Why 73% of American Homeowners Are Paying for the Wrong Insurance Type

Most homeowners grab the first policy their lender approves without understanding there are eight distinct types of homeowners insurance, and choosing the wrong one could cost you thousands in uncovered damages or unnecessary premiums. With home replacement costs climbing 55% between 2019 and 2022, according to the Insurance Information Institute, understanding your policy type isn’t just smart, it’s essential financial protection.

The Hidden Cost of Generic Home Insurance

Here’s what most Americans don’t realize: that standard “homeowners insurance” your mortgage company requires might be completely wrong for your situation. Whether you own a historic Victorian, rent a downtown apartment, or live in a manufactured home, there’s a specific insurance type designed for your needs, and using the generic approach often means paying more for less coverage.

The stakes are higher than ever. With inflation driving construction costs through the roof and extreme weather events becoming more frequent, having the right type of coverage isn’t just about compliance, it’s about protecting your family’s financial future.

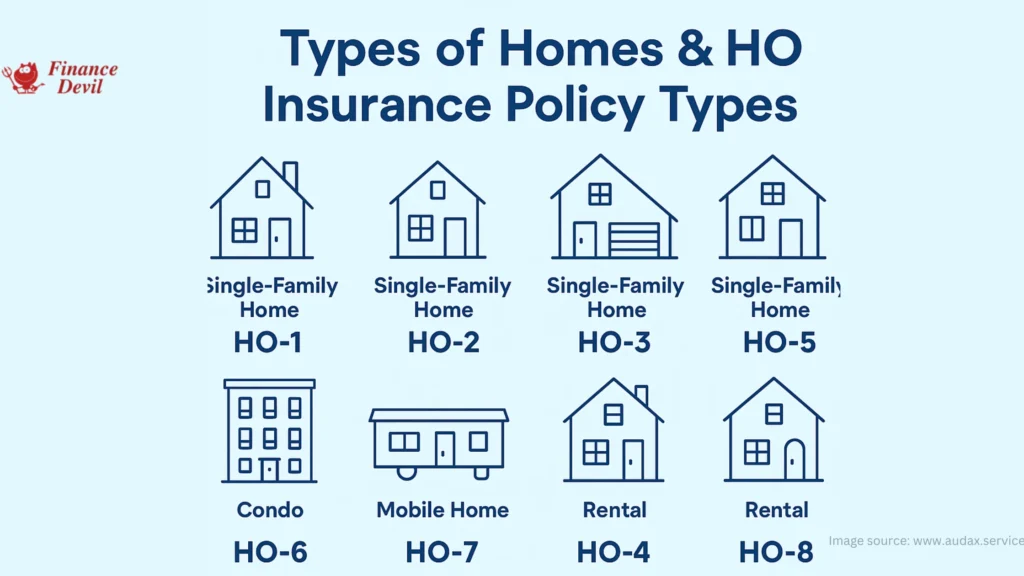

Understanding the 8 Types of Homeowners Insurance Policies

The insurance industry uses standardized policy forms created by the Insurance Services Office (ISO), ensuring consistency nationwide. Here’s your complete breakdown of each type:

HO-1: Basic Form (The Bare Minimum)

Coverage Level: Most limited

Best For: Properties seeking absolute minimum coverage (rarely available)

Market Share: Less than 2% of policies nationwide

HO-1 policies offer the most basic protection, covering only your home’s structure against 10 specific perils, including fire, lightning, windstorms, and theft. Notably absent: coverage for personal belongings, liability, or additional living expenses.

Key Limitations:

- No personal property coverage

- No liability protection

- Actual cash value only (depreciated replacement costs)

- Many states don’t offer this policy type

HO-2: Broad Form (Budget-Conscious Choice)

Coverage Level: Moderate

Best For: Cost-conscious homeowners seeking basic protection

Market Share: 6.7% of single-family home policies

HO-2 expands coverage to 16 named perils and includes personal property protection, liability coverage, and additional living expenses. Your belongings are covered at actual cash value, meaning depreciation reduces payouts.

