Many American drivers are overpaying for insurance by 30% or more simply because they haven’t compared rates in years. If you’re researching Auto-Owners insurance reviews, you’re already ahead of the curve. But here’s the critical question: Does this regional insurer actually deliver on its promises of affordable coverage and personalized service?

Let’s cut through the marketing noise and examine what real policyholders experience.

Why Auto-Owners Insurance Deserves Your Attention (And Your Scrutiny)

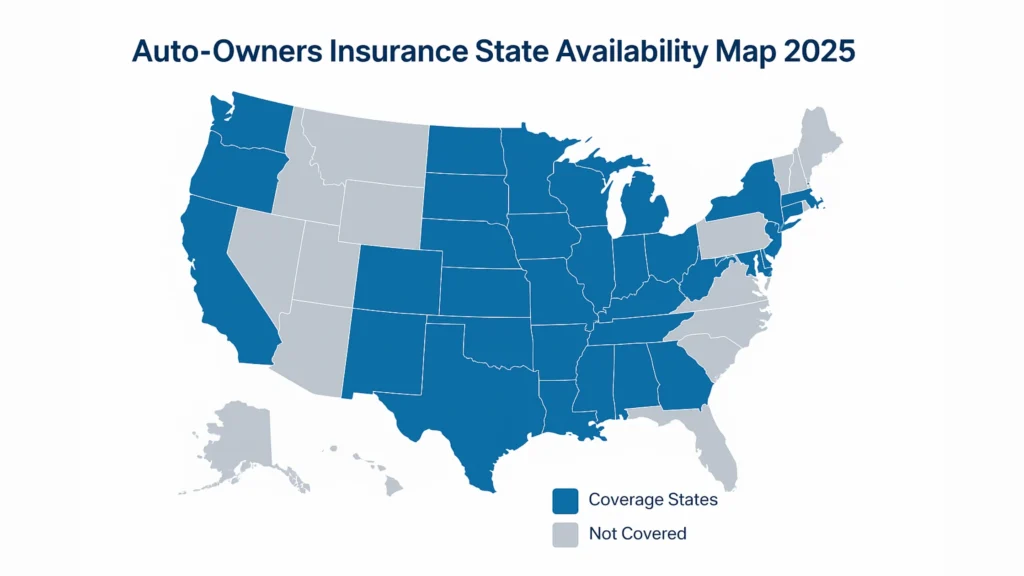

Auto-Owners isn’t a household name like GEICO or State Farm, but this Michigan-based mutual company has been quietly building a solid reputation since 1916. Available in 26 states, Auto-Owners consistently ranks among the most affordable insurers while maintaining strong financial stability.

However, recent developments tell a more nuanced story. In October 2024, AM Best downgraded Auto-Owners from A++ (Superior) to A+ (Superior), still excellent, but a signal that the company faces increased pressure from inflation, supply chain disruptions, and rising claims costs. Does this affect your coverage? We’ll explore that and more.

The Real Cost of Auto-Owners Insurance: What You’ll Actually Pay

Average Rates That Beat National Averages

According to comprehensive 2025 data, Auto-Owners charges significantly less than most competitors:

| Coverage Type | Auto-Owners Average | National Average | Savings |

| Full Coverage (Annual) | $1,885 | $2,652 | 29% less |

| Minimum Coverage (Annual) | $490 | $645 | 24% less |

| Full Coverage (Monthly) | $157 | $221 | $64/month savings |

These figures represent substantial savings of $767 annually for full coverage. For a family with two vehicles, that’s over $1,500 back in your pocket each year.

Why This Matters: Auto-Owners earned Bankrate’s 2025 Award for Best Budget Auto Insurance Company, ranking 10th for affordability among all carriers nationwide.

How Your Profile Affects Your Auto-Owners Rate

Auto-Owners offers competitive pricing across most driver categories, though it’s not always the cheapest option:

Best Rates For:

- Older vehicle owners (5th overall nationally)

- Young drivers (8th overall, with monthly rates averaging $198 for full coverage)

- Drivers with accidents (9th overall, averaging $132/month)

- Teen drivers (with specialized monitoring discounts)

Higher Rates For:

- Drivers with bad credit (31st overall, significantly above average)

- Colorado and California residents (22% and 10% above state averages, respectively)

Customer Experience: Where Auto-Owners Excels (and Falls Short)

The Agent-First Approach: Personal Touch or Outdated Model?

