Introduction

Are you one of the thousands of Connecticut drivers overpaying for car insurance? With average full coverage premiums reaching $2,715 annually in the Constitution State, significantly higher than 31 other states, many motorists are bleeding money without realizing better options exist just a few clicks away.

Here’s the reality: Connecticut drivers who compare quotes from multiple insurers save an average of $800 per year. Yet most people stick with the same provider year after year, watching their rates creep up at renewal time while more competitive options go undiscovered.

This comprehensive guide reveals exactly how to find the most affordable auto insurance in Connecticut, which providers consistently offer the lowest rates for different driver profiles, and proven strategies to reduce your premiums without sacrificing the protection you need.

Why Connecticut Auto Insurance Costs Are Rising (And What You Can Do About It)

Connecticut’s auto insurance landscape has become increasingly expensive for several key reasons:

The Fatal Crash Factor

According to the University of Connecticut’s Crash Data Repository, the state experienced 203 fatal crashes in 2024, with fatal accidents peaking at 337 in 2022. These alarming statistics directly impact insurance rates as insurers adjust premiums to reflect elevated risk levels across the state.

Urban Density and Traffic Congestion

As one of America’s most densely populated states, Connecticut faces higher frequencies of accidents, vandalism, and auto theft, particularly in urban centers. Cities like Hartford, Bridgeport and New Haven see premiums that run 26-30% higher than the state average due to concentrated risk factors.

Credit-Based Insurance Scoring

Connecticut allows insurers to use credit-based insurance scores in rate calculations. Drivers with poor credit can pay up to $1,971 more annually than those with excellent credit, a disparity that catches many residents off guard.

The good news? Understanding these cost drivers empowers you to take strategic action. By comparing quotes, maximizing discounts, and choosing the right coverage levels, Connecticut drivers can significantly offset these increases.

What Actually Affects Your Auto Insurance Rates in Connecticut

Before diving into provider comparisons, understanding how insurers calculate your premium helps you identify opportunities to save.

Age and Experience: The Numbers Tell the Story

| Driver Category | Average Annual Premium | Premium vs. State Average |

| 17-year-old (Teen) | $6,126-$6,825 | +290% to +335% |

| 25-year-old (Young Adult) | $1,816-$1,917 | +16% to +22% |

| 35-year-old (Adult) | $1,454-$1,489 | -7% to -5% |

| 60-year-old (Senior) | $1,334-$1,393 | -15% to -11% |

Teen drivers face dramatically higher premiums due to inexperience and statistically higher accident rates. However, these costs decrease substantially as drivers age and build clean driving records.

Your Driving Record: The Single Biggest Variable

The impact of violations on your Connecticut auto insurance costs:

- Clean Record: $1,567 average annual premium (baseline)

- Single Speeding Ticket: $1,776 average (+$209 annually)

- At-Fault Accident: $2,432 average (+$865 annually)

- DUI Conviction: $3,061 average (+$1,494 annually)

ZIP Code Matters More Than You Think

Location-based rate variations across Connecticut are substantial:

| City | Average Full Coverage | Difference from State Average |

| Bristol | $1,731 | -11% |

| Waterford | $2,268 | -18% |

| Hartford | $3,670 | +30% |

| Bridgeport | $3,637 | +29% |

| New Haven | $3,522 | +26% |

Urban centers consistently command higher premiums due to increased accident frequency, higher repair costs, and elevated theft rates.

Vehicle Type and Safety Features

Vehicles with lower safety ratings, higher repair costs, or elevated theft rates cost more to insure. Modern safety features like automatic emergency braking, lane departure warnings, and anti-theft systems can qualify you for discounts.

The Cheapest Auto Insurance Providers in Connecticut (2025 Rankings)

Based on comprehensive rate analysis across multiple driver profiles and coverage scenarios, here are Connecticut’s most affordable insurers:

Overall Cheapest: Geico

Average Annual Premium: $786-$1,894 (depending on coverage level)

Geico dominates Connecticut’s auto insurance market for affordability, offering the lowest sample premiums in nearly every category analyzed. The company excels particularly for:

- Clean-record drivers: $786 annually for full coverage

- Teen drivers: $2,525-$2,914 (lowest among major carriers)

- Young adults: $790-$853 (more than $1,000 below state average)

- Seniors: $775 for both male and female drivers

- Drivers with poor credit: $1,232 annually

Why Geico Stands Out:

- Highly-rated mobile app for claims and policy management

- Extensive discount offerings (federal employees, military, good students)

- Superior AM Best financial strength rating

- DriveEasy telematics program for safe driving rewards

Potential Drawbacks:

- Fewer additional coverage options than some competitors

- Below-average ranking in 2024 J.D. Power digital service study

Best for Military Families: USAA

Average Annual Premium: $1,121-$1,637

Available exclusively to military members, veterans, and their families, USAA earned the highest customer satisfaction score in the 2024 J.D. Power study. The company offers unique military-focused benefits:

- Garaging vehicle on-base discount

- MyUSAA Legacy discount for young adults previously covered under military parents

- Outstanding claims handling (745/1,000 satisfaction score)

- SafePilot telematics program

Important Note: USAA eligibility is restricted to military-affiliated individuals and their immediate families.

