing, lockouts | Included free (except CA, NV) |

| Rental Car Coverage | Rental reimbursement or rideshare | Optional add-on |

What Root Doesn’t Offer

Gap Insurance: Root does not provide gap coverage, a significant limitation if you’re leasing or financing your vehicle. You’ll need standalone gap insurance from another provider.

Accident Forgiveness: Unlike competitors, Root may increase your rates after an accident, even if you weren’t at fault.

Limited Add-On Options: Root’s additional coverage selections are minimal compared to carriers like State Farm or Allstate.

The Roadside Assistance Advantage

Root automatically includes 24-hour roadside assistance with every policy (except in California and Nevada), a rare industry perk. Coverage includes:

- Battery jump-starts

- Towing (up to $100 per incident)

- Fuel delivery

- Lockout assistance

- Flat tire changes

Limits: 3 incidents per vehicle per 6-month term, $100 maximum per incident

Root Insurance Cost Analysis: How Much Will You Really Pay?

National Average Comparison

| Coverage Level | National Average | Root Average | Savings with Root |

| Full Coverage | $2,399/year | $1,120/year | $1,279 (53%) |

| Minimum Coverage | $635/year | $692/year | -$57 (-9%) |

Key Insight: Root excels at full coverage pricing but costs slightly more for minimum coverage. If you only need state minimums, compare quotes from GEICO or Progressive.

How Root Compares to Major Insurers

According to independent rate analyses, Root ranks as the third-cheapest nationally for full coverage:

- American National: Data not widely available

- USAA: $1,200/year (military members only)

- Root: $1,394/year

- GEICO: $1,731/year

- Progressive: $1,960/year

- State Farm: $2,167/year

- Farmers: $2,979/year

Root averages $618 below the national average of $2,012 per year.

Demographic-Specific Savings

Root particularly benefits:

- Young adults (25 years old): Below-average rates despite high-risk age group

- Drivers with poor credit: Credit matters less than driving behavior

- Drivers with one speeding ticket: Past mistakes weigh less than current habits

- High-mileage drivers: Safe frequent drivers pay less than unsafe infrequent drivers

Sample Philadelphia Quote: In my personal test, Root quoted $1,289.40 annually for minimum coverage in Philadelphia, higher than the national minimum average due to the urban location. However, completing the test drive first could have reduced this significantly.

Root Insurance Availability: Where Can You Get Coverage?

Auto Insurance Availability (36 States)

Root auto insurance is currently available in:

Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, West Virginia, Wisconsin

States Where Root Is NOT Available

Alaska, Hawaii, Idaho, Maine, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Rhode Island, South Dakota, Vermont, Washington D.C., Wyoming

Home Insurance Note: Root partners with Homesite to offer homeowners insurance in just 17 states. However, you cannot manage home policies through the Root app; only auto insurance integrates fully with their platform.

Renters Insurance: Available in only 8 states (Arkansas, Georgia, Kentucky, Missouri, New Mexico, Ohio, Tennessee, and Utah).

What Real Root Customers Are Saying: 2,800+ Reviews Analyzed

Overall Sentiment Breakdown

After analyzing over 2,800 customer reviews across TrustPilot, Reddit, BBB, and Quora, here’s the reality check:

Top 3 Positives:

- Affordable rates for safe drivers – “My premium was lower. They are a great alternative to other insurers.” (Reddit user)

- User-friendly digital experience – “Root does and will continue to have your back…super nice to talk to a real person.” (Quora user)

- Quick sign-up process – Most users complete setup in under 5 minutes

Top 3 Negatives:

- Poor claims handling – Some customers report slow response times and difficulty reaching adjusters

- Unexpected rate increases – Premiums can jump after incidents, even non-fault accidents

- Passenger vs. driver confusion – Android app sometimes logs passengers as drivers, inflating risk scores

Third-Party Ratings

| Organization | Root’s Rating | Industry Context |

| Better Business Bureau | A- (3/5 customer rating) | BBB-accredited since 2017 |

| NAIC Complaint Index | 1.32 | Slightly above average complaints for company size |

| CRASH Network Report | C (74/97 insurers) | On par with major carriers |

| App Store (iOS) | 4.7/5 stars | Excellent user experience |

| Google Play (Android) | 3.3/5 stars | Passenger detection issues |

Notable Gap: Root is not rated by J.D. Power for customer satisfaction or AM Best for financial strength, making it harder to evaluate long-term stability compared to legacy carriers.

Cautionary Tales

Reddit Warning (February 2024): “This company is a SCAM!!!! They falsely advertise to get you in. After they collect your money, they cancel after a week… The test drive is a scam. Beware if you use GPS and you are not driving; they consider you the driver.”

Quora Complaint (February 2023): “Root sucks. I switched because I thought I was getting a better deal but ended up going back to Progressive… Canceling my policy with Root was very stressful.”

While these represent the negative extreme, they highlight potential friction points: strict eligibility enforcement and cancellation difficulties.