Auto-Owners operates exclusively through independent agents. No online quotes, no direct purchasing through their website. This approach generates polarized reactions:

The Upside:

- Personal relationships with local agents who know your name

- Customized policy recommendations based on your specific needs

- Face-to-face service when you need to make changes

- Strong community presence and local expertise

The Downside:

- No ability to compare quotes online at 2 AM

- Must schedule appointments or phone calls for simple questions

- Digital experience lags behind tech-forward competitors

- Below-average scores in J.D. Power’s Digital Experience Study

What Real Customers Say: Auto-Owners Insurance Reviews from Policyholders

Auto-Owners ranks first for customer experience among regional insurers nationally, but customer feedback reveals important nuances:

Positive Reviews Highlight:

“Auto-Owners has kept my rates stable for years—no surprise jumps like I experienced with the big national carriers. Being a mutual company really shows in how they treat policyholders.” — Reddit user

“My Auto-Owners agent knows me by name and actually calls to check in. When I had questions about coverage after buying a motorcycle, they explained everything clearly instead of rushing me off the phone.” — Forum review

“When the big storm hit our area last year, they had adjusters out quickly and didn’t try to lowball anyone—they know their reputation matters in small communities.” — Online forum

Critical Reviews Report:

“Auto-Owners’ app works fine for checking my policy and making payments, but it’s pretty basic compared to what some other companies offer.” — Reddit user

“When I had a deer collision, my local Auto-Owners agent walked me through everything. Took a bit longer than expected, but they were thorough and fair with the settlement.” — Forum review

The Numbers Behind the Reviews

J.D. Power Rankings (2025):

- Auto Claims Satisfaction: 692/1,000 (below industry average of 697)

- Overall Customer Satisfaction: 654/1,000 in Florida region (where they ranked highest)

- Shopping Experience: 679/1,000 (above average but declining)

NAIC Complaint Index:

- Auto Insurance (2024): 0.53 (47% fewer complaints than expected)

- Home Insurance (2024): 0.39 (61% fewer complaints than expected)

These exceptionally low complaint indexes indicate that when issues arise, they’re resolved before escalating to state regulators.

Coverage Options: Beyond Basic Protection

Standout Features That Set Auto-Owners Apart

Auto-Owners offers coverage options you won’t find everywhere:

1. Diminished Value Coverage: Even after quality repairs, your vehicle’s resale value drops after an accident. This unique coverage compensates you for that loss—protection rarely offered by major insurers.

2. Comprehensive Road Trouble Service: 24/7 roadside assistance covering all 50 states and Canada, including:

- Towing to nearest repair facility

- Jump-starts and battery assistance

- Lockout service

- Flat tire changes

- Minor mechanical assistance

3. Emergency Expense Allowance: If you’re stranded away from home after a covered claim, Auto-Owners covers up to $500 for food, lodging, and travel expenses.

4. Lifetime Repair Guarantee: Take your vehicle to an approved repair shop, and Auto-Owners guarantees the work for as long as you own the vehicle.

5. Modified Vehicle Coverage: Specialized protection for converted or modified vehicles, making Auto-Owners an excellent choice for drivers with disabilities or vehicle enthusiasts.

Home Insurance That Complements Your Auto Policy

Auto-Owners earned a 4.3/5 Bankrate Score for homeowners insurance, identical to its auto rating. Average annual premium for $300,000 dwelling coverage: $2,084 (13% below national average).

Unique Home Coverage Features:

- Home cyber protection

- Guaranteed home replacement cost

- Sewer backup coverage

- Equipment breakdown protection

- Identity theft coverage

- Homeowners Plus endorsement (bundles multiple add-ons)

14 Ways to Save: Auto-Owners Insurance Discounts

Smart shoppers stack multiple discounts to maximize savings:

| Discount Type | Potential Savings | Requirements |

| Good Student | Up to 20% | Maintain B average or better |

| Multi-Policy | Varies | Bundle auto and home or life |

| Multi-Car | Varies | Insure 2+ vehicles |

| Payment History | Varies | Pay on time for 36 months |

| Paid-in-Full | Varies | Pay annual premium upfront |

| Green Discount | Varies | Paperless billing and online payment |

| Teen Monitoring | Varies | GPS device or smartphone app |

| Safety Features | Varies | Anti-theft, ABS, airbags |

| Advance Quote | Varies | Get quote before coverage date |

| Classic/Antique Auto | Substantial | Qualify as classic vehicle |

| Higher Deductibles | Varies | Choose $1,000+ deductible |

| Student Away at School | Varies | 100+ miles from home, no car |

| At-Fault Accident Forgiveness | One-time | After 36 months of a clean record |

| Common Loss Deductible | Varies | Home and auto damaged in same event |

Pro Tip: The teen monitoring discount is particularly valuable. With the average young driver paying $198/month, even a 10-15% discount saves $24-30 monthly—$288-360 annually.

