Finding Cheapest Auto Insurance Tulsa OK doesn’t have to drain your wallet. With the right strategy, you could save hundreds, or even thousands, annually.

Many Tulsa drivers are overpaying for car insurance without realizing it. In fact, 33% of Tulsa drivers admit they’re paying too much for their current coverage. If you’re among them, this comprehensive guide will show you exactly how to find the cheapest auto insurance in Tulsa, OK, while maintaining the protection you need.

Why Car Insurance in Tulsa Costs More Than You Think

Car insurance in Tulsa is more expensive than many Oklahoma cities, ranking as the 6th most expensive city for auto insurance in the state. Several factors contribute to these elevated costs:

Population Density Impact

Tulsa’s urban environment, with 2,091 residents per square mile, creates more traffic congestion and accident opportunities compared to rural areas. Higher population density directly correlates with increased claim frequency, which insurers factor into their pricing models.

Pedestrian Safety Concerns

Tulsa ranks as the 41st most dangerous city for pedestrians nationally, according to Smart Growth America. Tulsa County experienced 18 pedestrian fatalities in the most recent data year, the second-highest in Oklahoma, contributing to higher insurance risk assessments.

Uninsured Driver Rates

Oklahoma has a 13.4% uninsured driver rate, ranking 17th nationally. In Tulsa specifically, approximately 36% of drivers lack current insurance, creating additional financial risk for insured motorists who may need to rely on their own coverage after accidents with uninsured drivers.

Weather-Related Claims

Oklahoma’s severe weather patterns, including hailstorms, tornadoes, and flooding, increase comprehensive claims in the Tulsa area, driving up premiums across all coverage types.

Cheapest Auto Insurance Companies in Tulsa, OK

Based on comprehensive rate analysis, here are the most affordable auto insurance providers in Tulsa:

Minimum Coverage Leaders

| Company | Monthly Premium | Annual Premium | Savings vs. City Average |

| Progressive | $34 | $414 | 37% below average |

| American Farmers & Ranchers | $45 | $535 | 32% below average |

| Mercury | $45 | $535 | 32% below average |

| State Farm | $46 | $551 | 30% below average |

| GEICO | $51 | $611 | 22% below average |

Full Coverage Champions

| Company | Monthly Premium | Annual Premium | Savings vs. City Average |

| Progressive | $107 | $1,283 | 37% below average |

| American Farmers & Ranchers | $129 | $1,548 | 23% below average |

| Mercury | $130 | $1,560 | 22% below average |

| GEICO | $128 | $1,536 | 21% below average |

| State Farm | $148 | $1,776 | 14% below average |

How Much Does Car Insurance Cost in Tulsa?

Understanding typical costs helps you recognize good deals and avoid overpaying. Here’s what Tulsa drivers currently pay:

Average Monthly Costs:

- Minimum Coverage: $62 per month ($746 annually)

- Full Coverage: $153 per month ($1,832 annually)

Comparison to State Averages:

- Tulsa minimum coverage: $746 vs. Oklahoma average: $946

- Tulsa full coverage: $1,832 vs. Oklahoma average: $2,053

Cost Variations by ZIP Code

Car insurance rates vary significantly across Tulsa neighborhoods:

Most Expensive ZIP Codes:

- 74120: $172/month (full coverage)

- 74115: $167/month (full coverage)

- 74112: $166/month (full coverage)

Most Affordable ZIP Codes:

- 74108: $145/month (full coverage)

- 74131: $148/month (full coverage)

- 74014: $151/month (full coverage)

Age-Based Insurance Rates in Tulsa

Your age significantly impacts insurance costs. Here’s how rates break down:

Teen Drivers (16-19)

- Cheapest Provider: American Farmers & Ranchers ($69/month minimum)

- Average Cost: $372/month (full coverage), $201/month (minimum)

- Key Insight: Teen drivers pay 151% more than drivers in their 20s

Young Adults (20-29)

- Cheapest Provider: USAA ($843 per 6 months), military families only

- Civilian Alternative: American Farmers & Ranchers

- Average Cost: $1,347 per 6 months

Adults (30-64)

- Cheapest Provider: Progressive ($34/month minimum)

- Average Savings: Up to 48% below city average

- Best Overall Value: Progressive and State Farm

Seniors (65+)