How to Maximize Savings with Root Insurance

1. Optimize Your Test Drive Performance

During your evaluation period:

- Brake gradually – Start slowing well before stops

- Avoid phone use – Enable Do Not Disturb while driving

- Drive during daylight – Nighttime driving increases risk scores

- Stay under speed limits – Even 5 mph over can impact your score

- Take smooth turns – Gradual acceleration/deceleration

Pro Tip: If possible, avoid driving during rush hour when stop-and-go traffic forces hard braking.

2. Bundle When Possible

Root offers a bundle discount if you combine auto and renters insurance. While home insurance is available through Homesite, bundling options are limited.

3. Install Anti-Theft Devices

According to Root, after-market anti-theft devices can save you 5-15% on premiums. Consider:

- GPS tracking systems

- Steering wheel locks

- Car alarms

- Immobilizers

4. Pay in Full or Semi-Annually

Many insurers charge fees for monthly payments. Paying 6 months upfront often reduces total costs.

5. Use Referral Rewards

Both you and the person who refers you can earn up to $100 when you sign up using a referral code.

Discounts Root Doesn’t Offer

Unlike traditional insurers, Root doesn’t provide:

- Good student discounts

- Military/veteran discounts

- Federal employee discounts

- Multi-vehicle discounts (in traditional sense)

- Homeownership discounts

Why? Root’s entire model is based on the fact that rates are already reduced for safe drivers, eliminating the need for traditional discount stacking.

Filing a Claim with Root: What to Expect

How to File

Three convenient methods:

- Root Mobile App – Answer questions and upload photos directly (fastest)

- Phone:

- New claims: 866-980-9431

- Existing claims: 866-489-1985

- Email: claims@joinroot.com

Response Time: Root claims most mobile claims receive responses within one week.

Claims Satisfaction Reality Check

Root ranked 74 out of 97 insurers in the 2025 CRASH Network Report with a C rating. While not impressive, this mirrors most major carriers; even household names rarely score above C+.

What this means: Your claims experience will likely be average, neither exceptional nor terrible. For comparison:

- GEICO: C+

- Progressive: C

- State Farm: C+

- Allstate: D+

Red Flags to Watch

Based on customer reviews:

- Some adjusters are difficult to reach

- Processing can be slow compared to digital-first promises

- Rate increases after claims are common

Root vs. Top Competitors: How Does It Stack Up?

Root vs. Lemonade

| Feature | Root | Lemonade |

| States Available | 36 | 7 (auto insurance) |

| Telematics | Required test drive | Optional usage-based program |

| Home Insurance | Partner company (Homesite) | Self-underwritten |

| Unique Perks | Free roadside assistance | Carbon offset, charity donations |

| Best For | Safe drivers seeking lowest rates | Eco-conscious, digitally savvy customers |

Winner: Root for availability and savings; Lemonade for social responsibility and home insurance integration.

Root vs. Allstate (Drivewise)

| Feature | Root | Allstate |

| Base Rates | Below national average | Significantly above average |

| Telematics Program | Mandatory for quote | Optional Drivewise program |

| Coverage Options | Limited add-ons | Extensive customization |

| Agent Support | Digital only | 10,000+ local agents |

| Best For | Budget-conscious safe drivers | Customers wanting in-person service |

Winner: Root for price; Allstate for comprehensive service and options.

Root vs. GEICO

| Feature | Root | GEICO |

| Average Full Coverage | $1,120/year | $1,731/year |

| Average Minimum Coverage | $692/year | $517/year |

| Discounts | Behavior-based only | 10+ traditional discounts |

| Financial Strength | Not rated by AM Best | A++ rating |

| Best For | Full coverage for safe drivers | Minimum coverage, financial stability |

Winner: Root for full coverage; GEICO for minimum coverage and proven stability.

Common Mistakes to Avoid When Choosing Root

Mistake 1: Not Comparing Multiple Quotes

Even if Root looks cheap, always compare at least 3-5 insurers. Rates vary wildly based on individual factors. Use comparison tools to check:

- GEICO

- Progressive

- State Farm

- Local/regional insurers

Mistake 2: Skipping the Test Drive for Immediate Coverage

If you’re not in urgent need, take the 2-4 weeks to complete the test drive first. Instant quotes don’t capture your safe driving premium reduction.

Mistake 3: Ignoring the Gap Insurance Gap

If you’re leasing or financing, confirm your lender’s gap insurance requirements. Root doesn’t offer it, so you’ll need standalone coverage; factor this into total cost comparisons.

Mistake 4: Choosing Minimum Coverage Without Understanding Risks

Minimum coverage saves money upfront but leaves you financially exposed. Consider:

- Will minimum limits cover a serious accident?

- Can you afford out-of-pocket repairs?

- What’s your personal asset risk?