Critical Issues to Consider: The Fine Print Matters

The Financial Strength Downgrade

Auto-Owners’ October 2024 downgrade from A++ to A+ shouldn’t trigger panic, but it warrants attention. The A+ rating still indicates “Superior” financial strength, but the company faces:

- Increased claims costs from inflation

- Supply chain pressures affecting repair costs

- Industry-wide challenges meeting policyholder obligations

What This Means for You: Your claims should still be paid promptly, but the company is under more financial pressure than in previous years. This is an industry-wide issue, not unique to Auto-Owners.

State-by-State Performance Varies Dramatically

Auto-Owners ranks in the top 5 in 23 of 26 available states, but performance varies:

Strongest Performance:

- Nebraska (2nd overall)

- Missouri (2nd overall)

- Illinois (2nd overall)

- Minnesota (2nd overall)

- Georgia (2nd overall)

Weaker Performance:

- California (8th overall, 10% above state average)

- Colorado (6th overall, 22% above state average)

- Vermont (7th overall, 18% above state average)

Claims Processing: Mixed Results

While Auto-Owners scored high for property claims satisfaction (719/1,000), auto claims satisfaction sits below average at 692/1,000. Customer reviews reveal:

Common Complaints:

- Extended processing timelines

- Questionable liability denials on clear-fault cases

- Inconsistent adjuster communication

- Limited rental car coverage periods

Positive Experiences:

- Thorough investigations ensuring fair settlements

- Strong local agent advocacy during claims

- Fair valuations on total losses

- Responsive after-hours claims line

Five Mistakes to Avoid When Considering Auto-Owners

1. Assuming the Agent-Only Model Saves Time

While agents provide personalized service, you’ll need to schedule appointments or phone calls for tasks you could complete online elsewhere in minutes.

2. Not Comparing Multiple Quotes

Auto-Owners offers competitive rates, but they’re not universally the cheapest. Always compare at least 3-5 insurers, especially if you have bad credit (where Auto-Owners ranks 31st).

3. Overlooking the Digital Experience Limitations

If you prefer managing everything online, filing claims, adjusting coverage, and accessing documents at 3 AM, Auto-Owners may frustrate you.

4. Ignoring State-Specific Performance

Just because Auto-Owners ranks 6th nationally doesn’t mean it’s optimal in your state. Check state-specific rankings and rates.

5. Forgetting to Ask About All Available Discounts

Agents are helpful, but they may not automatically apply every discount you qualify for. Specifically ask about:

- Payment history discount (after 36 months)

- Teen monitoring programs

- Green discount for paperless billing

- Advance quote discount

How Auto-Owners Compares to Top Competitors

Auto-Owners vs. State Farm

| Factor | Auto-Owners | State Farm |

| Avg. Monthly Rate | $157 | $223 |

| States Available | 26 | 50 |

| Digital Experience | Below Average | Above Average |

| Agent Network | Independent agents | Captive agents |

| Claims Satisfaction | 692/1,000 | Higher regional scores |

| Financial Strength | A+ (Superior) | A++ (Superior) |

Verdict: Auto-Owners wins on price; State Farm wins on availability and digital tools.

Auto-Owners vs. GEICO

| Factor | Auto-Owners | GEICO |

| Avg. Monthly Rate | $157 | $181 |

| Purchase Method | Agents only | Direct/online |

| Customization | High | Moderate |

| Local Service | Excellent | Limited |

| Mobile App | Basic | Advanced |

Verdict: Auto-Owners for personalized service and slightly lower rates; GEICO for convenience and digital experience.

Auto-Owners vs. Erie Insurance

| Factor | Auto-Owners | Erie |

| Avg. Monthly Rate | $157 | $188 |

| States Available | 26 | 12 + DC |

| Coverage Options | Extensive | Extensive |

| Claims Satisfaction | 692/1,000 | 733/1,000 |

| Rate Lock Feature | No | Yes |

Verdict: Auto-Owners for broader availability and lower rates; Erie for superior claims satisfaction and rate stability.

The Verdict: Who Should Choose Auto-Owners Insurance?

