Are you still overpaying for car insurance? The average American driver spends $2,308 annually on full coverage, yet many don’t realize better options exist. Travelers auto insurance offers full coverage rates at $1,714 per year, a compelling 26% savings compared to the national average. But affordability alone doesn’t make a great insurer. This comprehensive guide examines whether Travelers auto insurance deserves a place in your wallet, complete with real pricing data, customer experiences, and side-by-side comparisons.

The Car Insurance Cost Crisis: Why Most Americans Overpay

Insurance premiums have become a household budget burden. Many drivers accept whatever rate their current insurer quotes without exploring alternatives, a costly mistake. The insurance market includes dozens of carriers with vastly different pricing philosophies. What you pay depends on your age, location, driving history, credit score, and which insurer you choose.

For 2025, minimum coverage from Travelers averages $541 annually, while full coverage costs approximately $1,714 per year. This positions Travelers significantly below the national average, making it worth investigating whether this carrier can deliver the coverage you need at a price that works.

What Affects Your Travelers Auto Insurance Rates?

Before diving into Travelers-specific pricing, understand the major factors that determine what any insurer charges.

Age & Driving Experience

Age is one of the strongest rate determinants. Young drivers face substantially higher premiums due to inexperience and crash statistics.

Travelers rates an 18-year-old driver at $4,605 annually, 26% cheaper than the national average of $6,192, though still expensive compared to older drivers. For comparison, a 45-year-old pays an average of $1,552 per year with Travelers, and a 65-year-old pays approximately $1,486.

Key Insight: If you’re adding a teen driver, expect higher costs. Adding a 16-year-old to a Travelers policy increases annual premiums by $2,852, 18% above the national average of $2,408.

Driving History & Traffic Violations

Your record directly impacts rates. Drivers with a speeding ticket pay an average of $2,172 annually with Travelers, compared to the national average of $2,669, an 18% savings. For DUI convictions, Travelers charges approximately $2,766 per year versus the national average of $3,593, making Travelers a competitive choice even for high-risk drivers.

Credit Score

Insurance companies view credit history as an indicator of risk. Drivers with poor credit pay $2,811 annually with Travelers, 81% more than those with good credit at $1,551.

Location & State

Rates vary dramatically by state based on accident frequency, weather, and theft rates. Travelers charges $811 annually in Maine but $2,295 in Florida, though both rates remain below state averages. Iowa, Wisconsin, Pennsylvania, and Virginia offer Travelers’ cheapest rates, while New York, California, and South Carolina have the highest.

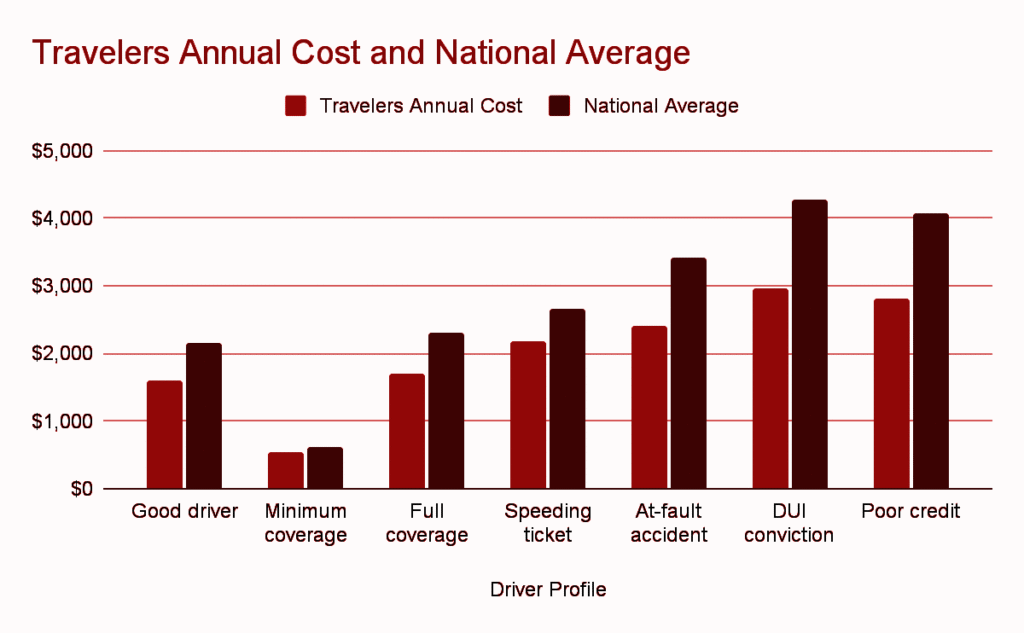

Travelers Auto Insurance Rates by Driver Profile (2025 Data)

