With car insurance rates climbing nationwide, finding affordable coverage that doesn’t compromise on protection has become increasingly challenging. Mercury Insurance, a California-based regional provider serving 11 states, promises competitive rates and solid coverage options, but does it deliver on these promises?

The Rising Cost of Car Insurance: Why Mercury Matters

Auto insurance premiums have increased by over 20% nationally in recent years, making cost-effective options like Mercury Insurance more attractive to budget-conscious drivers. However, lower premiums don’t always mean better value, especially when it comes to claims handling and customer service.

Mercury Auto Insurance: Company Overview

Founded in 1961 and headquartered in Los Angeles, Mercury Insurance Group has grown to become the seventh-largest auto insurer in California. Despite its regional focus, the company maintains an AM Best financial strength rating of A (Excellent), indicating strong financial stability and ability to pay claims.

Key Company Facts:

- Founded: 1961

- Headquarters: Brea, California

- States served: 11 (Arizona, California, Florida, Georgia, Illinois, Nevada, New Jersey, New York, Oklahoma, Texas, Virginia)

- AM Best Rating: A (Excellent)

- Market position: 7th largest in California

Mercury Auto Insurance Rates and Pricing Analysis

National Rate Comparison

Mercury’s pricing varies significantly depending on your location and driving profile. Here’s how Mercury stacks up against national averages:

| Coverage Type | Mercury Average | National Average | Potential Savings |

| Full Coverage | $2,318 | $2,671 | $353/year |

| Minimum Coverage | $663 | $806 | $143/year |

Data sources vary between studies, with some showing Mercury above national averages

Rates by Driver Profile

Mercury shows competitive pricing for certain driver categories:

| Driver Profile | Mercury Annual Rate | National Average | Difference |

| Good driver, good credit | $2,318 | $2,671 | -$353 |

| Good driver, poor credit | $3,236 | $4,693 | -$1,457 |

| One speeding ticket | $3,299 | $3,272 | +$27 |

| At-fault accident | $4,383 | $3,841 | +$542 |

| DUI conviction | $4,051 | $5,233 | -$1,182 |

Key Insight: Mercury appears particularly competitive for drivers with poor credit, offering savings of over $1,400 annually compared to the national average.

Age-Based Pricing

Mercury’s age-based pricing structure shows significant benefits for older drivers:

| Age | Mercury Rate | National Average | Savings |

| 16 | $4,626 | $5,710 | $1,084 |

| 25 | $3,117 | $3,294 | $177 |

| 40 | $2,318 | $2,671 | $353 |

| 60 | $2,025 | $2,415 | $390 |

Coverage Options: What Mercury Offers

Standard Coverage Types

- Liability insurance (required in most states)

- Comprehensive coverage

- Collision coverage

- Uninsured/underinsured motorist protection

- Personal injury protection (where required)

Unique Coverage Options

1. Rideshare Insurance

- Available for as low as $0.90 per day

- Covers gaps in personal and rideshare company coverage

- Not available in New Jersey or New York

2. Mechanical Breakdown Coverage

- Similar to extended warranty protection

- Covers engine, transmission, and electrical system failures

- Does not cover collision damage or wear-and-tear

3. Gap Insurance

- Pays difference between car value and loan balance if totaled

- Essential for financed or leased vehicles

- May be required by lender

4. Custom Equipment Coverage

- Protects aftermarket modifications and upgrades

- Important for customized vehicles

- Supplements standard comprehensive coverage

Money-Saving Opportunities with Mercury

Available Discounts

Mercury offers multiple ways to reduce your premium:

| Discount Type | Potential Savings | Requirements |

| Multi-policy bundling | Up to 14.5% | Bundle auto with home/renters |

| MercuryGO usage-based | Up to 40% | Install driving app, maintain good scores |

| RealDrive pay-per-mile | Up to 20% | Low-mileage drivers (California only) |

| Multi-vehicle | Variable | Insure multiple cars |

| Good student | Variable | Students with good grades |

| Anti-theft device | Variable | Qualifying security systems |

| Paperless billing | Small discount | Electronic statements and payments |

| Paid-in-full | Variable | Pay annual premium upfront |

MercuryGO Program Deep Dive

The MercuryGO telematics program offers substantial savings potential:

- Immediate discount: 10% just for enrolling

- Maximum discount: 40% at renewal for safe drivers

- Monitoring factors: Speed, braking, acceleration, phone use, time of day, trip duration

Customer feedback on MercuryGO is mixed, with some users reporting inconsistent scoring and lower-than-expected discounts.

