College students face unique financial challenges – from managing limited income to building financial literacy while pursuing their education. Finding the best savings accounts for college students with no fees has become crucial for establishing a solid financial foundation without the burden of monthly charges that can quickly drain limited funds.

According to recent data from the Federal Reserve, the average college student graduates with approximately $30,000 in debt, making every dollar saved during their academic years essential. This comprehensive guide will help you navigate the landscape of fee-free savings accounts specifically designed for college students, ensuring you can grow your money without worrying about hidden charges or minimum balance requirements.

Why Fee-Free Savings Accounts Matter for College Students

The financial reality for most college students is tight budgets, irregular income from part-time jobs, and the constant pressure of educational expenses. Traditional savings accounts often come with monthly maintenance fees ranging from $5 to $25, which can significantly impact a student’s ability to save effectively.

Fee-free savings accounts eliminate these barriers, allowing students to:

- Maximize every dollar saved without losing money to maintenance fees

- Build emergency funds for unexpected expenses like textbooks or car repairs

- Develop healthy financial habits early in their adult lives

- Earn interest on their savings without penalty

- Access funds easily when needed for educational or personal expenses

Research from the Consumer Financial Protection Bureau shows that students who maintain savings accounts during college are 40% more likely to achieve financial stability after graduation compared to those who don’t save regularly.

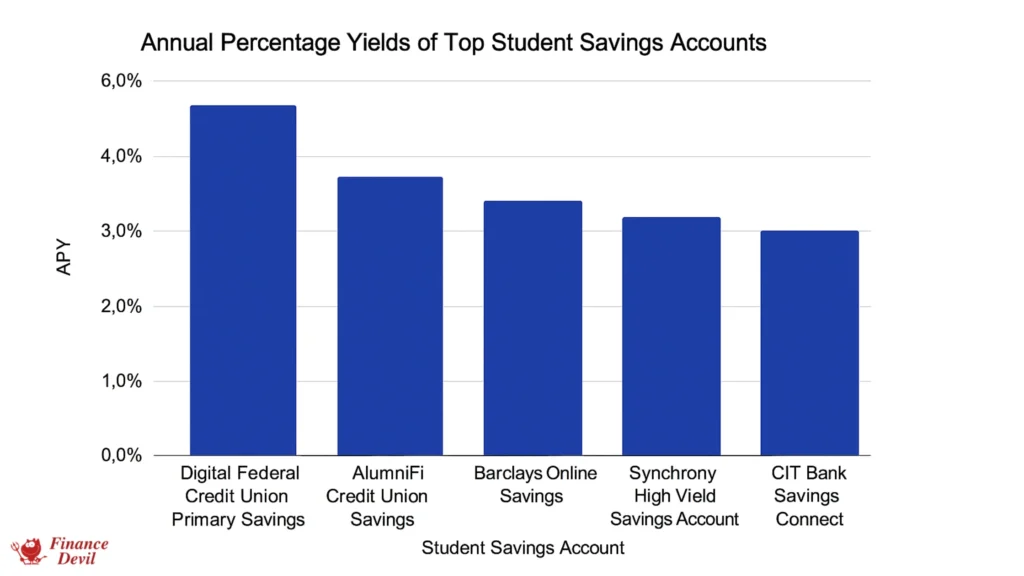

Top 10 Best Savings Accounts for College Students with No Fees

1. Synchrony High Yield Savings Account

APY: 4.00%

Minimum Deposit: $0

Monthly Fees: None

Synchrony consistently ranks among the top choices for the best savings accounts for college students with no fees. This account offers an impressive 4.00% APY with no minimum balance requirements, making it accessible to students with varying financial situations.

Key Features:

- No monthly maintenance fees

- Compound interest calculated daily

- Up to $5 in domestic ATM fee reimbursements

- 24/7 customer service

- FDIC insured up to $250,000

Best For: Students who want to maximize their interest earnings while maintaining complete fee-free banking.