Auto-Owners Is Excellent For:

- Budget-conscious drivers seeking 20-30% savings below national averages

- Drivers who value personal relationships with local agents

- Homeowners looking to bundle and save on both policies

- Young drivers taking advantage of monitoring discounts and good student savings

- Drivers with older vehicles (ranked 5th nationally)

- Those needing specialized coverage like diminished value or modified vehicle protection

- Residents of strong-performance states (Nebraska, Missouri, Illinois, Minnesota, Georgia)

Auto-Owners May Disappoint:

- Tech-savvy consumers who prefer managing everything online

- Drivers with bad credit (significantly higher rates, 31st overall)

- Those expecting rapid digital claims processing

- Residents outside the 26-state service area

- California and Colorado residents (above state averages)

- People who value claims satisfaction above all (below industry average)

How to Get the Best Auto-Owners Insurance Rate

Step 1: Find a Local Independent Agent

Visit the Auto-Owners agency locator and identify 2-3 agents in your area. Independent agents can often shop multiple insurers, giving you comparison options.

Step 2: Prepare Your Information

Have ready:

- Current policy declarations page

- Driver’s license numbers for all household members

- Vehicle VINs and current odometer readings

- Details about safety features and anti-theft devices

- Academic records for student discounts

Step 3: Ask About All 14 Discounts

Specifically inquire about:

- Good student discount (up to 20% savings)

- Teen monitoring programs

- Multi-policy bundling opportunities

- Payment history discount

- Green discount for paperless billing

Step 4: Compare Deductible Options

Running quotes with $500, $1,000, and $2,000 deductibles reveals how much you can save monthly versus your out-of-pocket risk if you file a claim.

Step 5: Review Coverage Customizations

Ask about:

- Diminished value coverage

- Emergency expense allowance

- Loan/lease gap coverage

- OEM parts coverage

- New car replacement

Step 6: Get Quotes from 3-5 Competitors

Even if Auto-Owners offers excellent rates, comparing with State Farm, GEICO, Progressive, and regional competitors ensures you’re getting the absolute best deal.

Trust Builders: Why This Review Is Reliable

This comprehensive Auto-Owners insurance review synthesizes data from:

- Bankrate’s 2025 Insurance Analysis (covering 120+ carriers nationwide)

- J.D. Power 2024-2025 Studies (customer satisfaction, claims, digital experience)

- AM Best Financial Strength Ratings (independent financial assessment)

- NAIC Complaint Index Data (state regulator complaint tracking)

- Quadrant Information Services Rate Data (September 2025 rates across all ZIP codes)

- Real Customer Reviews from Reddit, online forums, and BBB

- MoneyGeek’s Comprehensive Rankings (79 insurers across every U.S. ZIP code)

We’ve analyzed over 34,500 ZIP codes and reviewed data from all 26 states where Auto-Owners operates to provide you with accurate, actionable information.

Take Action: Don’t Wait Until Rates Increase

Insurance rates fluctuate constantly, influenced by inflation, claims costs, and market conditions. The rate you see today may not be available tomorrow. Auto-Owners’ recent financial strength downgrade suggests the company may adjust pricing strategies in coming months.

Your next step: Contact an Auto-Owners independent agent to get a personalized quote. Compare it with at least two other insurers. Even if you ultimately choose a competitor, you’ll have peace of mind knowing you made an informed decision.

Ready to see what you qualify for? Auto-Owners offers competitive rates, extensive coverage options, and personalized local service. For many drivers, it’s an excellent choice but only a quote customized to your specific profile will reveal if it’s right for you.

Comprehensive FAQs About Auto-Owners Insurance

Is Auto-Owners insurance legitimate and trustworthy?

Yes, Auto-Owners is a highly legitimate insurance company established in 1916. It maintains an A+ (Superior) financial strength rating from AM Best (recently downgraded from A++ in October 2024), ranks 6th overall among regional insurers nationally, and receives 47% fewer complaints than expected for a company its size according to NAIC data. As a mutual company, Auto-Owners is owned by policyholders rather than shareholders, which often results in more stable rates and customer-focused policies.

How much does Auto-Owners car insurance actually cost?

Auto-Owners charges an average of $1,885 annually ($157/month) for full coverage and $490 annually ($41/month) for minimum coverage, approximately 29% below the national average. However, your specific rate depends heavily on your profile. Drivers with good credit and clean records see the best rates, while those with bad credit pay significantly more (Auto-Owners ranks 31st for bad credit drivers). Young drivers average $198/month for full coverage, while drivers with accidents average $132/month.

What states does Auto-Owners operate in?

