In this TD Ameritrade review for 2023, we delve deep into what makes this brokerage stand out in the crowded financial landscape. TD Ameritrade has consistently excelled in several key areas, making it an attractive option for investors. Let’s explore the features that set TD Ameritrade apart.

Trading Platform and Mobile App Excellence

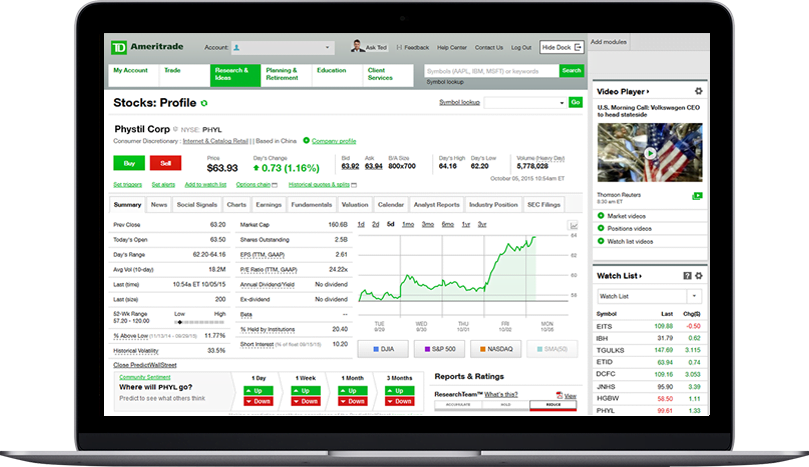

One of TD Ameritrade’s standout features is its robust trading platform, thinkorswim. This platform has been a reliable choice for traders, offering a wide range of tools and features. Additionally, TD Ameritrade offers a mobile version of thinkorswim, ensuring that traders can stay connected and make informed decisions on the go.

Diverse Range of Tradable Securities

TD Ameritrade impresses with its selection of tradable securities. While it covers the standard offerings like stocks, bonds, and funds, it goes further by including less common options such as forex and futures. This extensive range allows investors to diversify their portfolios with ease.

Commitment to Research and Education

Investors looking to enhance their financial knowledge will appreciate TD Ameritrade’s dedication to research and education. The brokerage offers live webcasts, news, and analysis across a wide array of market-related topics. From beginner’s guides to advanced options trading sessions, TD Ameritrade provides valuable resources to empower investors.

Integration with Charles Schwab

It’s worth noting that TD Ameritrade is in the process of integrating with Charles Schwab, its parent company. This integration promises to bring even more benefits to TD Ameritrade clients in the coming months. As a result, prospective investors may also want to consider exploring Charles Schwab and Fidelity Investments, both of which consistently receive high ratings in Finance Devil reviews.

Key Details and Ratings

Let’s take a closer look at TD Ameritrade’s key details and ratings:

- Finance Devil Score: 4.5 stars out of 5

- Cost: 4 stars out of 5

- Accounts & Trading: 5 stars out of 5

- Research and Education: 5 stars out of 5

- Mobile: 5 stars out of 5

- Customer Experience: 5 stars out of 5

- Minimum Balance: $0

- Cost per Stock Trade: $0

- Cost per Options Trade: $0.65 per contract

Notable Pros of TD Ameritrade

Commission-Free Funds

TD Ameritrade offers over 3,600 no-transaction-fee mutual funds, making it an attractive choice for fund-focused investors. While the fund screening function could be improved, each fund’s dedicated page provides essential statistics, including holdings and performance data.

Extensive Investment Selection

TD Ameritrade stands out for its comprehensive range of tradable assets. Whether you’re interested in stocks, bonds, options, forex, futures, or even cryptocurrency via futures contracts, TD Ameritrade has you covered. The ability to access publicly traded crypto-related funds adds an extra layer of versatility.

Rich Research and Education Resources

Investors at all levels will benefit from TD Ameritrade’s educational resources. Live webcasts, news, and analysis cover a broad spectrum of topics. For those investing in individual stocks, the brokerage provides access to reports from Morningstar, CFRA, Thomson Reuters, and more.

Multiple Trading Platforms

TD Ameritrade offers a variety of trading platforms to suit different needs:

- Web Platform: This classic platform covers the basics, including trading stocks, bonds, ETFs, and mutual funds. It also includes streaming news and third-party research.

- Thinkorswim Platform: Ideal for advanced traders, this platform adds futures, forex, and futures options to the mix. It offers access to technical studies, charting tools, and advanced analytics.

Mobile Apps

TD Ameritrade’s two mobile apps cater to different preferences:

- TD Ameritrade Mobile: Offers practical functionality in a user-friendly package, mirroring the desktop platform.