Most Balanced Option: State Farm

Average Annual Premium: $1,309-$3,178

State Farm, America’s largest auto insurer, provides comprehensive coverage options and extensive agent availability throughout Connecticut. The company particularly excels for:

- DUI violations: Lowest rates at $1,402 annually

- Accident forgiveness options (through agent negotiations)

- Bundling opportunities with home insurance

With agents in more than 75 Connecticut cities, State Farm appeals to drivers preferring face-to-face service over online interactions.

Best Customer Service: Amica

Average Annual Premium: $1,450-$2,816

Amica ranked first for customer satisfaction in the 2024 J.D. Power Auto Insurance Study for the New England region. Standout features include:

- Unique dividend policy paying back up to 20% of premiums annually

- Replacement cost value for new vehicles totaled within 180-365 days

- Second-place finish in 2024 J.D. Power Auto Claims Satisfaction study

- Robust coverage options and online claim center

Best for Minimum Coverage: Travelers

Average Annual Premium: $456-$1,414

Travelers dominates Connecticut’s minimum coverage market with exceptionally low rates:

- $456 annually for state minimum requirements

- $1,414 for full coverage (70-year-old drivers)

- Consistently lowest rates after accidents and violations

Connecticut Auto Insurance Requirements: What You Must Have

Connecticut mandates specific minimum coverage levels for all registered vehicles:

State-Required Minimums (25/50/25)

- Bodily Injury Liability: $25,000 per person / $50,000 per accident

- Property Damage Liability: $25,000 per accident

- Uninsured/Underinsured Motorist: $25,000 per person / $50,000 per accident

Why Minimum Coverage Usually Isn’t Enough

Consider this scenario: You cause an accident injuring two people. Medical bills, lost wages, and pain/suffering claims total $150,000. Your minimum liability coverage pays only $50,000, leaving you personally responsible for $100,000.

Insurance experts consistently recommend higher limits:

- Bodily injury liability: $100,000/$300,000

- Property damage liability: $50,000-$100,000

- Uninsured motorist coverage: $100,000/$300,000

Additional Coverage Worth Considering

Comprehensive Coverage ($500-$1,000 deductible) Protects against non-collision damage:

- Theft and vandalism

- Weather damage (hail, hurricanes, flooding)

- Falling objects

- Animal collisions

- Windshield damage

Connecticut experiences severe storms throughout summer months, making comprehensive coverage particularly valuable for drivers who cannot afford out-of-pocket repairs.

Collision Coverage ($500-$1,000 deductible) Covers vehicle damage from:

- Accidents with other vehicles

- Single-vehicle accidents

- Rollover accidents

- Pothole damage

Gap Insurance: Critical for financed or leased vehicles. If your car is totaled and you owe more than its actual cash value, gap insurance covers the difference, potentially saving thousands of dollars.

Medical Payments Coverage (MedPay): Pays medical bills and funeral costs for you and passengers regardless of fault, filling gaps in health insurance coverage.

Rental Car Reimbursement: Covers rental costs while your vehicle undergoes covered repairs, typically ranging from $30 to $50 per day.

How to Save Hundreds on Auto Insurance in Connecticut: 7 Proven Strategies

1. Compare Quotes from Multiple Insurers

The Single Most Effective Strategy

Rate variations between providers are dramatic. For the same coverage, you might receive quotes ranging from $786 to $2,274 annually, a difference of nearly $1,500. Insurance experts recommend comparing at least 3-5 quotes.

Pro Tip: Request identical coverage limits from each insurer to ensure accurate comparisons.

2. Maximize Available Discounts

Connecticut insurers offer numerous discount opportunities:

Multi-Policy/Bundling Discounts Combining auto and home insurance typically saves 15-25% on both policies.

Safe Driver Discounts Maintaining a clean driving record for 3-5 years can reduce premiums by 20-30%.