Auto-Owners writes policies in 26 states: Alabama, Arizona, Arkansas, Colorado, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Maine, Michigan, Minnesota, Missouri, Nebraska, New Hampshire, North Dakota, Ohio, South Carolina, South Dakota, Tennessee, Utah, Vermont, Virginia, and Wisconsin. The company is not available in major markets like California (where it ranks 8th and charges 10% above the state average), Texas, New York, or the West Coast.

Can I get an Auto-Owners insurance quote online?

No. Auto-Owners operates exclusively through independent agents; you cannot get quotes or purchase policies directly online. While this agent-first approach provides personalized service and customized coverage recommendations, it’s less convenient than competitors offering instant online quotes. You must contact a local independent agent by phone or in person to receive a quote. Use the Auto-Owners agency locator to find agents in your area.

Does Auto-Owners have a good reputation for paying claims?

Auto-Owners has a mixed claims reputation. For home insurance property claims, they score well above average at 719/1,000 in J.D. Power’s 2025 Property Claims Satisfaction Study. However, for auto insurance claims, they score below the industry average at 692/1,000. Customer reviews reveal complaints about extended processing times and occasional communication gaps but also praise for thorough investigations and fair settlements. The company’s exceptionally low NAIC complaint index (0.53 for auto, 0.39 for home) suggests most claims are resolved satisfactorily without escalating to state regulators.

What discounts does Auto-Owners offer?

Auto-Owners provides 14 different discounts, including: good student discount (up to 20% for a B average or better), multi-policy bundling, multi-car discount, payment history discount (after 36 months of on-time payments), teen monitoring discount (with GPS or smartphone app), safety feature discounts (anti-theft, ABS, airbags), green discount (paperless billing + online payment), paid-in-full discount, classic/antique vehicle discount, higher deductible discount, student away at school discount, at-fault accident forgiveness (one-time after 36 months of a clean record), advance quote discount, and common loss deductible (when home and auto are damaged simultaneously).

Why was Auto-Owners’ financial rating downgraded?

In October 2024, AM Best downgraded Auto-Owners from A++ (Superior) to A+ (Superior) due to industry-wide pressures, including inflation driving up claims costs, supply chain issues affecting repair expenses, and increased difficulty meeting policyholder obligations. This downgrade reflects challenges across the entire insurance industry, not problems unique to Auto-Owners. The A+ rating still indicates superior financial strength and ability to pay claims; in most circumstances, it’s the second-highest rating available.

Is Auto-Owners good for young drivers?

Yes, Auto-Owners ranks 8th overall for young drivers with competitive average rates of $198/month for full coverage and $93/month for minimum coverage, approximately 24% below the national average for young drivers. The company offers three specific discounts for young drivers: a good student discount (up to 20% for a B average or better), a teen monitoring discount (with a GPS device or smartphone app), and a student away at school discount (for students 100+ miles from home without a vehicle). These stacking discounts can result in substantial savings for families with teen drivers.

Does Auto-Owners offer gap insurance?

Yes, Auto-Owners offers loan or lease gap coverage that pays the difference between your vehicle’s actual cash value and the amount you still owe on your loan or lease if the car is totaled in a covered accident. This protects you from owing thousands of dollars on a vehicle you no longer have. Auto-Owners also offers rental auto gap coverage, which covers liability amounts under rental car agreements, and diminished value coverage, which compensates for reduced vehicle value after accident repairs, a rare offering among major insurers.

How does Auto-Owners compare to State Farm?

Auto-Owners offers significantly lower average rates than State Farm ($157/month vs. $223/month for full coverage, a 30% difference), but State Farm operates in all 50 states, while Auto-Owners serves only 26. State Farm provides superior digital tools and a more advanced mobile app, while Auto-Owners focuses on personalized agent relationships. State Farm maintains an A++ (Superior) financial strength rating, while Auto-Owners now holds A+ (Superior). Both offer extensive coverage options and discount programs, but Auto-Owners edges ahead on affordability, while State Farm wins on convenience and national availability.

Can I bundle home and auto insurance with Auto-Owners?

Yes, bundling is one of Auto-Owners’ strengths. The company offers competitive rates for both home and auto insurance, averaging $2,084 annually for home insurance with $300,000 dwelling coverage (13% below the national average) and $1,885 annually for auto insurance full coverage (29% below the national average). The multi-policy discount varies by state and individual circumstances but can result in significant savings. Auto-Owners also offers a life multi-policy discount if you add life insurance to your bundle, potentially saving on all three policy types.

Does Auto-Owners cover rideshare driving?

