Why Most Americans Overpay for Car Insurance (And How You Can Avoid It)

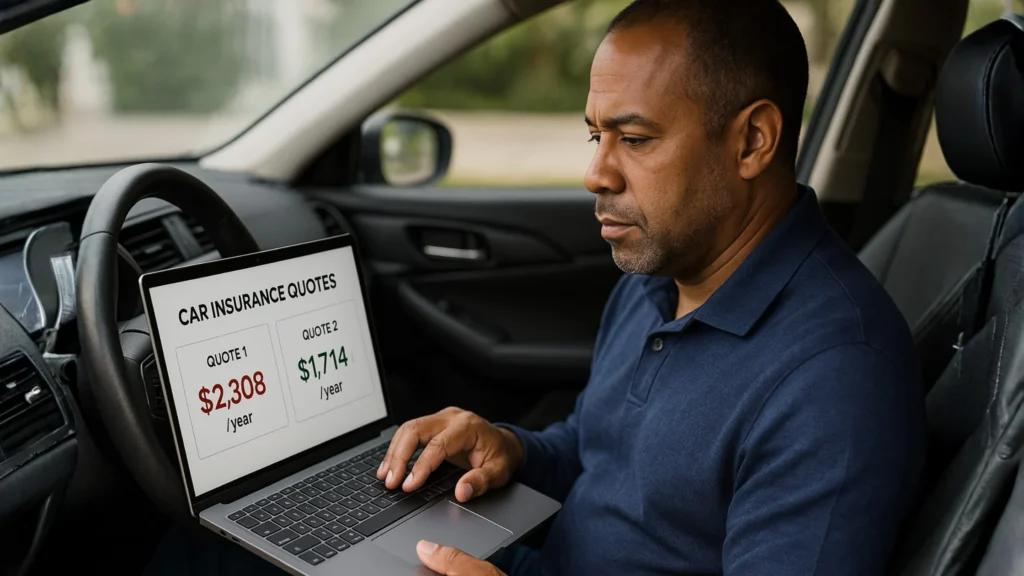

Here’s a shocking truth: 63% of American drivers haven’t compared car insurance rates in over three years, according to recent industry data. Meanwhile, insurance companies adjust their pricing algorithms constantly, meaning you could be paying hundreds or even thousands of dollars more than necessary for the exact same coverage.

Understanding auto insurance coverage types isn’t just about meeting legal requirements. It’s about protecting your financial future while avoiding unnecessary expenses. Whether you’re a first-time buyer, switching providers, or simply reviewing your policy, this comprehensive guide will walk you through everything you need to know about car insurance in 2025.

The Hidden Cost of Confusion: Why Understanding Coverage Types Matters

The average American household spends $1,780 annually on auto insurance, but many don’t fully understand what they’re paying for. This confusion leads to two costly mistakes:

- Over-insuring: Paying for coverage you don’t need (like collision coverage on a $2,000 car)

- Underinsuring: Lacking protection that could save you from financial disaster after an accident

The insurance landscape has evolved significantly in recent years. With rising vehicle repair costs, increased medical expenses, and more distracted drivers on the road, understanding auto insurance coverage types has never been more critical to your financial well-being.

The 6 Essential Auto Insurance Coverage Types Every Driver Should Know

Let’s break down the fundamental coverage types that form the backbone of any car insurance policy. Understanding these will empower you to make informed decisions and potentially save hundreds of dollars annually.

1. Liability Coverage: Your Legal Foundation

What It Is: Liability coverage is the cornerstone of auto insurance and is mandatory in 49 states (New Hampshire is the only exception). This coverage protects you financially when you’re at fault in an accident that causes injury or property damage to others.

Liability coverage has two critical components:

- Bodily Injury Liability: Covers medical expenses, lost wages, pain and suffering, and legal fees if you injure someone in an at-fault accident

- Property Damage Liability: Pays for damage you cause to another person’s vehicle, building, fence, or other property

Real-World Example: Sarah ran a red light in Atlanta and collided with another vehicle, injuring the driver and causing $35,000 in medical bills plus $12,000 in vehicle damage. Her liability coverage paid the entire $47,000 claim, protecting her from financial ruin.