2. AlumniFi Credit Union Savings

APY: 4.25% (Tier 1), 4.50% (Tier 2), 4.75% (Tier 3)

Minimum Deposit: $0

Monthly Fees: None

AlumniFi Credit Union, backed by Michigan State University Federal Credit Union, specifically caters to college graduates and students. Their tiered interest structure rewards savers with higher APYs as balances grow.

Key Features:

- Tiered interest rates with no minimum for the base rate

- NCUA insured up to $250,000

- Membership benefits for educational communities

- Online banking platform designed for young adults

Eligibility Requirements:

- Live, work, worship, or attend school in Michigan, OR

- Join the Desk Drawer Foundation with a small donation

3. Discover Bank Online Savings

APY: 3.60%

Monthly Fees: None

Minimum Deposit: $0

Discover Bank has built a reputation for student-friendly banking products. Their online savings account offers competitive rates with exceptional customer service and user-friendly digital tools.

Key Features:

- No monthly fees or minimum balance requirements

- Cash back rewards on debit card purchases

- Free cashier’s checks

- Award-winning customer service

- Mobile app with high user ratings

4. Ally Bank Online Savings

APY: 3.60%

Minimum Deposit: $0

Monthly Fees: None

Ally Bank stands out among the best savings accounts for college students with no fees due to its comprehensive savings tools and budgeting features that help students develop financial discipline.

Key Features:

- Savings buckets for goal-based saving

- Surprise savings transfers from checking

- No minimum balance or opening deposit

- 24/7 customer support

- Competitive interest rates

5. CIT Bank Savings Connect

APY: 4.00%

Minimum Deposit: $100

Monthly Fees: None

CIT Bank offers one of the most competitive rates available for students, though it requires a modest $100 opening deposit. The account consistently maintains high yields and has eliminated previous balance requirements.

Key Features:

- Consistently high APY

- No monthly maintenance fees

- Online banking platform

- Excellent rate stability

- FDIC insured

6. Barclays Online Savings

APY: 4.20%

Minimum Deposit: $0

Monthly Fees: None

Barclays Bank provides a straightforward, no-frills savings account that’s perfect for students who want simplicity combined with competitive returns.

Key Features:

- High APY with no balance requirements

- No monthly fees

- Easy online account management

- Strong security features

- Reliable customer service

7. American Express Personal Savings

APY: 3.60%

Minimum Deposit: $0

Monthly Fees: None

American Express leverages its financial expertise to offer a competitive savings account that’s particularly attractive to students beginning their financial journey.

Key Features:

- No minimum balance or monthly fees

- Easy integration with other Amex products

- Reliable online platform

- Strong brand reputation

- Consistent rate offerings

8. Marcus by Goldman Sachs

APY: 3.65%

Minimum Deposit: $1

Monthly Fees: None

Goldman Sachs’ consumer banking division offers a robust savings account with minimal requirements and competitive rates, making it accessible to college students.

Key Features:

- $1 minimum opening deposit

- No monthly fees

- User-friendly online interface

- Backed by Goldman Sachs’ financial expertise

- Excellent rate history

9. HSBC Direct Savings

APY: 3.60%

Minimum Deposit: $1

Monthly Fees: None

HSBC consistently maintains competitive rates and offers a straightforward savings account that appeals to students seeking simplicity and reliability.

Key Features:

- Low minimum opening deposit

- No monthly maintenance fees

- International banking capabilities

- Strong online platform

- Consistent rate offerings

10. Digital Federal Credit Union Primary Savings

APY: 5.50% (first $1,000), 0.15% (above $1,000)

Minimum Deposit: $5

Monthly Fees: None

DCU offers the highest introductory rate on our list, making it exceptional for students starting their savings journey with smaller amounts.

Key Features:

- Extremely high APY on first $1,000

- Low minimum opening deposit

- Extensive ATM network

- Shared branching locations nationwide

- Credit union member benefits

Essential Features to Look for in Student Savings Accounts

When searching for the best savings accounts for college students with no fees, consider these critical features:

No Monthly Maintenance Fees

This is non-negotiable for student accounts. Monthly fees can range from $5-$25, which adds up to $60-$300 annually – money that could otherwise be earning interest in your account.

