Introduction

Choosing the right credit card can significantly impact your financial health and spending power. The Summit Federal Credit Union offers several Visa credit card options, each designed to meet different financial needs and goals. This comprehensive guide will help you determine if a Summit credit card is worth it for your specific situation.

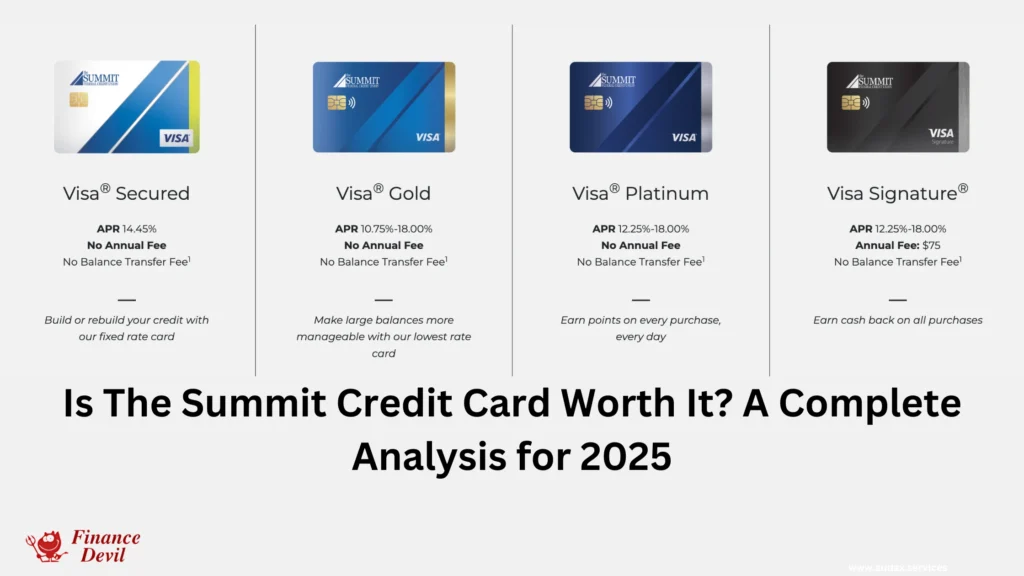

Summit Credit Card Portfolio Overview

Summit Federal Credit Union offers four distinct Visa credit card options:

1. Visa Secured Card

- APR: 14.45% (fixed)

- Annual Fee: None

- Minimum Security Deposit: $300

- Best for: Building or rebuilding credit

2. Visa Gold

- APR: 10.75%-18.00% (variable)

- Annual Fee: None

- Best for: Balance transfers and low interest rates

3. Visa Platinum

- APR: 12.25%-18.00% (variable)

- Annual Fee: None

- Rewards: 1 point per dollar on all purchases

- Best for: Everyday rewards earning

4. Visa Signature

- APR: 12.25%-18.00% (variable)

- Annual Fee: $75

- Rewards:

- 2 points per dollar on travel

- 1 point per dollar on all other purchases

- 10,000 bonus points after spending $3,000 in first 90 days

- Best for: Travel rewards and premium benefits

Key Benefits Across All Summit Credit Cards

Competitive Interest Rates

Summit credit cards stand out in today’s market with their notably lower interest rates. While the national average credit card APR hovers around 20.27%, Summit’s rates start as low as 10.75% for their Gold card. This significant difference can translate to substantial savings for cardholders who carry a balance.

No Balance Transfer Fees

One of the most compelling features of Summit credit cards is the absence of balance transfer fees. With most major card issuers charging 3-5% of the transferred amount, this benefit can lead to significant savings when consolidating debt.

Digital Banking Integration

Summit provides a comprehensive digital experience through:

- Real-time purchase alerts

- Mobile wallet compatibility

- Dedicated credit card management app

- Online banking integration

- Card controls (freeze/unfreeze)

- Travel notifications

Security Features

- Fraud protection services

- Zero liability for unauthorized transactions

- Real-time transaction monitoring

- EMV chip technology

- Contactless payment capability

Is a Summit Credit Card Worth It? Analysis by Card Type

READ ALSO: Imagine Visa Credit Card: A Complete Guide to This Credit-Building Option

Visa Secured Card Worth Analysis

This card is particularly valuable for:

- Individuals with limited credit history

- Those rebuilding credit after financial difficulties

- People seeking a fixed-rate card with predictable terms

The 14.45% fixed APR is competitive for a secured card, and the absence of an annual fee makes it an economical choice for credit building.