State Minimum Requirements: Every state sets minimum liability limits, typically expressed as three numbers (e.g., 25/50/25):

- $25,000 bodily injury per person

- $50,000 bodily injury per accident

- $25,000 property damage per accident

Expert Tip: Industry experts recommend carrying liability limits well above your state’s minimum, ideally 100/300/100 or higher, especially if you have significant assets to protect. For serious accidents, minimum coverage often falls dramatically short of actual costs.

2. Collision Coverage: Protecting Your Vehicle from Accident Damage

What It Is: Collision coverage pays to repair or replace your vehicle when it’s damaged in an accident, regardless of who’s at fault. This includes accidents with other vehicles, hitting fixed objects like guardrails or trees, and even single-vehicle rollovers.

When You Need It:

- You’re financing or leasing your vehicle (lenders require it)

- Your car’s value exceeds $3,000-$4,000

- You can’t afford to replace your vehicle out of pocket

When You Might Skip It: If your car is worth less than $2,000-$3,000, the cost of collision coverage may exceed the potential payout after your deductible.

How It Works: Collision coverage pays up to your vehicle’s actual cash value (ACV), minus your deductible. If you have a $500 deductible and $8,000 in damage, your insurer pays $7,500.

Money-Saving Strategy: Choosing a higher deductible ($1,000 instead of $500) can reduce your premium by 15-30%. Just ensure you have enough savings to cover the deductible if you need to file a claim.

3. Comprehensive Coverage: Protection Beyond Accidents

What It Is: Comprehensive coverage (sometimes called “other than collision”) protects your vehicle from non-accident damage, including:

- Theft (full vehicle or parts)

- Vandalism and malicious mischief

- Weather damage (hail, flooding, hurricanes)

- Fire and explosions

- Falling objects (trees, debris)

- Animal collisions (hitting a deer)

- Civil disturbances and riots

- Glass damage (windshield cracks)

USA-Specific Context: With extreme weather events increasing across America from California wildfires to Midwest tornadoes to Florida hurricanes, comprehensive coverage has become increasingly valuable. The National Oceanic and Atmospheric Administration (NOAA) reported that 2024 saw 23 separate billion-dollar weather disasters in the United States.

Real-World Example: Michael’s car was parked outside his Dallas home when a severe hailstorm caused $6,500 in body damage. His comprehensive coverage (with a $500 deductible) paid $6,000 for repairs.

Cost Consideration: Like collision coverage, comprehensive has a deductible and is typically required by lenders. However, it’s generally less expensive than collision because comprehensive claims are typically less costly.

4. Uninsured/Underinsured Motorist Coverage: Your Safety Net

What It Is

This crucial coverage protects you when you’re hit by a driver who either:

- Has no insurance (uninsured motorist)

- Has insufficient coverage to pay your claims (underinsured motorist)

The Shocking Statistics: According to the Insurance Research Council, approximately 1 in 8 drivers in the United States is uninsured. In some states like Mississippi and Michigan, that number exceeds 25%. Even insured drivers often carry only minimum liability limits that may not cover your actual expenses.

Coverage Components:

- Uninsured/Underinsured Motorist Bodily Injury (UM/UIM BI): Covers medical bills, lost wages, and pain and suffering

- Uninsured/Underinsured Motorist Property Damage (UMPD): Covers vehicle damage (available in some states)

State Requirements: This coverage is mandatory in approximately half of U.S. states and highly recommended in all others.

Real-World Example: Jennifer was rear-ended in Phoenix by a driver with only $15,000 in liability coverage. Her medical bills totaled $45,000. Her underinsured motorist coverage paid the $30,000 gap, preventing financial hardship.

Expert Recommendation: This is one of the most cost-effective coverages available, often adding just $50-$150 to your annual premium while providing substantial protection.

5. Personal Injury Protection (PIP): No-Fault Medical Coverage

What It Is: Personal Injury Protection, also called “no-fault insurance,” covers medical expenses, lost wages, and other costs for you and your passengers after an accident, regardless of who caused it.

What PIP Typically Covers:

- Medical and hospital expenses

- Rehabilitation costs

- Lost wages and replacement services

- Funeral expenses

- Childcare expenses while injured

State Availability: PIP is required in 12 “no-fault” states: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah. It’s optional in several others.

PIP vs. Medical Payments Coverage: While similar, PIP offers broader protection than medical payments coverage (MedPay). PIP covers lost wages and essential services; MedPay covers only medical expenses but is available in more states.