This table provides concrete pricing for the scenarios most American drivers face:

| Driver Profile | Travelers Annual Cost | National Average | Savings |

| Good driver | $1,597 | $2,149 | 26% |

| Minimum coverage | $541 | $627 | 14% |

| Full coverage | $1,714 | $2,308 | 26% |

| Speeding ticket | $2,172 | $2,669 | 18% |

| At-fault accident | $2,411 | $3,415 | 29% |

| DUI conviction | $2,968 | $4,274 | 31% |

| Poor credit | $2,811 | $4,064 | 31% |

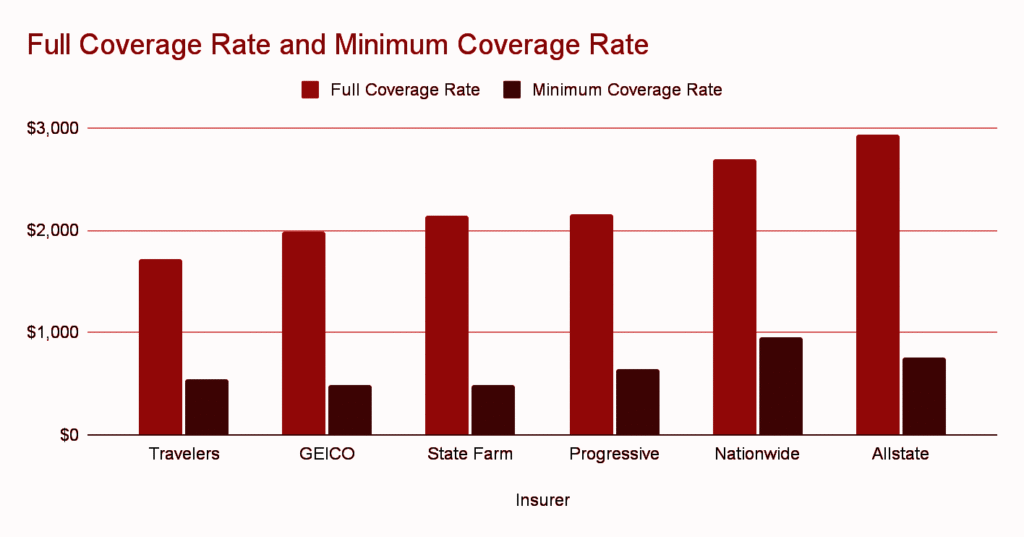

How Travelers Auto Insurance Compares to Major Competitors

Rate comparison shopping is non-negotiable. Here’s how Travelers stacks against industry giants for a 35-year-old good driver with full coverage:

Key Takeaway: Travelers’ average cost for good drivers ($1,597 annually) is 48% cheaper than Allstate and competitive with GEICO.

Why Choose Travelers Auto Insurance? Key Advantages

1. Exceptional Affordability Across All Driver Profiles

Travelers is ranked as the #1 best auto insurance provider overall, #2 most affordable for minimum liability coverage, and #1 most affordable for full liability coverage. This distinction matters because it shows competitive pricing isn’t a one-off for good drivers, Travelers maintains low rates even for higher-risk applicants.

2. Comprehensive Coverage & Unique Add-Ons

Travelers offers a wide selection of add-on auto protections, including Premier New Car Replacement, which replaces your car with a new model if totaled within the first five years of ownership, longer coverage than most competitors. Additional add-ons include:

- Roadside assistance

- Rental coverage

- Gap insurance

- Accident forgiveness

- Ride-sharing coverage

The Responsible Driver Plan includes accident forgiveness and minor violation forgiveness, while the Premier Responsible Driver Plan adds a decreasing deductible (up to $500 off) and a total loss deductible waiver.

3. Reward Safe Drivers Through IntelliDrive

Travelers’ IntelliDrive program uses the MyTravelers app to track driving habits over 90 days, offering qualified drivers up to 30% discounts at renewal. This is one of the most generous usage-based insurance programs available.

4. Extensive Discount Menu (14+ Discounts Available)

Travelers offers 14 types of car insurance discounts, well above the industry average of eight. These include:

- Multi-policy bundle (13%)

- Safe driver (20-40% depending on state)

- Continuous insurance (15%)

- Multi-car (8%)

- Hybrid/electric vehicle discount

- Good student (B average or higher)

- Homeownership (5%)

- Driver training (8%)

5. Strong Financial Stability & Low Complaint Rates

Travelers holds an A++ (Superior) financial strength rating from AM Best, the highest available rating, ensuring the company can pay claims when you need them. Additionally, Travelers has the lowest complaint ratio (0.41) among major insurers, compared to the industry average of 1.00.

6. Smooth Claims Experience

Customer satisfaction with the claims process is critical. Surveys show 76% of Travelers auto insurance policyholders are satisfied with their provider, 82% would recommend to a friend, and 100% of respondents with a car insurance policy rated their customer service 8/10 or higher. Furthermore, Travelers approves 100% of auto claims and resolves them in 1-2 weeks on average.