Low or No Minimum Balance Requirements

Students’ finances fluctuate significantly throughout the semester. Look for accounts with either no minimum balance or very low requirements (under $100) to avoid fees during tight financial periods.

Competitive Interest Rates

While fees are the primary concern, earning competitive interest helps your money grow. Current high-yield savings accounts offer APYs between 3.50% and 5.50%, significantly higher than traditional bank rates of 0.01% to 0.05%.

Easy Access to Funds

Students need quick access to their money for emergencies or unexpected expenses. Look for accounts offering:

- Online and mobile banking

- ATM access with fee reimbursements

- Electronic transfers

- Mobile check deposit

FDIC or NCUA Insurance

Ensure your chosen account is federally insured up to $250,000, protecting your savings even if the financial institution faces difficulties.

Educational Resources and Tools

Many banks offer financial literacy resources, budgeting tools, and savings calculators specifically designed to help students develop healthy financial habits.

How to Choose the Right No-Fee Savings Account

Selecting the best savings accounts for college students with no fees requires careful consideration of your specific needs and circumstances:

Assess Your Banking Habits

- Digital vs. Branch Banking: If you prefer online banking, focus on digital banks offering higher rates. If you need in-person service, consider credit unions or banks with local branches.

- ATM Usage: Calculate your typical ATM usage and choose accounts offering fee reimbursements if you frequently use out-of-network ATMs.

- Transfer Frequency: Consider how often you’ll move money between accounts and ensure your chosen bank offers easy, free transfers.

Consider Your Financial Goals

- Emergency Fund Building: Look for accounts with savings tools and automatic transfer features

- Short-term Savings: Focus on accounts with easy access and no penalties for withdrawals

- Long-term Growth: Prioritize accounts with the highest stable APYs

Evaluate Customer Service

As a student, you may need guidance on financial matters. Choose banks offering:

- 24/7 customer support

- Educational resources

- User-friendly mobile apps

- Responsive online chat or phone support

Maximizing Your Student Savings Account

Once you’ve chosen the best savings account for college students with no fees, implement these strategies to maximize its benefits:

Set Up Automatic Transfers

Arrange automatic transfers from your checking account to savings, even if it’s just $25-$50 per month. This “pay yourself first” approach builds savings without requiring active decision-making.

Use Savings Goals and Buckets

Many banks offer goal-setting tools that help you save for specific purposes:

- Emergency fund (aim for $500-$1,000)

- Textbooks and supplies

- Study abroad programs

- Post-graduation expenses

- Technology upgrades

Take Advantage of Round-Up Programs

Some banks offer programs that round up purchases to the nearest dollar and transfer the difference to savings. This micro-saving approach can add $20-$100 to your savings monthly.

Monitor Interest Rates

While the best savings accounts for college students with no fees typically offer competitive rates, these can change. Stay informed about rate changes and be prepared to switch accounts if better options become available.

Avoid Common Pitfalls

- Don’t use savings for non-emergency expenses – maintain the discipline to let your savings grow

- Don’t ignore account statements – review monthly to track progress and catch any errors

- Don’t choose based solely on promotional rates – ensure the standard rate remains competitive

Building Financial Literacy Through Smart Savings

The best savings accounts for college students with no fees serve as more than just places to store money – they’re educational tools that teach valuable financial lessons:

Understanding Compound Interest

Even small amounts saved during college demonstrate the power of compound interest. A student saving $100 monthly at 4% APY will have over $4,900 after four years, compared to $4,800 in a non-interest-bearing account.

Developing Budgeting Skills

Regular savings require budgeting discipline. Students learn to distinguish between needs and wants, prioritize expenses, and allocate funds strategically.