Telematics Programs

- Geico’s DriveEasy

- State Farm’s Drive Safe & Save

- USAA’s SafePilot

- Progressive’s Snapshot

These programs monitor driving habits (speed, braking, and mileage) and reward safe behavior with discounts up to 30%.

Good Student Discounts Students maintaining a B average or better qualify for 10-25% discounts.

Vehicle Safety Feature Discounts Anti-theft devices, automatic emergency braking, and other safety technologies can reduce premiums by 5-20%.

Low Mileage Discounts Driving fewer than 7,500-10,000 miles annually qualifies for reduced rates with most insurers.

Automatic Payment Discounts Setting up automatic payments and paperless billing typically saves 3-10%.

3. Strategically Adjust Your Deductible

Increasing your deductible from $250 to $500 can reduce premiums by 15-20%. Raising it to $1,000 can save 30-40%.

Important Consideration: Only select a deductible you can comfortably afford to pay immediately after an accident.

4. Improve Your Credit Score

In Connecticut, credit-based insurance scores significantly impact rates. Drivers with poor credit pay an average of $2,757 annually versus $1,567 for those with good credit, a $1,190 difference.

Credit-Improvement Actions:

- Pay bills on time consistently

- Reduce credit card balances below 30% of limits

- Don’t close old credit accounts

- Dispute credit report errors

5. Take a Defensive Driving Course

Many Connecticut insurers offer 5-15% discounts for completing approved defensive driving courses. Benefits last 3-5 years, potentially saving hundreds of dollars.

6. Review and Update Coverage Annually

Life changes affect insurance needs:

- Vehicle age (older cars may not need comprehensive/collision)

- Mileage changes (remote work reducing commute)

- Teen drivers leaving for college

- Marriage or divorce

Annual policy reviews ensure you’re not paying for unnecessary coverage.

7. Ask About Affiliation Discounts

Many insurers offer savings for:

- Alumni associations

- Professional organizations

- Employer groups

- AAA membership

- Military service (USAA, Geico)

- Federal employment (Geico)

Common Auto Insurance Mistakes Connecticut Drivers Must Avoid

Mistake 1: Accepting the First Quote

Nearly 60% of drivers never shop around, costing them an average of $800 annually. The solution? Compare at least three quotes before purchasing or renewing.

Mistake 2: Selecting Minimum Coverage Only

While state minimums satisfy legal requirements, they rarely provide adequate financial protection. One serious accident can create devastating financial consequences.

Mistake 3: Ignoring Coverage Gaps

Many drivers assume they’re fully protected without understanding policy exclusions:

- Rental car damage when traveling

- Rideshare driving (requires special endorsement)

- Custom equipment and modifications

- Personal belongings stolen from vehicles

Mistake 4: Letting Policies Auto-Renew Without Review

Insurers often increase rates at renewal, banking on customer inertia. Annual shopping can identify better rates and coverage options.

Mistake 5: Failing to Report Life Changes

Marriage, home purchase, vehicle changes, and mileage reductions can all qualify you for lower rates, but only if your insurer knows about them.

Mistake 6: Misunderstanding Deductibles

Some drivers select high deductibles for lower premiums without maintaining emergency savings to cover them. This creates financial vulnerability after accidents.

Auto Insurance for Special Situations in Connecticut

High-Risk Drivers: Connecticut AIARP

Drivers unable to obtain coverage through standard markets due to serious violations can access the Connecticut Automobile Insurance Assigned Risk Plan (CT AIARP).

Contact Information:

- Phone: 401-946-2800

- Email: ctaiarp@aipso.com

While assigned risk policies cost more than standard coverage, they provide the legally required insurance for drivers who cannot obtain it elsewhere.

Teen Drivers: Strategies to Minimize Costs

Adding a teen to your Connecticut auto insurance increases premiums by 250-300% on average. Cost-reduction strategies include:

Best Practices:

- Add teens to parent policies rather than purchasing separate coverage

- Ensure teens maintain good grades for student discounts

- Consider usage-based insurance programs to reward safe driving

- Start with an older, safe vehicle with lower insurance costs

- Emphasize defensive driving courses

Cheapest Insurers for Teen Drivers:

- Geico: $2,525-$2,914 annually

- USAA: $3,498-$3,652 annually

- State Farm: $3,578-$4,456 annually

Drivers with DUIs: Your Best Options

DUI convictions increase Connecticut auto insurance by an average of $1,494 annually. The most affordable providers for drivers with DUIs:

- State Farm: $1,402 annually (best option)

- Progressive: $2,154 annually

- USAA: $2,287 annually

- Geico: $2,697 annually

Important: DUI surcharges typically remain for 3-5 years. Maintaining a clean record during this period helps rates gradually decrease.