Additional Perils Covered:

- Weight of snow, ice, or sleet

- Accidental water discharge from appliances

- Freezing of plumbing systems

- Sudden electrical damage

- Falling objects

HO-3: Special Form (America’s Most Popular Choice)

Coverage Level: Comprehensive for structures, named perils for belongings

Best For: Most single-family homeowners

Market Share: 78.2% of home insurance policies

The HO-3 is the gold standard of home insurance, offering open-perils coverage for your home’s structure (covered unless specifically excluded) while protecting belongings against 16 named perils.

Why It’s Popular:

- Replacement cost coverage for your home

- Comprehensive structural protection

- Includes liability, medical payments, and additional living expenses

- Flexible coverage options

Common Exclusions:

- Floods and earthquakes

- Intentional damage

- War and nuclear hazards

- Wear and tear

- Mold (unless from covered water damage)

HO-4: Renters Insurance (Tenant Protection)

Coverage Level: Personal property and liability only

Best For: Renters and tenants

Market Share: Separate from homeowner statistics

Despite the “homeowners” designation, HO-4 is specifically for renters. It covers your personal belongings, liability, and additional living expenses but excludes the building structure (that’s your landlord’s responsibility).

Perfect For:

- Apartment renters

- House renters

- College students in dorms

- Anyone not owning their residence

HO-5: Comprehensive Form (Premium Protection)

Coverage Level: Highest available

Best For: High-value homes and extensive personal property

Market Share: 13% of home insurance policies

HO-5 provides open-perils coverage for both your home AND personal belongings, the most comprehensive protection available. Both dwelling and possessions are covered at replacement cost value.

Premium Features:

- Open-perils coverage for all property

- Higher coverage limits for jewelry, furs, and valuables

- Replacement cost for everything

- Enhanced coverage for mysterious disappearance

Qualification Requirements:

- Newer home construction

- Above-average replacement costs

- Low-risk location

- Higher premiums (typically 10-20% more than HO-3)

HO-6: Condo Insurance (Unit Owner Protection)

Coverage Level: Interior coverage plus personal property

Best For: Condominium and co-op owners

Market Share: Growing segment of insurance market

HO-6 policies provide “walls-in” coverage, protecting your unit’s interior, personal belongings, and improvements you’ve made. The condo association’s master policy covers exterior structures and common areas.

Typical Coverage Includes:

- Interior fixtures and improvements

- Personal belongings

- Additional living expenses

- Liability protection

- Loss assessment coverage (for special assessments)

HO-7: Mobile Home Form (Manufactured Home Protection)

Coverage Level: Similar to HO-3 but for mobile structures

Best For: Mobile, manufactured, and modular home owners

Market Share: Specialized segment

HO-7 provides comprehensive coverage similar to HO-3 but designed for non-permanent structures including single-wide, double-wide, and modular homes.

Covered Structures:

- Single and double-wide manufactured homes

- Mobile homes and trailers

- Park model homes

- Sectional and modular homes

Important Note: Coverage typically applies only when the home is stationary, not during transport.

HO-8: Modified Coverage (Historic Home Specialist)

Coverage Level: Tailored for older properties

Best For: Historic homes where rebuilding costs exceed market value

Market Share: 0.4% of policies (highly specialized)

HO-8 addresses the unique challenge of historic properties where authentic restoration costs far exceed the home’s market value. Coverage pays based on functional replacement rather than exact restoration.

Ideal For:

- Homes built more than 40 years ago

- Historic landmarks

- Properties with unique architectural features

- Homes where rebuilding costs exceed market value

Comparison Table: Which Type Fits Your Situation?

| Policy Type | Best For | Dwelling Coverage | Personal Property | Market Share |

| HO-1 | Absolute minimum (rarely available) | Named perils | None | <2% |

| HO-2 | Budget-conscious owners | Named perils | Named perils (ACV) | 6.7% |

| HO-3 | Most homeowners | Open perils | Named perils | 78.2% |

| HO-4 | Renters/tenants | None | Named perils | N/A |

| HO-5 | High-value properties | Open perils | Open perils | 13% |

| HO-6 | Condo owners | Walls-in coverage | Named perils | Growing |

| HO-7 | Mobile/manufactured homes | Open perils | Named perils | Specialized |

| HO-8 | Historic properties | Modified coverage | Named perils | 0.4% |

Expert Tips for Choosing the Right Type in 2025

1. Match Your Living Situation

“The biggest mistake I see is people choosing based on price alone without considering their actual housing situation,” says Laura Adams, personal finance expert. Start with your basic housing type:

- Own a single-family home → HO-3 or HO-5

- Rent any property → HO-4

- Own a condo → HO-6

- Own a mobile home → HO-7

- Own a historic property → HO-8

2. Consider Your Risk Tolerance

Higher policy numbers generally mean more comprehensive coverage but higher premiums. With replacement costs up 55% since 2019, skimping on coverage could be penny-wise but pound-foolish.

3. Evaluate Your Personal Property Value

If you own high-value items like jewelry, art, or collectibles, HO-5’s open-perils personal property coverage might justify the extra cost. Standard policies have strict sub-limits on valuable items.

4. Factor in Geographic Risks

Living in areas prone to natural disasters? Remember that standard policies exclude floods and earthquakes, you’ll need separate coverage regardless of policy type.

Common Mistakes That Cost Homeowners Thousands

Mistake #1: Choosing Based on Monthly Payment Alone

Lower premiums often mean higher deductibles or coverage gaps. That $50/month savings could cost you $10,000+ in an uncovered claim.

Mistake #2: Assuming All Policies Are the Same

The difference between named-perils and open-perils coverage can be massive. HO-3 covers your home against all risks except those specifically excluded, while HO-2 only covers specifically listed perils.

Mistake #3: Ignoring Coverage Limits

Standard policies cap coverage for items like jewelry ($1,500), cash ($200), and electronics. If you own valuable items, you need scheduled coverage or an HO-5 policy.

Mistake #4: Not Updating After Home Improvements

Added a new kitchen? Finished the basement? Your coverage needs updating. Insurance companies can’t pay for improvements they don’t know about.

How Market Trends Affect Your Choice in 2025

Rising Construction Costs

With lumber, labor, and material costs still elevated, ensuring adequate dwelling coverage is crucial. Many homeowners are underinsured without realizing it.

Increased Weather Events

Climate change is driving more frequent, severe weather, making comprehensive coverage more valuable. Open-perils policies provide broader protection against unexpected risks.

Technology Integration

Smart home features can qualify for discounts but may also increase your property value, requiring coverage adjustments.

Making Your Decision: A Step-by-Step Approach

Step 1: Determine Your Housing Category

- Single-family homeowner → HO-3 or HO-5

- Renter → HO-4

- Condo owner → HO-6

- Mobile home owner → HO-7

- Historic home owner → HO-8

Step 2: Calculate Your Coverage Needs

Get a professional estimate of your home’s replacement cost. Don’t rely on market value, replacement costs are typically higher.

Step 3: Inventory Your Personal Property

High-value items may push you toward HO-5 coverage or require scheduled endorsements on other policy types.

Step 4: Compare Quotes from Multiple Insurers

Rates vary significantly between companies for identical coverage. Get quotes from at least three insurers.

Step 5: Review Annually

Home values and replacement costs change. Annual reviews ensure your coverage keeps pace with reality.

Take Action: Secure the Right Coverage Today

Understanding the types of homeowners insurance isn’t just academic, it’s your financial protection strategy. With home replacement costs continuing to climb and extreme weather becoming more common, having the right policy type could mean the difference between quick recovery and financial disaster.

Ready to find your perfect policy match? Insurance rates change daily, and the best deals often have limited availability. Don’t wait until disaster strikes to discover your coverage gaps.

Compare personalized quotes from top-rated insurers in your area today. It takes less than 5 minutes to see what you qualify for, and you could save hundreds while getting better protection.

Remember: This guide provides general information about homeowners insurance types. Your specific needs may vary based on your location, property, and circumstances. Always consult with licensed insurance professionals for personalized advice.

In another related article, Personal Liability Insurance for Homeowners