Preparing for Post-Graduation Financial Responsibilities

Building savings habits during college prepares students for adult financial responsibilities like:

- Apartment deposits and moving expenses

- Professional wardrobe purchases

- Transportation costs for job interviews

- Emergency fund maintenance

Comparing Online vs. Traditional Banks for Student Savings

Online Banks: Advantages for Students

Higher Interest Rates: Online banks typically offer APYs 10-20 times higher than traditional banks due to lower overhead costs.

Lower Fees: Digital-first banks often eliminate many fees that traditional banks charge, making them ideal for fee-conscious students.

Advanced Technology: Mobile apps and online platforms are typically more sophisticated, offering better budgeting tools and account management features.

24/7 Access: Online banking doesn’t require visiting branches during business hours, perfect for students with irregular schedules.

Traditional Banks: When They Make Sense

Local Presence: Students attending college in their hometown may benefit from familiar local banking relationships.

Cash Deposits: If you frequently receive cash (from family, tips, odd jobs), local branches make deposits easier.

In-Person Service: Some students prefer face-to-face assistance when learning about financial products.

Comprehensive Services: Traditional banks may offer easier access to other products like student loans or credit cards.

State-Specific Considerations for College Students

California Students

California’s high cost of living makes fee-free savings accounts particularly important. Students attending UC or CSU schools should prioritize accounts with:

- High APYs to combat inflation

- No ATM fees for frequent cash needs

- Mobile banking for busy lifestyles

Texas Students

Texas students benefit from no state income tax, making savings growth more effective. Consider:

- Credit unions affiliated with major Texas universities

- Accounts offering cash back on purchases

- Banks with strong Southwest regional presence

New York Students

High living costs in NYC make every saved dollar crucial. Prioritize:

- Accounts with the highest available APYs

- Banks offering ATM fee reimbursements

- Digital banks with strong mobile platforms

Florida Students

Florida’s growing fintech presence offers unique opportunities:

- Emerging digital banks with competitive rates

- Credit unions serving multiple Florida universities

- Accounts with international capabilities for diverse student populations

Impact of Federal Policy on Student Savings

Recent federal policy changes affect how students approach savings:

Federal Reserve Interest Rate Policy

The Federal Reserve’s monetary policy directly impacts savings account rates. Understanding these trends helps students:

- Time account openings to maximize rate benefits

- Anticipate rate changes and adjust savings strategies

- Compare fixed vs. variable rate products

FDIC Insurance Coverage

Recent discussions about FDIC insurance limits remind students to:

- Verify their chosen bank’s insurance status

- Understand coverage limits ($250,000 per depositor, per bank)

- Consider spreading large savings across multiple institutions if necessary

Student Loan Policy Changes

Evolving student loan policies affect savings priorities:

- Income-driven repayment plan changes

- Loan forgiveness program modifications

- Interest rate adjustments on federal student loans

Technology and Innovation in Student Banking

The best savings accounts for college students with no fees increasingly leverage technology to enhance the user experience:

Artificial Intelligence and Financial Management

Modern banking apps use AI to:

- Analyze spending patterns and suggest savings opportunities

- Provide personalized financial advice

- Automate savings based on income and expense patterns

- Send alerts about unusual account activity

Blockchain and Security

Emerging blockchain technology enhances account security through:

- Improved fraud detection

- Enhanced transaction verification

- Better privacy protection

- Reduced risk of identity theft

Integration with Student Life

Banking apps increasingly integrate with student-specific services:

- Campus payment systems

- Student discount programs

- University financial aid offices

- Academic calendar-based budgeting tools

Conclusion: Your Path to Financial Success Starts with Smart Savings

Choosing the best savings accounts for college students with no fees represents a crucial first step in your financial journey. The accounts highlighted in this guide offer competitive interest rates, eliminate costly fees, and provide the tools needed to build healthy financial habits that will serve you long after graduation.

Remember that the best account for you depends on your specific needs, banking preferences, and financial goals. Whether you choose a high-yield online account like Synchrony or a student-focused credit union like AlumniFi, the key is to start saving consistently and let compound interest work in your favor.