Michigan’s Unique System: Michigan offers unlimited PIP coverage, though recent reforms allow drivers to opt for lower limits. This makes Michigan auto insurance among the most expensive in the nation, with average premiums exceeding $2,600 annually.

6. Medical Payments Coverage (MedPay): Supplemental Medical Protection

What It Is: Medical payments coverage helps pay medical expenses for you and your passengers following an accident, regardless of fault. It’s simpler and more limited than PIP.

What MedPay Covers:

- Emergency room visits

- Hospital stays

- Surgery and X-rays

- Ambulance fees

- Dental procedures resulting from accidents

- Prosthetics

- Professional nursing services

State Requirements: MedPay is required in Maine, New Hampshire, and Pennsylvania. It’s optional in most other states.

When It’s Valuable:

- You have a high-deductible health insurance plan

- Your health insurance doesn’t cover auto accidents immediately

- You want to avoid filing health insurance claims for auto accidents

- You regularly have passengers who might not have adequate health insurance

Typical Coverage Amounts: MedPay limits usually range from $1,000 to $10,000, with higher limits available. Even small amounts ($2,000-$5,000) can cover emergency room visits and immediate treatment.

Additional Auto Insurance Coverage Options to Consider

Beyond the six fundamental coverage types, insurers offer several optional coverages that can enhance your protection and convenience.

Gap Insurance: Protecting Against Depreciation

What It Covers: Gap insurance covers the “gap” between what you owe on your car loan and your vehicle’s actual cash value if it’s totaled or stolen.

Why It Matters: New cars depreciate 20-30% in the first year. If you financed $35,000 and your car is totaled after six months, it might be worth only $28,000, but you still owe $33,000. Gap insurance covers that $5,000 difference.

Who Needs It:

- Made a small down payment (less than 20%)

- Financed for 60+ months

- Purchased a vehicle that depreciates quickly

- Rolled negative equity from a previous loan into your new loan

Cost: Typically $20-$40 per year when added to your auto policy (much cheaper than buying from a dealership).

Rental Reimbursement Coverage

What It Covers: Pays for a rental car while your vehicle is being repaired after a covered claim.

Typical Coverage: $30-$50 per day with maximums of $900-$1,500 per claim.

Cost-Benefit Analysis: This coverage costs approximately $30-$80 annually. If you don’t have alternate transportation and need a rental for even a few days after an accident, it pays for itself.

Roadside Assistance/Towing Coverage

What It Includes:

- Towing to the nearest repair facility

- Battery jump-starts and replacement

- Flat tire changes

- Fuel delivery

- Lockout service

Cost: Usually $10-$30 per year

Alternative: Compare this to AAA or other roadside assistance programs to determine the best value for your needs.

New Car Replacement Coverage

What It Covers: Replaces your totaled vehicle with a brand-new car of the same make and model (rather than paying depreciated value).

Eligibility: Typically available only for vehicles less than two years old.

Value Proposition: Particularly valuable for new car buyers who want protection against first-year depreciation.

Rideshare Coverage

Essential for Uber/Lyft Drivers: Personal auto insurance doesn’t cover you while driving for rideshare companies. Rideshare coverage fills the gaps between your personal policy and the rideshare company’s commercial coverage.

Who Needs It: Anyone who drives for Uber, Lyft, DoorDash, or similar services, even part-time.

READ ALSO: Travelers Auto Insurance: Complete Guide to Rates, Discounts & Coverage

Understanding Auto Insurance Coverage Types: State-by-State Requirements

Insurance requirements vary significantly across the United States. Here’s what you need to know about state-specific mandates.

Mandatory Coverage by State Type

Traditional Tort States (Majority): Drivers must carry liability coverage. At-fault drivers are responsible for damages.

No-Fault States (12 states): Drivers must carry PIP coverage and use their own insurance for medical expenses, regardless of fault.

Choice No-Fault States (3 states): Drivers can choose between traditional tort or no-fault systems.

States with Highest/Lowest Requirements

Highest Minimum Requirements:

- Alaska: 50/100/25

- Maine: 50/100/25

- Delaware: 25/50/10 plus PIP

Lowest Minimum Requirements:

- California: 15/30/5

- Arizona: 25/50/15

- Several states: 25/50/25

Critical Warning: Minimum requirements are often dangerously low. A single accident can easily exceed these limits, leaving you personally liable for the difference.