- Cheapest Provider: Progressive ($48/month minimum, $117/month full)

- Average Savings: 44% below city average

- Alternative Options: American Farmers & Ranchers, State Farm

High-Risk Driver Solutions in Tulsa

Even drivers with marks on their records can find affordable coverage:

After a DUI

- Cheapest: Progressive ($43/month minimum)

- Rate Impact: 54% savings compared to city average

- Alternative: State Farm ($49/month minimum)

With Bad Credit

- Cheapest: American Farmers & Ranchers ($69/month minimum)

- Key Insight: Poor credit increases rates by 92% compared to excellent credit

- Tip: Check your credit score regularly—improvements can lead to immediate savings

After an At-Fault Accident

- Cheapest: American Farmers & Ranchers ($45/month minimum)

- Rate Impact: 51% below city average

- Recovery Time: Most insurers reassess rates after 3-5 years

With a Speeding Ticket

- Cheapest: Progressive ($48/month minimum)

- State Farm: $49/month (nearly tied)

- Rate Impact: Varies by speed and location of violation

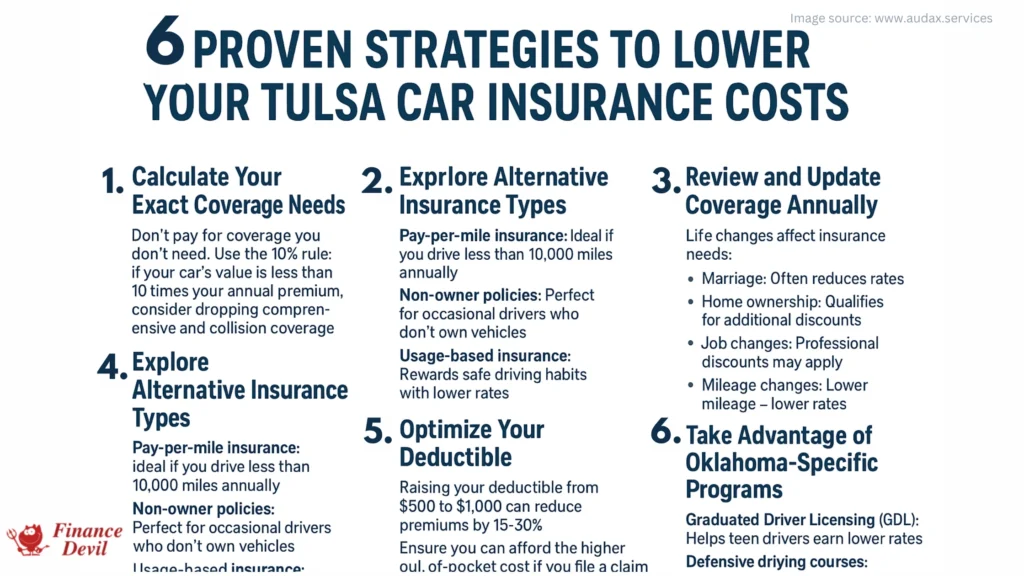

7 Proven Strategies to Lower Your Tulsa Car Insurance Costs

1. Calculate Your Exact Coverage Needs

Don’t pay for coverage you don’t need. Use the 10% rule: if your car’s value is less than 10 times your annual premium, consider dropping comprehensive and collision coverage.

2. Explore Alternative Insurance Types

- Pay-per-mile insurance: Ideal if you drive less than 10,000 miles annually

- Non-owner policies: Perfect for occasional drivers who don’t own vehicles

- Usage-based insurance: Rewards safe driving habits with lower rates

3. Stack Multiple Discounts

Common Tulsa discounts include:

- Multi-policy bundling: Up to 25% savings

- Multi-vehicle discount: 10-25% savings

- Good driver discount: 10-15% savings

- Safety feature discounts: Anti-lock brakes, airbags, anti-theft devices

- Payment discounts: Automatic payments, paid-in-full discounts

4. Optimize Your Deductible

Raising your deductible from $500 to $1,000 can reduce premiums by 15-30%. Ensure you can afford the higher out-of-pocket cost if you file a claim.

5. Maintain Excellent Credit

Oklahoma allows credit-based insurance scoring. Improving your credit score from “fair” to “good” can save over $1,000 annually in Tulsa.