Customer Experience and Satisfaction

Third-Party Ratings Summary

| Rating Agency | Mercury Score | Industry Context |

| AM Best Financial Strength | A (Excellent) | Strong financial stability |

| J.D. Power Auto Claims (2024) | 663/1000 | 34 points below average, ranked last |

| J.D. Power Shopping Study (2025) | 609/1000 | 58 points below average |

| NAIC Complaints | Close to expected | Typical complaint volume for size |

Real Customer Insights

Based on analysis of over 1,000 customer reviews across multiple platforms:

Top Positives:

- Affordable premiums

- Easy digital policy management

- Straightforward claims process for simple incidents

Top Negatives:

- Communication challenges and slow response times

- Complex claims handling issues

- Unexpected rate increases

Customer Quote: “Mercury is extremely hard to get on the phone, as usually they operate as a ‘team’ and you basically need to leave a voice message and someone from the team will call you eventually.”

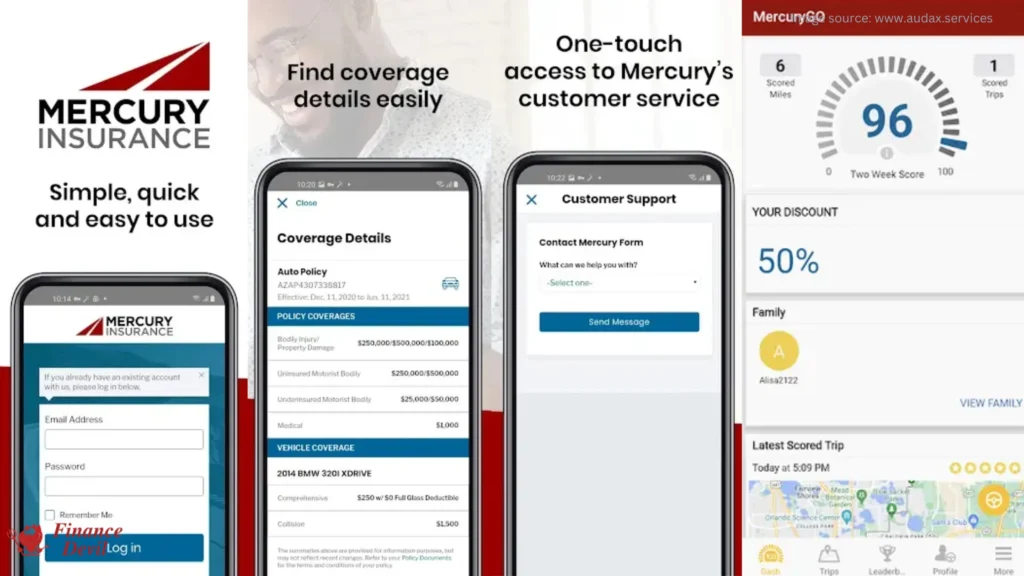

Digital Tools and Mobile Experience

Mercury Mobile App Features

- Digital insurance ID cards

- Policy management and changes

- Bill payment and autopay setup

- Claims filing and tracking

- Roadside assistance requests

App Ratings:

- iPhone: 4.6/5 stars

- Android: 4.3/5 stars

MercuryGO App (Separate)

- Real-time driving feedback

- Discount tracking

- Trip logging and analysis

- Safety score monitoring

MercuryGO App Ratings:

- iPhone: 3.5/5 stars

- Android: 3.7/5 stars

Mercury vs. Major Competitors

Rate Comparison with Top Insurers

| Company | Full Coverage | Minimum Coverage | Market Position |

| Mercury | $2,318 | $663 | Regional specialist |

| Progressive | $2,189 | $729 | National leader |

| State Farm | $2,676 | $897 | Largest US insurer |

| USAA | $2,059 | $596 | Military members only |

| GEICO | $1,731 | $517 | Major national carrier |

| Allstate | $3,354 | $985 | Premium national brand |

When Mercury Makes Sense vs. Alternatives

Choose Mercury if you:

- Live in one of their 11 service states

- Have poor credit (significant savings potential)

- Need rideshare coverage

- Prefer regional, personalized service

- Want bundling opportunities

Consider alternatives if you:

- Move frequently between states

- Prioritize top-tier customer service

- Need accident forgiveness

- Want extensive coverage options

- Require 24/7 customer support

Common Mistakes to Avoid When Choosing Mercury

Mistake #1: Not Comparing Quotes

Even if Mercury appears affordable on average, your individual rate may vary significantly. Always compare quotes from at least 3-5 insurers.

Mistake #2: Overlooking Coverage Gaps

Mercury doesn’t offer some common options like accident forgiveness or vanishing deductibles. Ensure you understand what’s not included.

Mistake #3: Ignoring Customer Service Ratings

While rates matter, consider Mercury’s below-average customer satisfaction scores, especially for claims handling.

Mistake #4: Assuming Discounts Apply

Not all advertised discounts may be available in your state or for your situation. Verify eligibility before making decisions.

Mistake #5: Neglecting Long-term Costs

Some customers report unexpected rate increases. Ask about rate stability and review policies annually.