Financial Responsibility Laws

Every state (except New Hampshire and Virginia) requires proof of financial responsibility through:

- Auto insurance policy

- Self-insurance (for those with substantial assets)

- Cash deposits with the state

- Surety bonds

Penalties for Driving Uninsured:

- Fines ranging from $100 to $5,000

- License suspension

- Vehicle impoundment

- SR-22 requirement (high-risk insurance certification)

- Potential jail time for repeat offenses

Understanding Your Auto Insurance Policy Documents

When your policy arrives, these key documents require your attention:

Declarations Page

What It Contains:

- Policy period (start and end dates)

- Named insureds and vehicles covered

- Coverage types and limits

- Deductibles

- Premium amounts

- Discounts applied

- Lienholder information

Action Required: Review immediately for accuracy. Report any errors within 30 days.

Coverage Detail Section

What It Contains

Detailed explanation of each coverage, including:

- What’s covered and what’s excluded

- Limits of liability

- How deductibles apply

- Definition of key terms

- Policy conditions and requirements

Action Required: Read carefully to understand your actual protection.

Endorsements and Exclusions

What It Contains

Modifications to standard coverage, including:

- Special coverage additions

- Named driver exclusions

- Vehicle-specific limitations

- Geographic restrictions

Action Required: Understand how these modify your base policy.

Special Situations: Unique Coverage Considerations

High-Risk Drivers

Who Qualifies:

- Multiple accidents or violations

- DUI/DWI convictions

- License suspensions

- Lapses in coverage

- Teen drivers with violations

Options:

- State-assigned risk pools

- High-risk specialist insurers

- SR-22 or FR-44 filings (proof of insurance)

- Non-standard insurance markets

Cost Impact: Expect to pay 50-300% more than standard rates.

Path to Lower Rates: Maintain a clean record for 3-5 years to qualify for standard insurance again.

Classic and Collector Cars

Special Considerations:

- Agreed value coverage (not actual cash value)

- Mileage restrictions

- Storage requirements

- Qualified driver provisions

- Car show coverage

Specialized Insurers: Hagerty, Grundy, American Modern

Savings Opportunity: Classic car insurance is often 50-70% cheaper than standard coverage due to limited use.

Commercial and Business Use

When Required:

- Vehicles titled in business name

- Vehicles used regularly for business purposes

- Food delivery, rideshare, or transportation services

- Contractor work vehicles

Coverage Differences:

- Higher liability limits required

- Additional insured endorsements

- Hired and non-owned auto coverage

- Cargo and equipment coverage

Teen Drivers

Cost Reality: Adding a teen driver increases family premiums by $1,500-$3,500 annually on average.

Money-Saving Strategies:

- Good student discounts (can save 15-25%)

- Defensive driving courses

- Add teen to least expensive vehicle

- Consider usage-based insurance programs

- Set driving restrictions (curfews, passenger limits)

- Some insurers offer “away at school” discounts if teen doesn’t have car at college

The Future of Auto Insurance: Trends Shaping Coverage in 2025 and Beyond

Usage-Based Insurance (UBI) Growth

How It Works

Telematics devices or smartphone apps monitor:

- Miles driven

- Acceleration and braking patterns

- Speed

- Time of day driving

- Phone usage while driving

Potential Savings: Safe drivers can save 15-40%

Privacy Considerations: Weigh savings against data sharing comfort level.

Major Programs:

- Progressive Snapshot

- State Farm Drive Safe & Save

- Allstate Drivewise

- Geico DriveEasy

Autonomous Vehicle Coverage Evolution

As self-driving technology advances, insurance models are evolving:

- Shifting liability from driver to manufacturer

- New coverage types for system failures

- Reduced collision frequency projections

- Cybersecurity and hacking coverage needs

Climate Change Impact

Increasing Comprehensive Claims: More severe weather events affect

- Hail damage claims

- Flood-related losses

- Wildfire vehicle destruction

- Hurricane and tornado damage

Result: Comprehensive coverage premiums are rising in high-risk areas.

Digital-First Insurance Models

New Features:

- Instant quotes and binding

- Digital ID cards

- App-based claims filing with photo upload

- Virtual vehicle inspections

- AI-powered claim processing

- Chatbot customer service

Frequently Asked Questions About Auto Insurance Coverage Types

Q1: What is the difference between full coverage and liability-only insurance?