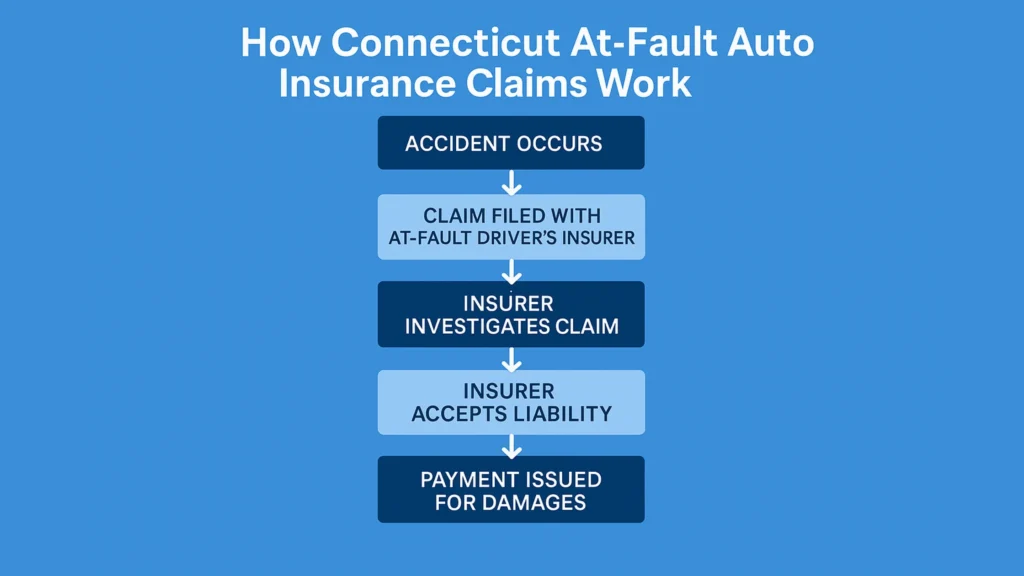

Understanding Connecticut’s At-Fault Insurance System

Connecticut operates under an at-fault insurance system, meaning the driver responsible for an accident pays for resulting damages through their liability coverage.

How At-Fault Claims Work

Scenario: You run a red light and cause an accident, injuring another driver and damaging their vehicle.

Your Liability Coverage Responds:

- Bodily injury liability pays the other driver’s medical expenses (up to policy limits)

- Property damage liability covers vehicle repairs (up to policy limits)

- Your liability coverage also pays legal defense costs if you’re sued

Your Own Damages:

- Collision coverage repairs your vehicle (minus deductible)

- Medical payments coverage addresses your injuries

- Your rates will likely increase at renewal

Uninsured/Underinsured Motorist Coverage: Critical Protection

Connecticut requires uninsured/underinsured motorist coverage because it protects you when at-fault drivers lack sufficient insurance. This coverage pays for:

- Your medical expenses and lost wages

- Passenger injuries

- Hit-and-run accidents

- Damages exceeding the at-fault driver’s liability limits

Comprehensive FAQ: Auto Insurance in Connecticut

How much is auto insurance in Connecticut per month?

Connecticut drivers pay an average of $226 per month ($2,715 annually) for full coverage and $89 per month ($1,072 annually) for minimum coverage. Individual rates vary significantly based on age, driving record, location, vehicle type, and credit score.

What is the absolute cheapest car insurance in Connecticut?

Travelers offers the lowest minimum coverage at $456 annually ($38 monthly) for a 35-year-old driver with a clean record and good credit. Geico provides the lowest full coverage at $786 annually ($66 monthly) for similar driver profiles.

How do I show proof of insurance in Connecticut?

Connecticut accepts both physical insurance ID cards and electronic versions displayed on smartphones or mobile devices. Keep proof of insurance in your vehicle at all times, as law enforcement can request it during traffic stops. You’ll also need proof of vehicle registration.

Is Connecticut a no-fault insurance state?

No. Connecticut uses an at-fault system where the driver responsible for an accident pays damages through their liability insurance. This differs from no-fault states, where each driver’s insurance covers their own injuries regardless of fault.

What happens if I drive without insurance in Connecticut?

Driving uninsured in Connecticut results in serious penalties:

- Minimum $150 fine for first offense

- License and registration suspension

- $175 restoration fee

- Potential SR-22 filing requirement

- Dramatically higher insurance rates when coverage is restored

Can I get insurance with a suspended license in Connecticut?

Some insurers offer non-owner car insurance policies for drivers with suspended licenses who don’t own vehicles but occasionally drive. This maintains continuous coverage and prevents gaps that increase future rates.