Visa Gold Card Worth Analysis

The Gold card offers exceptional value for:

- Balance transfer seekers

- Those who occasionally carry balances

- Cardholders prioritizing low rates over rewards

With rates starting at 10.75%, this card could save substantial money compared to the national average of 20.27%.

Visa Platinum Card Worth Analysis

The Platinum card provides good value for:

- Regular spenders seeking rewards

- Those who want rewards without an annual fee

- Cardholders who prefer flexible redemption options

The earning rate of 1 point per dollar is standard, but the combination with no annual fee and lower APR makes it competitive.

Visa Signature Card Worth Analysis

This premium card delivers value through:

- Enhanced travel rewards (2x points)

- Welcome bonus worth 10,000 points

- Premium concierge service

- Advanced travel benefits

The $75 annual fee needs to be weighed against the benefits, but can be worthwhile for frequent travelers or high spenders.

Breaking Down the Value Proposition

Cost Savings Analysis

Balance Transfer Scenario

Let’s examine potential savings when transferring a $5,000 balance:

Traditional Card:

- 3% transfer fee = $150

- 20.27% APR = ~$1,013.50 in interest (first year)

- Total first-year cost: $1,163.50

Summit Card:

- No transfer fee = $0

- 10.75% APR = ~$537.50 in interest (first year)

- Total first-year cost: $537.50

Potential first-year savings: $626

Rewards Value Analysis

Platinum Card Example

Annual spending of $24,000:

- 24,000 points earned (worth approximately $240 in redemption value)

- No annual fee

- Net value: $240

Signature Card Example

Annual spending of $24,000:

- $6,000 travel spending (12,000 points)

- $18,000 other spending (18,000 points)

- 10,000 welcome bonus points

- Total points: 40,000 (worth approximately $400)

- Less annual fee: -$75 Net value: $325

Who Should Consider a Summit Credit Card?

Ideal Candidates

Balance Transfer Seekers

- Looking to consolidate debt

- Want to avoid transfer fees

- Need lower interest rates

Credit Builders

- New to credit

- Rebuilding credit history

- Want a secured card with growth potential

Rate-Conscious Consumers

- Occasionally carry balances

- Prioritize low rates over rewards

- Want predictable terms

Rewards Enthusiasts

- Regular credit card users

- Travel frequently

- Can maximize point earnings

Less Ideal Candidates

Heavy Cash Back Users

- Prefer straight cash back to points

- Want category bonuses

- Seek quarterly rotating categories

International Travelers

- Need no foreign transaction fees

- Want extensive travel insurance

- Require global acceptance guarantees

Maximizing Your Summit Credit Card

Best Practices

Payment Strategy

- Set up automatic payments

- Pay more than the minimum

- Utilize online banking tools

Rewards Optimization

- Use Signature card for travel purchases

- Track point accumulation

- Plan redemptions strategically

Credit Building Tips

- Keep utilization below 30%

- Make timely payments

- Monitor credit score progress

Conclusion

The Summit credit card lineup offers compelling value through low rates, no balance transfer fees, and flexible rewards options. The cards are particularly worth it for:

- Balance transfer seekers

- Rate-conscious consumers

- Credit builders

- Reward earners who value flexibility

Consider your specific financial needs, spending patterns, and credit profile when choosing among their four card options. The absence of balance transfer fees and below-average APRs make these cards especially attractive for debt consolidation and long-term value.

Ready to apply for a Summit credit card? Visit their website or call (800) 836-7328 to discuss your options with a credit union representative.

Frequently Asked Questions

Q: What credit score do I need for a Summit credit card?

A: While specific requirements aren’t published, generally:

- Secured Card: 300+ (no minimum in some cases)

- Gold/Platinum: 640+

- Signature: 720+

Q: Can I upgrade from a secured to an unsecured card?

A: Yes, Summit offers upgrade paths based on payment history and credit improvement.

Q: How do I redeem rewards points?

A: Points can be redeemed through:

- Online banking portal

- CURewards website

- Phone banking For merchandise, travel, cash back, or statement credits.

Q: Are Summit credit cards available nationwide?

A: Summit Federal Credit Union membership is required. Eligibility is typically based on geographic location or employer relationships.

Q: How long does balance transfer processing take?

A: Typically 7-14 business days, though some transfers may complete sooner.

In another related article, Expert Guide to Ulta Credit Card Login