6. Review and Update Coverage Annually

Life changes affect insurance needs:

- Marriage: Often reduces rates

- Home ownership: Qualifies for additional discounts

- Job changes: Professional discounts may apply

- Mileage changes: Lower mileage = lower rates

7. Take Advantage of Oklahoma-Specific Programs

- Graduated Driver Licensing (GDL): Helps teen drivers earn lower rates

- Defensive driving courses: Can reduce points and qualify for discounts

Understanding Oklahoma Insurance Requirements

Oklahoma mandates minimum liability coverage:

- Bodily Injury: $25,000 per person / $50,000 per accident

- Property Damage: $25,000 per accident

Expert Recommendation: These minimums may be insufficient. Consider 50/100/50 or 100/300/100 limits for better protection.

Additional Coverage Options Worth Considering

Uninsured/Underinsured Motorist Coverage. With 36% of Tulsa drivers uninsured, this coverage protects you when others can’t pay for damages they cause.

Medical Payments Coverage covers medical expenses regardless of fault, valuable given Oklahoma’s at-fault insurance system.

Rental Reimbursement covers rental car costs while your vehicle is being repaired, particularly useful in Tulsa’s severe weather season.

Common Mistakes That Cost Tulsa Drivers Money

1. Accepting the First Quote

Insurance rates vary by hundreds of dollars between companies. Always compare at least 3-4 quotes.

2. Ignoring Local Factors

Tulsa’s specific risks (severe weather, high pedestrian accidents, uninsured drivers) should influence your coverage choices.

3. Not Updating Coverage After Life Changes

Marriage, home purchases, job changes, and improved credit scores can all trigger rate reductions.

4. Choosing Coverage Based Solely on Price

The cheapest policy isn’t always the best value. Consider:

- Financial strength ratings (AM Best, Moody’s)

- Customer service scores (J.D. Power)

- Claims satisfaction ratings

- Local agent availability

5. Forgetting About Usage-Based Programs

Many insurers offer telematics programs that can reduce rates by 10-30% for safe drivers.

When to Switch Insurance Companies

Consider switching if:

- Your rate increases by more than 10% at renewal without claims or violations

- You experience poor customer service

- Your life circumstances change significantly

- You find quotes 15% or more below your current rate

- Your current insurer doesn’t offer discounts you qualify for

Switching Tips:

- Maintain continuous coverage to avoid lapses

- Start shopping 30-45 days before renewal

- Don’t cancel your current policy until new coverage is confirmed

- Ask about accident forgiveness and other perks

READ ALSO: How to Find the Cheapest Car Insurance in Mississippi

Top Insurance Companies Serving Tulsa: Detailed Profiles

Progressive

- Best For: Overall value and digital experience

- Strengths: Lowest overall rates, extensive coverage options, Name Your Price tool

- Unique Features: Snapshot usage-based program, custom parts coverage

- Customer Service: 24/7 claims reporting, mobile app rated 4.8/5

State Farm

- Best For: Local agent relationships and bundling

- Strengths: Extensive agent network, competitive bundling discounts

- Unique Features: Drive Safe & Save program, Steer Clear for young drivers

- Customer Service: Local agents throughout the Tulsa metro area

GEICO

- Best For: Military families and federal employees

- Strengths: Competitive rates, strong financial ratings

- Unique Features: Emergency roadside service, mechanical breakdown insurance

- Limitation: Available only to military members, veterans, and families

American Farmers & Ranchers

- Best For: High-risk drivers and rural areas

- Strengths: Forgiving underwriting, competitive rates for difficult-to-insure drivers

- Coverage Areas: Strong presence in Oklahoma and surrounding states

The Future of Car Insurance in Tulsa

Several trends are shaping Tulsa’s insurance landscape:

Technology Integration

- Telematics programs are becoming standard

- AI-powered claims processing reduces settlement times

- Mobile apps handle most customer needs

Climate Considerations

Oklahoma’s increasingly severe weather frequency may impact:

- Comprehensive coverage costs

- Deductible structures

- Risk assessment models

Regulatory Changes

Oklahoma continues evaluating:

- Credit scoring limitations

- Rate approval processes

- Consumer protection measures

Expert Tips for Tulsa Drivers

From Insurance Professionals:

- “Shop your insurance every 6 months, not just at renewal. Companies constantly adjust their risk appetites and rates.” – Licensed Insurance Agent

- “Tulsa’s weather makes comprehensive coverage essential, even for older vehicles. One hail storm can total a car.” – Claims Adjuster

- “Don’t just look at price, check the company’s claim service ratings. You’ll appreciate good service when you need it most.” – Consumer Advocate

Conclusion: Take Action on Your Tulsa Car Insurance Today

Car insurance rates in Tulsa change frequently based on market conditions, weather patterns, and company strategies. The cheapest company for you today might not be the best option six months from now.