How long do accidents and tickets affect my Connecticut insurance rates?

Most violations impact rates for 3-5 years:

- Minor speeding tickets: 3 years

- At-fault accidents: 3-5 years

- Major violations (DUI, reckless driving): 5+ years

Impact gradually decreases over time, particularly with no additional violations.

What discounts can lower my Connecticut auto insurance?

Common Connecticut auto insurance discounts include:

- Multi-policy bundling: 15-25%

- Good driver: 20-30%

- Good student: 10-25%

- Telematics programs: Up to 30%

- Vehicle safety features: 5-20%

- Low mileage: 10-20%

- Defensive driving course: 5-15%

- Automatic payments: 3-10%

- Professional/alumni affiliations: 5-15%

Should I get full coverage or minimum coverage in Connecticut?

Choose full coverage if:

- Your vehicle is financed or leased (usually required)

- You cannot afford to repair/replace your vehicle out-of-pocket

- Your vehicle is worth more than $3,000-$5,000

- You want comprehensive protection against multiple risks

Minimum coverage may suffice if:

- You own an older vehicle with minimal value

- You have substantial savings to cover repairs/replacement

- You’re willing to accept financial risk

How often should I shop for new auto insurance in Connecticut?

Insurance experts recommend comparing quotes annually, plus after major life changes:

- Moving to a new address

- Adding/removing drivers

- Purchasing a new vehicle

- Marriage or divorce

- Changes in credit score

- After violations drop off your record

What should I do immediately after an auto accident in Connecticut?

Critical Steps:

- Ensure safety and call 911 if anyone is injured

- Exchange information with other drivers (names, insurance, contact details)

- Document the scene (photos, witness statements, police report)

- Contact your insurance company within 24 hours

- Follow your insurer’s claims process instructions

- Don’t admit fault or make statements about the accident beyond factual information

Can I get auto insurance if I have bad credit in Connecticut?

Yes. While poor credit increases rates significantly (average $2,757 annually vs. $1,567 for good credit), Connecticut insurers cannot deny coverage based solely on credit scores. Compare quotes from multiple providers, as rate impacts vary by company.

Does Connecticut require uninsured motorist coverage?

Yes. Connecticut mandates minimum uninsured/underinsured motorist coverage of $25,000 per person and $50,000 per accident. This protects you when at-fault drivers lack adequate insurance.

What is gap insurance and do I need it in Connecticut?

Gap insurance covers the difference between your vehicle’s actual cash value and your loan/lease balance if it’s totaled or stolen. You need gap insurance if:

- You made a down payment of less than 20%

- You financed for more than 48-60 months

- Your vehicle depreciates faster than you’re paying down the loan

- You rolled negative equity from a previous vehicle into your current loan

Take Action Today: Your Next Steps

Connecticut’s auto insurance market offers significant savings opportunities for informed consumers willing to compare options and optimize coverage. Here’s your action plan:

Immediate Actions (This Week):

- Gather your current policy documents and declaration page

- List your vehicles, drivers, and coverage details

- Request quotes from at least 3-5 insurers

- Review available discounts and eligibility

- Compare quotes using identical coverage limits

Short-Term Actions (This Month):

- Select the best coverage and provider for your needs

- Confirm all applicable discounts are applied

- Consider telematics programs for additional savings

- Review and adjust deductibles strategically

- Complete any defensive driving courses for discounts

Long-Term Strategies (Ongoing):

- Maintain a clean driving record

- Improve your credit score gradually

- Review coverage annually or after life changes

- Shop for new quotes every 12 months

- Update your insurer about life changes qualifying for discounts

Remember: Connecticut auto insurance rates can change daily, and the best time to compare options is right now. The average driver who shops around saves $800 annually, money that could fund vacations, emergency savings, or other financial goals.

Don’t leave hundreds or thousands of dollars on the table. Start comparing quotes today and discover how much you could save on auto insurance in Connecticut.

Need Additional Help?

Connecticut Insurance Department

- Phone: 800-203-3447

- Email: insurance@ct.gov

- Website: ct.gov/cid

The Connecticut Insurance Department provides free consumer assistance, complaint filing, and educational resources about insurance requirements and consumer rights.

Connecticut Automobile Insurance Assigned Risk Plan

- Phone: 401-946-2800

- Email: ctaiarp@aipso.com

For drivers unable to obtain coverage through standard markets due to driving records or other factors.

Article last updated: November 2025. Insurance rates and requirements are subject to change. Always verify current rates and coverage requirements with licensed insurance professionals.