Who Should Consider Mercury Auto Insurance?

Best Fit Profiles:

- California residents: Strong market presence and competitive rates

- Drivers with poor credit: Significant savings compared to national averages

- Rideshare drivers: Affordable gap coverage options

- Budget-conscious consumers: Below-average rates in many categories

- Multi-policy bundlers: Substantial discounts available

Poor Fit Profiles:

- Frequent travelers: Limited to 11 states only

- Premium service seekers: Below-average customer satisfaction ratings

- Accident-prone drivers: No accident forgiveness program

- New drivers needing guidance: Limited educational resources and support

How to Get the Best Mercury Auto Insurance Rate

Step-by-Step Savings Strategy:

- Bundle policies: Combine auto with home/renters for up to 14.5% savings

- Enroll in MercuryGO: Get 10% immediately, up to 40% for safe driving

- Consider RealDrive: If in California and low-mileage driver

- Set up autopay: Automatic billing discount plus convenience

- Go paperless: Small but easy discount to claim

- Maintain good credit: Significant impact on rates in most states

- Shop annually: Rates change frequently, review options yearly

Red Flags to Watch For:

- Significant rate increases at renewal without claims

- Difficulty reaching customer service during claims

- Pressure to accept quick settlements on complex claims

- Limited agent availability in your area

The Bottom Line: Is Mercury Auto Insurance Worth It?

Mercury Auto Insurance presents a mixed value proposition that depends heavily on your specific circumstances and priorities.

Mercury Excels When:

- You prioritize affordability over premium service

- You have poor credit and face higher rates elsewhere

- You need rideshare coverage at competitive prices

- You live in California or another core Mercury state

- You can maximize their discount programs

Mercury Falls Short When:

- You need exceptional customer service and claims handling

- You want comprehensive coverage options and flexibility

- You require nationwide coverage or plan to relocate

- You prioritize financial strength ratings above A level

Final Recommendation:

Mercury can be an excellent choice for cost-conscious drivers in their service areas, particularly those with credit challenges or specific needs like rideshare coverage. However, the company’s customer service limitations and geographic restrictions mean it’s not ideal for everyone.

Take Action: Insurance rates change frequently and vary dramatically by individual circumstances. Get quotes from Mercury and at least 2-3 competitors to find your best option. Many drivers can save $500+ annually by comparing rates.

Frequently Asked Questions About Mercury Auto Insurance

Q: Is Mercury Insurance financially stable?

A: Yes, Mercury maintains an AM Best rating of A (Excellent), indicating strong financial stability and ability to pay claims. However, AM Best revised their outlook to negative in 2025 due to California wildfire losses.

Q: Does Mercury offer accident forgiveness?

A: No, Mercury does not currently offer accident forgiveness, which allows one at-fault accident without rate increases. This is a significant limitation compared to many competitors.

Q: How much can I save with Mercury’s MercuryGO program?

A: You get 10% off immediately for enrolling, with potential savings up to 40% at renewal based on safe driving scores. However, customer reviews suggest actual discounts are often lower than the maximum advertised.

Q: Does Mercury offer coverage nationwide?

A: No, Mercury only operates in 11 states: Arizona, California, Florida, Georgia, Illinois, Nevada, New Jersey, New York, Oklahoma, Texas, and Virginia.

Q: What makes Mercury different from other insurers?

A: Mercury’s key differentiators include competitive rates for drivers with poor credit, affordable rideshare coverage, unique mechanical breakdown protection, and strong regional presence in California.

Q: Can I get Mercury insurance if I have a DUI?

A: Mercury does provide coverage for drivers with DUI convictions, often at more competitive rates than the national average. However, availability may vary by state and individual circumstances.

Q: How does Mercury’s customer service compare to competitors?

A: Mercury’s customer service ratings are below average, particularly for claims handling. J.D. Power ranked them last among assessed insurers for auto claims satisfaction in 2024.

Q: What discounts does Mercury offer?

A: Mercury offers multiple discounts including multi-policy bundling (up to 14.5%), MercuryGO usage-based discounts (up to 40%), multi-vehicle, good student, anti-theft device, paperless billing, and paid-in-full discounts.

Q: Is Mercury’s rideshare coverage worth it?

A: At $0.90 per day, Mercury’s rideshare coverage is competitively priced and essential for Uber/Lyft drivers. However, it’s not available in New Jersey or New York.

Q: How often should I review my Mercury policy?

A: Review your Mercury policy annually, especially given customer reports of unexpected rate increases. Shopping for quotes yearly ensures you’re still getting competitive rates.

Remember: Insurance rates change daily based on market conditions and individual risk factors. The information in this review reflects 2025 data and may not represent current pricing. Always obtain personalized quotes for accurate rate comparisons.

In another related article, Landlord Insurance vs Homeowners Insurance: The Complete 2025 Guide to Choosing the Right Coverage