In today’s dynamic financial landscape, savvy Americans are discovering that Cash Management Accounts (CMAs) offer a powerful alternative to traditional banking. With yields reaching 4.50% APY and insurance coverage up to $8 million, these innovative accounts are revolutionizing how we manage money in 2025.

What Is a Cash Management Account?

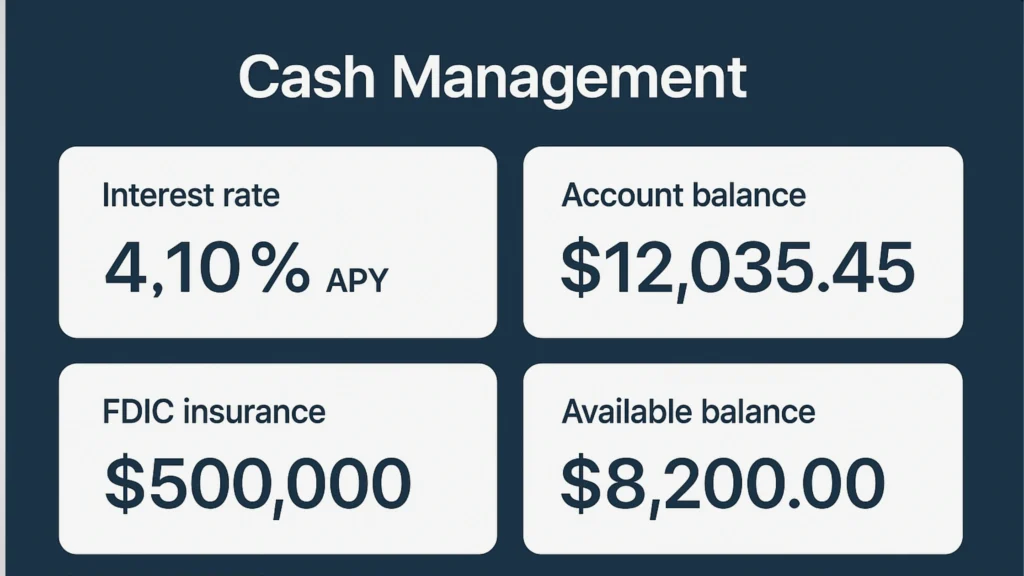

A Cash Management Account is a hybrid financial product that combines the best features of checking and savings accounts with investment capabilities. Unlike traditional bank accounts, CMAs are offered by brokerage firms and investment companies, providing a unique blend of convenience, higher returns, and enhanced protection for your funds.

The fundamental difference between Cash Management Accounts and conventional banking products lies in their structure. While banks directly insure deposits through FDIC coverage, CMA providers partner with multiple banks to sweep your funds across various institutions, often resulting in dramatically higher insurance limits—some as high as $8 million for individual accounts.

Key Features That Set Cash Management Accounts Apart

Cash Management Accounts distinguish themselves through several compelling features:

- Competitive Interest Rates: As of 2025, top CMAs offer rates between 3.65% and 4.50% APY

- Enhanced FDIC Insurance: Coverage ranging from $1.25 million to $8 million

- No Monthly Fees: Most leading providers charge zero maintenance fees

- Investment Integration: Seamless connection to brokerage accounts

- Advanced Technology: Mobile check deposit, bill pay, and instant transfers

- ATM Fee Reimbursements: Worldwide access with fee refunds

How Cash Management Accounts Work

Cash Management Accounts operate through a sophisticated sweep mechanism that maximizes both returns and security. When you deposit funds into a CMA, the provider automatically distributes your money across multiple partner banks, each providing standard FDIC insurance of $250,000 per depositor, per institution.