Mistake 5: Not Reading Cancellation Policies

Customer complaints often center on cancellation difficulties. Before signing up:

- Understand Root’s cancellation process

- Know refund timelines

- Have backup coverage lined up if needed

Is Root Auto Insurance Right for You? The Bottom Line

Root Is Excellent For:

- Safe, defensive drivers who want their habits rewarded

- Young adults (25+) typically facing high premiums

- Tech-comfortable users who prefer app-based management

- Full coverage seekers looking for below-average rates

- Drivers with past credit issues who’ve improved their habits

- People with limited discount eligibility at traditional insurers

Root Is NOT Ideal For:

- Drivers in unavailable states (see availability section)

- Those needing gap insurance for leased/financed vehicles

- Risky drivers who speed, brake hard, or use phones while driving

- People preferring in-person agents for claims and service

- Drivers wanting accident forgiveness or extensive add-ons

- Anyone uncomfortable with location tracking via smartphone

The Verdict

Bankrate Score: 3.4/5 | U.S. News Rating: 3.3/5

Root Insurance represents a legitimate disruption in auto insurance, offering potentially massive savings for safe drivers through its behavior-based model. The ability to cut full coverage costs nearly in half makes it compelling for the right demographic.

However, limitations are real: spotty availability, minimal add-on options, no gap insurance, and mixed claims experiences mean Root won’t fit everyone. The lack of AM Best and J.D. Power ratings also creates uncertainty about long-term financial stability and customer satisfaction benchmarks.

Recommendation: If you’re a safe driver in an available state who doesn’t need gap coverage, Root deserves a quote, especially if you complete the test drive first. But always compare with at least two other insurers to ensure you’re getting the absolute best rate.

Frequently Asked Questions (FAQs)

How do I contact Root car insurance?

Phone: 866-980-9431 (Monday-Friday, 9 AM – 8 PM ET) Email: help@joinroot.com (48-hour response time) Live Chat: Available on Root’s website during business hours App Support: In-app messaging for current policyholders

Does Root Insurance affect my credit score?

Root may check your credit during the quote process, but this is typically a soft inquiry that doesn’t impact your score. More importantly, Root is phasing out credit scores as a rating factor in most states, making past credit less relevant to your premium.

Can I add my teenager to my Root policy?

Yes, you can add teen drivers to your Root policy. However, their driving behavior will also be monitored through the app. If your teen is a safe driver, this could save you money compared to traditional insurers. If not, rates may increase significantly.

What happens if I fail the Root test drive?

If your driving behavior doesn’t meet Root’s safety standards during the test drive, you won’t receive a quote. Root only insures drivers it considers low-risk. In this case, you’ll need to explore coverage with traditional insurers.

Does Root offer roadside assistance in all states?

Roadside assistance is included with every Root policy except in California and Nevada. The coverage includes jump-starts, towing (up to $100), fuel delivery, lockout assistance, and flat tire changes, limited to 3 incidents per vehicle per 6-month term.

Can I turn off the Root app when I’m not driving?

Technically yes, but this can cause issues. The app needs to run continuously to accurately distinguish when you’re driving vs. when you’re a passenger. Frequently toggling it off may result in incomplete data or misclassified trips, potentially affecting your rate.

How quickly can I get Root insurance?

If you choose the instant quote option, you can get coverage immediately, sometimes within minutes of completing the application. If you opt for the test drive first, you’ll need to wait 2-4 weeks before receiving your personalized quote.

Does Root raise rates after accidents?

Yes, Root may increase your premiums after an accident, even if you weren’t at fault. Unlike insurers offering accident forgiveness, Root doesn’t guarantee rate protection. However, safe driving behavior going forward can help mitigate increases over time.

Is Root Insurance financially stable?

Root is a publicly traded company but is not rated by AM Best for financial strength. This makes it difficult to independently verify long-term stability. For customers prioritizing financial security, carriers with A+ or higher AM Best ratings may be preferable.

Can I bundle home and auto insurance with Root?

Root auto insurance can be bundled with Root renters insurance in 8 states, offering a discount. For homeowners insurance, Root partners with Homesite in 17 states, but these policies are underwritten by Homesite, not Root, and may not offer the same app integration.

What if I move to a state where Root isn’t available?

If you move to a state where Root doesn’t operate, you’ll need to cancel your policy and find coverage with another insurer. Plan ahead to avoid a coverage gap; research options in your new state before relocating.

Does Root cover rideshare driving (Uber/Lyft)?

Root’s standard personal auto policy does not cover commercial activities like ridesharing. If you drive for Uber or Lyft, you’ll need separate commercial or rideshare insurance. Root currently does not offer these products.

Take Action: See What You Could Save Today

Insurance rates change frequently, and safe drivers with Root could be saving nearly $1,300 annually compared to the national average. Since eligibility requires passing the test drive, the sooner you start, the sooner you’ll know if Root’s model can work for your budget.

Next Steps:

- Download the Root app (iOS or Android)

- Choose your path: Test drive first for maximum savings, or get an instant quote for immediate coverage

- Compare with 2-3 other insurers to confirm you’re getting the best rate

- Review coverage carefully and ensure you’re not missing critical protections like gap insurance

Remember: Rates are personalized. The only way to know your actual Root premium is to complete their evaluation process and receive a quote.

Disclaimer: Insurance rates vary by individual circumstances, location, and coverage selections. Always compare multiple quotes and read policy documents carefully before purchasing.

In another related article, The Complete Guide to Usage-Based Insurance: Save Up to 40% on Car Insurance in 2025