Your next steps:

- Compare quotes from at least three companies

- Review your current coverage for gaps or excesses

- Ask about all available discounts

- Consider increasing deductibles if financially feasible

- Set a calendar reminder to review rates every six months

Remember: Tulsa drivers who actively manage their car insurance save an average of $400-800 annually compared to those who remain with the same company without shopping around.

Ready to start saving? The companies highlighted in this guide represent your best starting points for finding affordable, reliable coverage in the Tulsa area.

Comprehensive FAQ

Q: What’s the cheapest car insurance company in Tulsa, OK?

A: Progressive offers the lowest rates overall, with average annual premiums of $414 for minimum coverage and $1,283 for full coverage. However, American Farmers & Ranchers and Mercury also provide competitive rates, especially for high-risk drivers.

Q: How much does car insurance cost in Tulsa on average?

A: Tulsa drivers pay an average of $153 monthly for full coverage and $62 monthly for minimum coverage. These rates are higher than many Oklahoma cities due to population density and accident rates.

Q: Why is car insurance more expensive in Tulsa than other Oklahoma cities?

A: Several factors contribute to higher rates: Tulsa ranks as the 41st most dangerous city for pedestrians nationally, has high population density (2,091 residents per square mile), and faces a 36% uninsured driver rate. Additionally, severe weather increases comprehensive claims.

Q: Can I get cheap car insurance in Tulsa with bad credit?

A: Yes, American Farmers & Ranchers offers the best rates for drivers with poor credit, starting at $69 monthly for minimum coverage. However, improving your credit score can save over $1,000 annually, as poor credit increases rates by 92% compared to excellent credit.

Q: What discounts are available for Tulsa car insurance?

A: Common discounts include multi-policy bundling (up to 25% savings), multi-vehicle discounts (10-25%), good driver discounts (10-15%), safety feature discounts, automatic payment discounts, and good student discounts for teens.

Q: Is USAA available to all Tulsa drivers?

A: No, USAA is only available to military members, veterans, and their families. While it offers some of the lowest rates ($113/month average), civilians should consider Progressive, American Farmers & Ranchers, or State Farm as alternatives.

Q: How often should I shop for car insurance in Tulsa?

A: Review your rates every six months, not just at renewal. Insurance companies frequently adjust their risk appetites and pricing strategies, so the cheapest company can change throughout the year.

Q: What’s the minimum car insurance required in Oklahoma?

A: Oklahoma requires 25/50/25 liability coverage: $25,000 bodily injury per person, $50,000 bodily injury per accident, and $25,000 property damage per accident. However, these minimums may be insufficient given Tulsa’s accident rates and medical costs.

Q: How do speeding tickets affect insurance rates in Tulsa?

A: Speeding tickets can increase your premium by 18-26% depending on the severity. Progressive and State Farm offer the best rates for drivers with speeding violations, both around $48-49 monthly for minimum coverage.

Q: Should I drop comprehensive coverage on an older car in Tulsa?

A: Consider your car’s value and Oklahoma’s severe weather risks. Even if your car’s value is low, comprehensive coverage protects against hail damage, which is common in Tulsa. Use the 10% rule: if your car’s value is less than 10 times your annual premium, consider dropping it.

Q: What should I do if I can’t find affordable insurance in Tulsa?

A: Contact the Oklahoma Automobile Insurance Plan at (405) 842-0844. This state-sponsored program helps high-risk drivers who can’t find coverage in the standard market obtain required insurance.

Q: How does my ZIP code affect insurance rates in Tulsa?

A: Rates vary significantly across Tulsa neighborhoods. ZIP code 74120 has the highest rates ($172/month full coverage), while 74108 offers the lowest rates ($145/month full coverage). This 18% difference reflects varying accident rates, theft levels, and population density.

In another related article, The Cheapest Car Insurance Companies of 2025