This sweep process happens behind the scenes, allowing you to:

- Maintain a single account interface while your funds are distributed across multiple banks

- Maximize FDIC insurance coverage far beyond the standard $250,000 limit

- Earn competitive interest rates on your entire balance

- Access funds instantly through debit cards, checks, or electronic transfers

The Technology Behind CMAs

Modern Cash Management Accounts leverage cutting-edge financial technology to provide features that traditional banks often struggle to match. Through sophisticated APIs and banking partnerships, CMA providers can offer:

- Real-time balance updates across all sweep accounts

- Instant fund availability for transactions

- Automated optimization of interest earnings

- Seamless integration with investment platforms

Top Cash Management Accounts in 2025

1. Wealthfront Cash Account

APY: 4.00% | FDIC Insurance: Up to $8 million | Monthly Fee: $0

Wealthfront’s Cash Account stands out as the industry leader, offering exceptional features that justify its top ranking. With no minimum balance requirements and a competitive 4.00% APY, it provides:

- Access to over 19,000 fee-free ATMs nationwide

- Two monthly ATM fee reimbursements (up to $7.50 each)

- Direct deposit availability up to two days early

- Seamless integration with Wealthfront’s investment platform

- Mobile bill pay and peer-to-peer payment connectivity

2. Betterment Cash Reserve

APY: 4.50% promotional (4.00% standard) | FDIC Insurance: Up to $2 million | Monthly Fee: $0

Betterment offers an attractive promotional rate for new customers, making it an excellent choice for those looking to maximize returns. Key features include:

- Three-month promotional rate of 4.50% APY for qualifying deposits

- No minimum balance beyond the $10 account opening requirement

- Global ATM fee reimbursements

- Mobile check deposit capabilities

- Companion checking account with debit card access

3. Vanguard Cash Plus Account

APY: 3.65% | FDIC Insurance: Up to $1.25 million | Monthly Fee: $0 (with e-statements)

Vanguard’s offering appeals to investors already using their platform, providing:

- No minimum balance requirements

- $25 annual fee waived with electronic statements

- Integration with Vanguard’s extensive investment products

- Simplified cash management for retirement planning

4. Empower Personal Cash

APY: 3.75% | FDIC Insurance: Standard limits | Monthly Fee: $0

Empower (formerly Personal Capital) excels in budgeting and financial planning tools:

- Robust mobile apps with spending analysis

- No fees or minimum balance requirements

- Advanced financial dashboard and net worth tracking

- Limited to electronic transfers (no cash deposits or check writing)

5. Fidelity Cash Management Account

APY: 2.21% | FDIC Insurance: Up to $5 million | Monthly Fee: $0

Fidelity’s established reputation and comprehensive features include:

- Unlimited ATM fee reimbursements worldwide

- Free check writing with no minimum

- Integration with Fidelity’s extensive investment options

- 24/7 customer support

Benefits of Cash Management Accounts

Superior Returns on Cash Balances

In 2025’s interest rate environment, Cash Management Accounts consistently outperform traditional savings accounts. While the average brick-and-mortar bank offers 0.42% APY on savings, leading CMAs provide returns 8-10 times higher, translating to hundreds or thousands of dollars in additional annual interest for account holders.

Interest Earnings Comparison (Based on $50,000 Balance)

- Traditional Savings (0.42% APY): $210 annual interest

- Average CMA (3.65% APY): $1,825 annual interest

- Top CMA (4.50% APY): $2,250 annual interest

Enhanced FDIC Insurance Protection

Perhaps the most compelling advantage of Cash Management Accounts is their extraordinary FDIC insurance coverage. Through partnerships with multiple banks, providers can offer:

- Wealthfront: Up to $8 million in coverage

- Fidelity: Up to $5 million in coverage

- Betterment: Up to $2 million per individual account

- Vanguard: Up to $1.25 million in coverage

This enhanced protection proves invaluable for high-net-worth individuals, business owners, and anyone maintaining substantial cash reserves.

Streamlined Financial Management

Cash Management Accounts excel at consolidating financial services under one roof. Users benefit from:

- Single login access to checking, savings, and investment features

- Automated transfers between cash and investment accounts

- Comprehensive reporting for tax preparation and financial planning

- Reduced paperwork and simplified account management

Cost Savings and Fee Avoidance

Unlike traditional banks that often charge monthly maintenance fees, overdraft fees, and ATM charges, most Cash Management Accounts eliminate these costs entirely:

- No monthly maintenance fees

- No minimum balance requirements

- Free or reimbursed ATM transactions

- No overdraft fees (many accounts don’t allow overdrafts)

- Free check writing and bill pay services

READ ALSO: Financial Risk Management Strategies for Optimal Business Protection

Choosing the Right Cash Management Account

Factors to Consider

Selecting the optimal Cash Management Account requires evaluating several key factors:

- Interest Rate and Stability

- Current APY and historical rate consistency

- Promotional rates versus standard rates

- Rate competitiveness compared to alternatives

- Insurance Coverage Needs

- Current and projected account balances

- FDIC insurance limits offered

- Coverage adequacy for your financial situation

- Banking Features Required

- ATM access and fee reimbursement policies

- Check writing capabilities

- Mobile deposit availability

- Bill pay functionality

- Investment Integration

- Existing brokerage relationships

- Investment goals and strategies

- Platform ease of use and features

- Technology and User Experience

- Mobile app quality and features

- Website functionality

- Customer support availability

- Security measures

Best Use Cases by User Type

Different Cash Management Accounts excel for various user profiles:

For High-Net-Worth Individuals

- Best Choice: Wealthfront Cash Account

- Why: Maximum $8 million FDIC insurance, competitive rates, comprehensive features

For Active Malaysia

- Best Choice: Betterment Cash Reserve

- Why: Promotional rates, robust budgeting tools, seamless checking integration

For Existing Vanguard Investors

- Best Choice: Vanguard Cash Plus

- Why: Platform integration, simplified account management, trusted brand

For Technology Enthusiasts

- Best Choice: Empower Personal Cash

- Why: Advanced financial dashboards, spending analytics, mobile-first design

For Traditional Investors

- Best Choice: Fidelity Cash Management

- Why: Established reputation, comprehensive features, extensive branch network

Cash Management Accounts vs. Traditional Banking

Comparative Analysis

When evaluating Cash Management Accounts against traditional banking options, several distinctions emerge:

Advantages of CMAs

- Higher interest rates (3-10x traditional banks)

- Superior FDIC insurance coverage

- Better technology and user experience

- Lower or no fees

- Investment integration

Advantages of Traditional Banks

- Physical branch locations

- Cash deposit capabilities

- Established relationships

- Broader ATM networks

- Traditional services (safe deposit boxes, notary)

Making the Transition

Transitioning from traditional banking to a Cash Management Account requires strategic planning:

- Gradual Migration: Start by opening a CMA alongside existing accounts

- Test Features: Verify all needed services are available

- Update Automatic Payments: Redirect bills and deposits systematically

- Maintain Relationships: Keep one traditional account for cash deposits

- Monitor Performance: Track interest earnings and fee savings

Tax Implications and Considerations

Interest Income Reporting

Cash Management Account interest earnings are taxable as ordinary income. Account holders should:

- Expect Form 1099-INT for interest exceeding $10

- Track interest earnings for tax planning

- Consider tax-efficient strategies for high earners

- Understand state tax implications

Tax-Advantaged Strategies

Maximize after-tax returns through:

- Municipal Bond Funds: For high-income earners in high-tax states

- Tax-Loss Harvesting: Through integrated investment accounts

- Retirement Account Coordination: Balancing taxable and tax-deferred savings

- Strategic Timing: Managing income recognition across tax years

Security and Protection

Digital Security Measures

Leading Cash Management Account providers implement robust security protocols:

- Multi-factor authentication for account access

- Encryption of all data transmissions

- Fraud monitoring with real-time alerts

- Biometric authentication options

- Secure messaging systems

Regulatory Oversight

Cash Management Accounts operate under strict regulatory frameworks:

- SIPC Protection: Securities Investor Protection Corporation coverage

- SEC Oversight: Securities and Exchange Commission regulation

- FINRA Compliance: Financial Industry Regulatory Authority rules

- State Regulations: Additional consumer protections

Future Trends in Cash Management

Emerging Technologies

The Cash Management Account landscape continues to evolve with:

- Artificial Intelligence: Automated optimization of cash positions

- Blockchain Integration: Enhanced security and transaction speed

- Open Banking: Improved account aggregation and insights

- Cryptocurrency Support: Digital asset integration

Market Predictions for 2025-2026

Industry experts anticipate:

- Continued rate competition among providers

- Expansion of FDIC insurance limits

- Enhanced mobile-first features

- Greater personalization through AI

- Increased consolidation in the industry

Conclusion

Cash Management Accounts represent a paradigm shift in personal finance management, offering Americans unprecedented combination of high yields, exceptional insurance coverage, and modern banking features. As we progress through 2025, these accounts continue to outperform traditional banking options across virtually every metric that matters to consumers.