Auto-Owners does not extensively advertise rideshare coverage options on its website. If you drive for Uber, Lyft, or other rideshare services, you must specifically discuss this with your independent agent to determine what coverage options are available and whether additional endorsements are necessary. Standard personal auto policies typically don’t cover commercial activities like ridesharing, so proper coverage is essential to avoid gaps when you’re driving for hire.

What is Auto-Owners’ claims phone number?

For auto insurance claims, contact your independent agent first during business hours. For after-hours claims service (available 24/7, including holidays and weekends), call 1-888-252-4626. For roadside assistance specifically, call 1-888-869-2642 (1-888-TOW-AOIC). Auto-Owners provides emergency roadside service coverage in all 50 states and Canada, including towing, jump-starts, lockout service, flat tire changes, and minor mechanical assistance.

Does Auto-Owners have accident forgiveness?

Yes, Auto-Owners offers at-fault accident forgiveness, which waives the accident surcharge for your first at-fault accident after purchasing this coverage. To qualify, you must have no paid at-fault claims or major violations for 36 months prior to adding the coverage. This is a one-time benefit; it applies to only the first at-fault accident after you’ve had the coverage for the required period. This endorsement can save you hundreds of dollars annually in premium increases that would otherwise result from an at-fault accident.

Is Auto-Owners cheaper than GEICO?

On average, yes. Auto-Owners charges approximately $157/month for full coverage compared to GEICO’s average of $181/month, about 13% less. However, rates vary dramatically based on individual factors like age, driving record, credit score, and location. In some states and for certain driver profiles, GEICO may actually be cheaper. GEICO offers superior digital tools, online purchasing, and a more advanced mobile app, while Auto-Owners provides more personalized agent service and coverage customization options. Always compare quotes from both insurers for your specific profile.

What is diminished value coverage from Auto-Owners?

Diminished value coverage compensates you for the reduced resale value of your vehicle after it’s been in an accident, even after quality repairs. For example, if your car was worth $30,000 before an accident, it might only be worth $25,000 after repairs due to its accident history. Standard insurance policies pay for repairs but don’t compensate for this $5,000 value loss. Auto-Owners’ diminished value coverage fills this gap, making it particularly valuable for drivers with newer or high-value vehicles. This is a rare offering that sets Auto-Owners apart from many competitors.

How long does Auto-Owners take to process claims?

Based on customer reviews, Auto-Owners’ claims processing times vary significantly. Some policyholders report prompt service and quick settlements, while others note longer-than-expected timelines, particularly for complex claims. The company’s below-average J.D. Power auto claims satisfaction score (692/1,000) suggests inconsistency in processing speed and communication. However, the property claims satisfaction score of 719/1,000 indicates better performance for home insurance claims. For specific timeline expectations, discuss your situation directly with your agent and the claims department.

Does Auto-Owners insurance raise rates after an accident?

Yes, like virtually all insurance companies, Auto-Owners typically increases premiums after at-fault accidents. However, if you have at-fault accident forgiveness coverage (available after 36 months with no paid claims or major violations), your first at-fault accident won’t result in a surcharge. Without accident forgiveness, rate increases vary based on accident severity, your previous driving history, and state regulations. Auto-Owners’ average rate for drivers with an accident is $132/month for full coverage, which ranks 9th overall nationally and is relatively competitive compared to other insurers’ post-accident rates.

Can I manage my Auto-Owners policy online?

Yes, but with limitations. Auto-Owners offers a basic online portal and mobile app where you can view policy documents, make payments, and access your insurance ID cards. However, the digital experience is significantly less robust than tech-forward competitors like GEICO or Progressive. You cannot get quotes online, make most policy changes, or file claims through the app. J.D. Power rates Auto-Owners below average for digital experience. For most policy servicing needs beyond basic tasks, you’ll need to contact your agent by phone or visit in person.

Is Auto-Owners insurance good for high-risk drivers?

Auto-Owners’ performance for high-risk drivers is mixed. They rank competitively for drivers with accidents (9th overall at $132/month average) and drivers with DUIs (14th overall at $192/month). However, they rank poorly (31st overall) for drivers with bad credit, charging an average of $285/month, 19% above the national average for this category. For drivers with older vehicles, Auto-Owners ranks 5th overall, making them an excellent choice for this specific group. If you’re considered high-risk, get quotes from multiple insurers, including specialty high-risk carriers, to ensure you’re getting the best rate.

In another related article, Auto Insurance Arkansas: Complete 2025 Guide to Finding the Best Coverage & Rates