As you move through your college years, regularly review your savings strategy and be prepared to adapt as your needs change. The financial discipline you develop now will pay dividends throughout your career, helping you achieve major life goals like homeownership, starting a business, or early retirement.

Take action today by researching the accounts that best fit your needs, gathering required documentation, and opening your fee-free student savings account. Your future self will thank you for the financial foundation you’re building during these formative college years.

Ready to start your savings journey? Compare the accounts listed in this guide, choose the one that best fits your needs, and begin building the financial future you deserve. Remember, the best time to start saving was yesterday – the second-best time is today.

Frequently Asked Questions

What makes a savings account specifically good for college students?

The best savings accounts for college students with no fees typically offer no minimum balance requirements, no monthly maintenance fees, competitive interest rates, and user-friendly digital platforms. These features accommodate students’ typically limited and irregular income while providing tools to build financial literacy.

Can international students open fee-free savings accounts in the USA?

Yes, many banks offer accounts to international students, though requirements vary. International students typically need:

- Valid passport and visa documentation

- Social Security Number or Individual Taxpayer Identification Number (ITIN)

- Proof of enrollment at a U.S. educational institution

- Initial deposit (varies by bank)

Some banks specializing in international student banking include Capital One, Chase, and various credit unions affiliated with universities.

How much should college students aim to save monthly?

Financial experts recommend students save at least 10-20% of their income, but any amount is beneficial. A practical approach for students might be:

- Part-time job income: Save $50-$100 monthly

- Financial aid refunds: Save 25-50% of excess funds

- Family support: Save a portion of money received from family

- Emergency fund goal: Build to $500-$1,000 over time

Are credit unions or banks better for student savings accounts?

Both can offer excellent options for the best savings accounts for college students with no fees. Credit unions often provide:

- Higher interest rates

- Lower fees

- More personalized service

- Community focus

Banks typically offer:

- Wider ATM networks

- More advanced technology

- Greater convenience

- Broader product selection

The best choice depends on individual preferences and needs.

What happens to my student savings account after graduation?

Most student-specific accounts automatically convert to regular accounts after graduation or when you reach a certain age (typically 24-26). This may result in:

- Monthly maintenance fees (unless waived through other means)

- Different minimum balance requirements

- Changed fee structures

- Loss of student-specific benefits

Review your account terms and consider switching to a different account type if necessary.

How do savings account interest rates compare to inflation?

Current high-yield savings accounts offering 3.50-5.50% APY generally outpace or match recent inflation rates (2-4% annually). This means your money maintains or grows in purchasing power, unlike traditional savings accounts offering 0.01-0.05% APY, which lose value to inflation.

Can I have multiple savings accounts as a student?

Yes, many students benefit from multiple savings accounts for different purposes:

- Emergency fund account

- Goal-specific savings (study abroad, car, etc.)

- Long-term savings

- Textbook and supply fund

Just ensure each account meets the criteria for the best savings accounts for college students with no fees to avoid unnecessary costs.

What’s the difference between APY and interest rate?

APY (Annual Percentage Yield) includes the effect of compound interest, showing the actual return you’ll earn over a year. Interest rate is the basic rate before compounding. APY is the more important figure when comparing accounts, as it reflects your true earnings.

Should I prioritize paying off student loans or building savings?

This depends on your loan interest rates compared to savings account rates:

- High-interest loans (above 6-7%): Prioritize loan payments

- Low-interest loans (below 4-5%): Build emergency savings first

- Federal loans with income-driven repayment: Maintain balanced approach

Always maintain some emergency savings regardless of loan obligations.

How do I know if my savings account is FDIC insured?

Check for the FDIC logo on the bank’s website or marketing materials. You can also verify coverage through the FDIC’s online database at fdic.gov. Credit unions offer similar protection through NCUA insurance. This insurance protects deposits up to $250,000 per depositor, per institution.