Travelers Auto Insurance Drawbacks & Limitations

No insurer is perfect. Here’s what you should know about Travelers’ limitations:

1. No SR-22 Filing Support

Travelers doesn’t offer SR-22 insurance, which some states mandate for high-risk drivers. If you need this certificate, you’ll require a different carrier.

2. Limited Geographic Availability

Travelers auto insurance is available in 42 states and Washington, D.C., but not in Alaska, Hawaii, Louisiana, Michigan, North Dakota, South Dakota, West Virginia, or Wyoming.

3. Below-Average Claims Satisfaction Ratings

Despite low complaint numbers, Travelers didn’t fare well in J.D. Power consumer studies, and received a C grade from collision repair professionals for its claims procedures, scoring average compared to competitors.

4. Higher Costs for Teen Drivers

Adding a 16-year-old costs $2,852 annually with Travelers, significantly higher than competitors like Nationwide ($993).

5. Online Quote Only—Must Call to Buy

While Travelers offers online quotes, you cannot complete a purchase online. You must contact an agent to finalize your policy.

Travelers Discounts: How to Save the Most

Maximizing discounts is key to lowering your premiums. Here are the top ways to save:

Bundling Discount (13% Average Savings)

Combining auto and home insurance with Travelers can yield substantial savings. The average bundled premium is $5,436 for minimum coverage and $6,561 for full coverage annually.

Safe Driver Discount (Up to 40%)

Maintain a clean driving record with no accidents, violations, or claims for 3-5 years to qualify for state-specific savings: 20% in ID/MD/NJ, 22% in FL, 40% in NV, and 30% in most other states.

IntelliDrive Usage-Based Discount (Up to 30%)

Enroll in the 90-day IntelliDrive program to earn an initial 12% discount, with potential bonuses reaching 30% at renewal for safe driving.

Continuous Insurance Discount (15%)

Keep coverage with Travelers without gaps to earn 15% off.

Homeownership Discount (5%)

Simply owning a home, even if insured elsewhere, qualifies you for savings.

Good Student Discount

High school or college students maintaining a B average or higher can save.

Travelers Auto Insurance Coverage Options Explained

Travelers offers standard coverage plus valuable add-ons:

Standard Coverage (Usually Required)

- Bodily Injury Liability: Covers injuries you cause to others

- Property Damage Liability: Covers vehicle damage you cause

- Uninsured/Underinsured Motorist: Protects you from uninsured drivers

- Collision: Covers accidents regardless of fault

- Comprehensive: Covers theft, weather, vandalism

Unique Coverage Add-Ons

Travelers offers gap insurance, new car replacement up to 5 years, rideshare insurance, accident forgiveness, and rental car reimbursement.

What Travelers Does NOT Offer

- Pay-per-mile insurance

- SR-22 filings

Travelers Auto Insurance by State: Rate Examples

Regional pricing varies significantly. Here’s a snapshot:

| State | Annual Rate (Travelers) | State Average | Savings |

| California | $2,804 | $2,848 | 1.5% |

| Florida | $2,295 | $3,536 | 35% |

| New York | $3,784 | $2,898 | 30% higher |

| Texas | Varies | Varies | Check rate |

| Pennsylvania | $1,240 | $2,334 | 47% |

| Virginia | $1,084 | $1,776 | 39% |

| Iowa | $980 | $1,683 | 42% |

Note: New York rates are higher due to state regulations. If you live in an unsupported state, compare with regional carriers.

The Claims Process: What to Expect with Travelers

When you need to file a claim, Travelers makes the process straightforward:

How to File

You can report a claim through the Travelers website, mobile app, or by calling 1-800-252-4633. For significant damage or injuries, phone reporting is recommended.

Timeline & Approval Rates

Travelers approves 100% of auto claims and resolves them in 1-2 weeks on average, aligning with industry standards.

Mobile & Digital Support

Use the MyTravelers app to:

- File claims and track status

- View insurance cards

- Arrange roadside assistance

- Access claim documents

Experience Hassle-Free Claims

Get support 24/7 when you need it most.

How to Get a Travelers Auto Insurance Quote

Obtaining a quote takes minutes:

- Online: Visit Travelers’ website and use the quote tool (note: finalization requires agent contact)

- Phone: Call 1-888-695-4625 for immediate quotes

- Local Agent: Work with an independent agent in your area

Tip: Get quotes from multiple carriers (GEICO, Progressive, State Farm) simultaneously to ensure you’re maximizing savings.

Cancellation Policy & Customer Service

If you decide Travelers isn’t right for you, canceling is straightforward and penalty-free.

How to Cancel

Contact Travelers at 1-800-842-5075, visit a local agent, or mail cancellation notice to: Travelers, P.O. Box 5600, Hartford, CT 06102. No early cancellation fees apply.