Answer: “Full coverage” is actually an insurance industry myth; it’s not a specific product. Most people use this term to mean they have liability coverage plus collision and comprehensive coverage. Liability-only covers damage you cause to others but not damage to your own vehicle. The right coverage level depends on your vehicle’s value, your financial situation, and lender requirements. Most financial experts recommend more than just liability-only if you couldn’t afford to replace your vehicle out of pocket.

Q2: Is it better to have collision or comprehensive coverage?

Answer: You don’t have to choose; they protect against different risks. Collision covers accident damage to your vehicle, while comprehensive covers non-collision events like theft, weather, vandalism, and animal strikes. Most drivers need both if their vehicle is worth more than $3,000-$4,000, especially if required by a lender. However, for older vehicles with low value, you might drop both since the potential payout minus your deductible might not justify the premium cost.

Q3: How much liability coverage do I really need?

Answer: State minimums are rarely sufficient. Financial experts recommend carrying liability limits of at least 100/300/100 ($100,000 per person for bodily injury, $300,000 per accident, and $100,000 for property damage). If you have significant assets to protect, like a home with substantial equity or retirement accounts, consider even higher limits or an umbrella policy. A serious accident can easily cost $200,000-$500,000 or more in medical bills and damages, and you’re personally liable for any amount exceeding your policy limits.

Q4: What happens if I’m hit by an uninsured driver?

Answer: This depends on whether you have uninsured motorist (UM) coverage. If you do, your UM coverage will pay for your injuries (and property damage in some states) up to your policy limits. If you don’t have UM coverage, you can sue the at-fault driver personally, but uninsured drivers typically lack assets to collect from. Given that approximately one in eight U.S. drivers is uninsured, UM coverage is one of the best investments you can make, usually costing only $50-$150 annually.

Q5: Does my insurance cover me when I drive someone else’s car?

Answer: Generally, yes, but it’s complicated. Auto insurance typically follows the car, not the driver. This means the vehicle owner’s insurance is primary coverage. Your insurance may provide secondary coverage if the owner’s policy limits are exceeded. However, there are important exceptions: rental cars have separate coverage rules, business vehicles may not be covered, and coverage can vary significantly by state and policy. Always verify coverage before regularly driving someone else’s vehicle.

Your Action Plan: Getting the Right Coverage Today

Now that you understand auto insurance coverage types, here’s your step-by-step action plan to ensure you have the right protection at the best price:

Immediate Actions (This Week)

1. Review Your Current Policy

Pull out your declarations page and identify:

- Your current coverage types and limits

- Your deductibles for comprehensive and collision

- Discounts you’re receiving

- Your premium amount and payment schedule

2. Assess Your Coverage Needs

Ask yourself:

- Do I have adequate liability limits to protect my assets?

- Is my vehicle value still high enough to justify collision and comprehensive?

- Am I carrying uninsured/underinsured motorist coverage?

- Do I have proper coverage for my current life situation?

3. Identify Potential Savings Opportunities

Look for:

- Unused discounts you qualify for

- Appropriate deductible adjustments

- Coverage you’re paying for but don’t need

- Bundling opportunities with home or renters insurance

This Month: Compare and Optimize

1. Gather Quotes from Multiple Insurers Get at least 3-5 quotes with identical coverage to compare accurately. Don’t just focus on price; consider customer service, financial stability, and claim-handling reputation.

2. Ask About All Available Discounts

Specifically inquire about:

- Multi-policy bundling

- Good driver and accident-free discounts

- Vehicle safety features

- Low mileage or usage-based programs

- Professional affiliations

- Paperless and auto-pay options

3. Consider Your Total Risk Profile Think beyond just saving money:

- What could you afford to pay out of pocket after an accident?

- Do you have emergency savings to cover a higher deductible?

- What assets do you need to protect from lawsuits?

- Are you comfortable with your current coverage gaps?

Ongoing: Annual Review and Adjustment

Set a Calendar Reminder Review your auto insurance every 12 months, or immediately after:

- Buying or selling a vehicle

- Moving to a new location

- Marriage or divorce

- Teen driver getting a license

- Paying off a car loan

- Major changes in driving patterns

- Credit score improvements

Stay Informed:

Keep up with:

- State law changes affecting required coverage

- New discount opportunities

- Emerging insurance technologies (telematics, usage-based)

- Your insurer’s financial health ratings

Why Understanding Auto Insurance Coverage Types Protects Your Financial Future

Auto insurance isn’t just about complying with state laws or satisfying your lender; it’s about protecting everything you’ve worked to build. A single serious accident without adequate coverage could:

- Drain your savings or retirement accounts

- Force you into bankruptcy

- Result in wage garnishment for years

- Damage your credit score

- Cost you your home

On the flip side, understanding auto insurance coverage types empowers you to:

✓ Make informed decisions rather than buying based on price alone

✓ Avoid paying for coverage you don’t need while ensuring you have protection where it matters

✓ Protect your financial future against catastrophic losses

✓ Save hundreds or thousands annually through strategic shopping and optimization

✓ Have peace of mind knowing you’re properly protected

Take Action Now: Insurance Rates Change Daily

Here’s a sobering reality: Insurance companies adjust their rates constantly, sometimes daily. The quote you get today might not be available tomorrow. Market conditions, your driving record, and even your credit score changes can affect your eligibility for the best rates.

That’s why the absolute best time to review your coverage and compare quotes is right now, while this information is fresh in your mind.

What to Do Next

1. Calculate Your Ideal Coverage Levels Based on what you’ve learned, determine:

- Appropriate liability limits for your asset protection needs

- Whether collision and comprehensive make sense for your vehicles

- Your optimal deductible based on your emergency savings

- Additional coverages that fit your situation

2. Get Multiple Quotes Don’t settle for the first quote you receive. Rates vary dramatically between insurers, sometimes by 50% or more for identical coverage. Comparing multiple quotes ensures you’re getting competitive pricing.

3. Review and Compare Apples to Apples Make sure all quotes include:

- The same liability limits

- Identical deductibles

- The same coverage types

- All applicable discounts

4. Choose Coverage That Fits Your Needs AND Budget The “best” insurance isn’t the cheapest or the most expensive; it’s coverage that provides adequate protection at a price you can sustain long-term.

5. Ask Questions Before Buying If anything is unclear, ask your agent or insurer to explain it. Understanding your policy before you buy prevents unpleasant surprises after an accident.

The Bottom Line: Knowledge Is Your Best Asset

Understanding auto insurance coverage types isn’t just about saving money, though that’s certainly a benefit. It’s about taking control of your financial protection and making strategic decisions based on your unique circumstances rather than guesswork or outdated assumptions.

You now have the knowledge to:

- Understand what each coverage type protects

- Identify which coverages are mandatory and which are optional

- Recognize when you’re over-insured or under-insured

- Compare quotes effectively and spot the best value

- Avoid common mistakes that cost thousands

- Ask informed questions and advocate for yourself

Remember these key takeaways:

- State minimums are rarely sufficient: protect your assets with adequate liability limits

- Uninsured motorist coverage is essential: one in eight drivers lacks insurance

- Shop around regularly: rates vary dramatically between insurers and change frequently

- Don’t just buy the cheapest policy: balance price with coverage adequacy and insurer reputation

- Review your policy annually: your needs change, and so do insurance markets

- Ask about all available discounts: you might be missing savings opportunities

- Understand your policy completely: know what’s covered and what’s not before you need to file a claim

Auto insurance is one of the most important financial protections you’ll ever purchase. Take the time to get it right, review it regularly, and adjust as your life circumstances change.

Your financial security depends on the decisions you make today. Don’t wait until after an accident to discover you didn’t have the coverage you thought you had.

Ready to Compare Quotes and Find Better Coverage?

Insurance rates are constantly changing, and the best time to ensure you have the right coverage at the right price is today. Whether you’re looking to save money on your current policy, need to add a vehicle or driver, or simply want to make sure you’re adequately protected, comparing quotes from multiple insurers is the smart financial move.

Take the next step:

✓ Compare personalized quotes from top-rated insurers

✓ See potential savings in minutes

✓ Choose coverage levels that fit your needs and budget

✓ Access exclusive discounts and bundling opportunities

✓ Get expert guidance from licensed insurance professionals

Most people save an average of $500+ per year by comparing quotes. See how much you could save with coverage that actually protects you.

Disclaimer: This article provides general information about auto insurance coverage types for educational purposes. Insurance requirements, coverage availability, and pricing vary by state, insurer, and individual circumstances. Always consult with a licensed insurance professional to discuss your specific needs and review policy documents carefully before purchasing coverage. Rates and discounts mentioned are approximate and based on industry averages; your actual costs may differ.

In another related article, Nationwide Auto Insurance: Guide to Rates, Coverage & Savings