The competitive landscape has driven providers to offer increasingly attractive terms, with yields reaching 4.50% APY and FDIC insurance coverage extending to $8 million. For anyone maintaining significant cash reserves, operating without a Cash Management Account means leaving money on the table—potentially thousands of dollars annually in foregone interest.

Whether you’re a high-net-worth individual seeking maximum insurance coverage, a tech-savvy millennial wanting seamless investment integration, or a retiree looking to maximize returns on cash holdings, there’s a Cash Management Account tailored to your needs. The key is taking action to evaluate your options and make the switch from traditional banking to these superior alternatives.

Take Action Today

- Assess your current banking relationships and calculate potential interest earnings with a CMA

- Compare the top providers based on your specific needs and priorities

- Open an account with your chosen provider—most applications take less than 10 minutes

- Start maximizing your returns while enjoying enhanced features and protection

Don’t let another day pass earning minimal interest in traditional accounts. The future of banking has arrived, and Cash Management Accounts are leading the way. Make 2025 the year you optimize your cash management strategy and join millions of Americans already benefiting from these innovative financial products.

Frequently Asked Questions

What exactly is a Cash Management Account?

A Cash Management Account is a financial product offered by brokerage firms and investment companies that combines features of checking and savings accounts with investment capabilities. They typically offer higher interest rates, enhanced FDIC insurance, and seamless integration with investment platforms.

How do Cash Management Accounts differ from high-yield savings accounts?

While both offer competitive interest rates, Cash Management Accounts provide additional features like debit cards, check writing, and investment integration. CMAs also typically offer higher FDIC insurance limits through partnerships with multiple banks, whereas savings accounts are limited to $250,000 per institution.

Are Cash Management Accounts FDIC insured?

Yes, Cash Management Accounts are FDIC insured through the provider’s partner banks. Unlike traditional banks that offer $250,000 in coverage, CMAs can provide much higher limits—up to $8 million in some cases—by distributing funds across multiple partner institutions.

Can I use a Cash Management Account as my primary bank account?

Absolutely. Most Cash Management Accounts offer all the features needed for primary banking, including direct deposit, bill pay, debit cards, and ATM access. Many users successfully use CMAs as their sole banking relationship, especially when combined with a traditional account for occasional cash deposits.

What are the tax implications of Cash Management Account interest?

Interest earned in Cash Management Accounts is taxable as ordinary income. You’ll receive a Form 1099-INT for interest exceeding $10, and this income must be reported on your tax return. The tax rate depends on your overall income bracket.

How quickly can I access funds in a Cash Management Account?

Fund accessibility in Cash Management Accounts is typically immediate for electronic transactions, debit card purchases, and ATM withdrawals. Check deposits may require standard clearing times, though many providers offer expedited processing. Transfers to external accounts usually complete within 1-3 business days.

Are there any downsides to Cash Management Accounts?

The main limitations include the lack of physical branch locations, limited or no cash deposit options, and potentially less personalized service compared to traditional banks. Some users also find the technology-focused approach challenging if they prefer in-person banking.

How do I choose the best Cash Management Account for my needs?

Consider factors like interest rates, FDIC insurance limits, required features (ATM access, check writing), investment integration needs, and minimum balance requirements. Evaluate your primary use case—whether for high-yield savings, daily banking, or investment complement—to guide your decision.

Can businesses use Cash Management Accounts?

Yes, many providers offer business Cash Management Accounts with similar features to personal accounts. These often include higher transaction limits, multiple user access, and enhanced reporting features suitable for business operations.

What happens if my Cash Management Account provider fails?

Your funds remain protected through FDIC insurance at the partner banks holding your deposits. Even if the CMA provider experiences difficulties, your money is safeguarded up to the insured limits at each partner institution.

Note: This article provides general information about Cash Management Accounts. Interest rates and features are subject to change. Always verify current rates and terms directly with providers before making financial decisions. Consult with a qualified financial advisor for personalized advice regarding your specific situation.

In another related article, Understanding Debit Balances in Margin Accounts