Customer Service Hours

Travelers offers 24/7 support at 1-866-366-2077 for general inquiries, with specialized lines for billing (1-800-842-5075), claims (1-800-252-4633), and roadside assistance.

What Real Customers Say About Travelers Auto Insurance

Positive Feedback

- “Claims were processed incredibly fast, within 10 days.”

- “Customer service was professional and patient throughout the process.”

- “Bundling saved us hundreds compared to separate policies.”

Areas for Improvement

- “Premium increased more than expected after one minor accident.”

- “Wish I could complete my purchase entirely online without an agent call.”

- “Customer service wait times were lengthy during peak hours.”

Overall Sentiment: 82% of Travelers auto policyholders would recommend the company to a friend, indicating strong customer loyalty despite minor service concerns.

Travelers vs. GEICO, State Farm & Progressive: Which Is Best?

| Factor | Travelers | GEICO | State Farm | Progressive |

| Best For | Budget-conscious drivers | Tech-savvy savers | Bundlers | Customization |

| Full Coverage Rate | $1,714 | $1,983 | $2,142 | $2,162 |

| Discounts | 14+ | Excellent | Very good | Excellent |

| Claims Satisfaction | Good | Very good | Excellent | Good |

| Digital Experience | 4.2/5 | Excellent | Very good | Excellent |

| Best Add-Ons | New car replacement | Direct billing | Bundling | Name-your-price |

Bottom Line: Choose Travelers if affordability and new car replacement coverage are priorities. Choose State Farm for claims satisfaction; GEICO for digital innovation; Progressive for maximum customization.

Frequently Asked Questions About Travelers Auto Insurance

Q: Is Travelers a good insurance company?

A: Yes. Travelers ranks as the #1 best auto insurance provider overall with a 4.9-5.0 rating across major review sites, offers affordability 26% below national average, and maintains an A++ financial strength rating.

Q: How much does Travelers auto insurance cost?

A: Full coverage averages $1,714 annually; minimum coverage averages $541 annually. Costs vary based on age, location, driving history, and credit score.

Q: What states offer Travelers auto insurance?

A: Travelers operates in 42 states and Washington, D.C., excluding Alaska, Hawaii, Louisiana, Michigan, North Dakota, South Dakota, West Virginia, and Wyoming.

Q: Does Travelers offer roadside assistance?

A: Yes. Travelers includes roadside assistance, rental car coverage, and other add-ons to enhance your policy.

Q: Can I buy Travelers insurance online?

A: You can get an online quote, but you must contact an agent to finalize and purchase your policy.

Q: How long does it take to get a Travelers insurance claim approved?

A: Travelers approves auto claims in 1-2 weeks on average, with a 100% approval rate.

Q: Does Travelers offer SR-22 insurance?

A: No. Travelers does not provide SR-22 filings, so you’ll need to find another carrier if this is required.

Q: What discounts does Travelers offer?

A: Travelers offers 14+ discounts including bundling (13%), safe driver (up to 40%), IntelliDrive (up to 30%), continuous insurance (15%), homeownership (5%), good student, driver training, and more.

Q: How does Travelers IntelliDrive work?

A: IntelliDrive is a 90-day program using the MyTravelers app to track driving habits including speed, time of day, phone use, and braking patterns. Safe drivers earn up to 30% discounts at renewal.

Q: Can I cancel my Travelers policy without a penalty?

A: Yes. Travelers charges no early cancellation fees and allows cancellation via phone (1-800-842-5075), in-person, or mail.

Conclusion: Is Travelers Auto Insurance Right for You?

Travelers auto insurance stands as the #1 best auto insurance provider overall, offering a compelling combination of affordability, coverage options, and customer satisfaction. With full coverage 26% cheaper than the national average, 14+ discounts, and unique add-ons like new car replacement coverage up to five years, Travelers delivers genuine value.

However, consider your specific situation:

Choose Travelers if you:

- Want the lowest possible rates

- Appreciate extensive discounts and bundling options

- Value new car replacement coverage

- Have a good or clean driving record

- Live in one of the 42 supported states

Look elsewhere if you:

- Need SR-22 filing support

- Require coverage in Alaska, Hawaii, Louisiana, or other excluded states

- Prioritize the highest claims satisfaction ratings

- Are adding teen drivers and want the absolute cheapest option

The Bottom Line: Rates change daily, and your personal situation determines the best choice. The only way to know if Travelers auto insurance is right for you is to compare personalized quotes.

See What You Could Save with Travelers Auto Insurance

Stop guessing about your insurance costs. Get your free, personalized Travelers auto insurance quote today and discover how much you could save.

In another related article, Landlord Insurance vs Homeowners Insurance: The Complete 2025 Guide to Choosing the Right Coverage