- Thinkorswim Mobile: Transforms the thinkorswim platform into a handheld trading powerhouse, providing advanced options and live video streaming from CNBC.

Wide Range of Account Types

TD Ameritrade is highly accommodating when it comes to account types. In addition to standard options, it offers custodial accounts, 529 accounts, education savings accounts, trusts, and partnership accounts. For retirement planning, TD Ameritrade offers various IRA options and business retirement accounts.

Trading Simulator

TD Ameritrade’s paperMoney simulator allows users to practice trading strategies with $100,000 in virtual cash. It’s a valuable tool for honing your skills and gaining confidence in your trading decisions.

Areas for Improvement

While TD Ameritrade offers an array of benefits, there are a few areas where it could improve:

Account Fees

TD Ameritrade imposes a $75 transfer-out fee for full account transfers, although partial transfers are free. Additionally, there’s a short-term trading fee of $49.99 if you don’t hold certain mutual funds for at least 180 days. Some competitors, like Fidelity Investments and Interactive Brokers, now offer fee-free ACATS transfers.

Fractional Shares

Unlike some competitors, TD Ameritrade does not allow the purchase of fractional shares. This limitation may affect newer investors looking to invest in high-priced securities.

Mutual Fund Fees

While TD Ameritrade offers a vast selection of mutual funds, trading some no-load funds incurs a fee of up to $49.95 when you buy. For load funds, investors may face sales commissions. Competitors like Charles Schwab and Fidelity offer more favorable terms in this regard.

READ ALSO: Chase Freedom® Student Credit Card Review

How TD Ameritrade stack up to other brokerage options

When comparing TD Ameritrade to other brokerage options, it’s essential to consider various factors, including fees, minimum requirements, and key highlights. Let’s evaluate how TD Ameritrade stacks up against two competitors: Fidelity and Robinhood.

TD Ameritrade

- Finance Devil Score: 4.5 out of 5

- Fees: $0 online commissions for U.S. exchange-listed stocks & ETFs. Exception and service fees still apply.

- Minimum: $0 to open

- Highlights: TD Ameritrade offers commission-free online equity trading, personalized education, a dedicated support team, and the powerful Thinkorswim® platform for charting and analysis.

Fidelity

- Finance Devil Score: 5 out of 5

- Fees: $0

- Minimum: $0

- Highlights: Fidelity offers a $100 bonus when you open a new eligible account with $50 or more (limited-time offer, terms apply). It is known for its robust investment options and educational resources.

Robinhood

- Finance Devil Score: 3.5 out of 5

- Fees: Robinhood provides commission-free trading.

- Minimum: $0

- Highlights: Robinhood is designed to be intuitive and accessible for both newcomers and experienced investors. It provides user-friendly tools for investing.

Summary of Comparisons

Finance Devil Score:

- TD Ameritrade: 4.5

- Fidelity: 5

- Robinhood: 3.5

Fees:

- TD Ameritrade: $0 online commissions with exceptions

- Fidelity: $0

- Robinhood: Commission-free

Minimum:

- TD Ameritrade: $0

- Fidelity: $0

- Robinhood: $0

Highlights:

- TD Ameritrade offers personalized education and the Thinkorswim platform.

- Fidelity provides a $100 bonus for new accounts and extensive investment options.

- Robinhood is user-friendly and designed for all levels of investors.

TD Ameritrade and Fidelity are both strong choices, with Fidelity earning a slightly higher Finance Devil score and offering a bonus for new accounts. Robinhood, while commission-free and user-friendly, has a lower Finance Devil score. The choice between them depends on your specific preferences and investment goals.

To Recap

In conclusion, TD Ameritrade shines as a reliable and versatile online brokerage option. With a Finance Devil Score of 4.5 out of 5, it has earned its reputation as a top choice for investors. The brokerage offers an array of features that cater to both novice and experienced traders.

One of its standout features is the Thinkorswim trading platform, known for its robust tools and analysis capabilities. Whether you’re trading stocks, bonds, ETFs, or exploring less common options like forex and futures, TD Ameritrade provides the resources you need.

Moreover, the commitment to research and education sets TD Ameritrade apart. From live webcasts to in-house sessions at branch locations, investors have access to valuable insights. The inclusion of research reports from respected sources adds another layer of credibility.

TD Ameritrade’s dedication to investors extends to its mobile apps, making trading accessible on the go. Whether you prefer a straightforward mobile experience or advanced options and live video streaming, TD Ameritrade has you covered.

Additionally, the brokerage’s commission-free funds, extensive investment selection, and diverse account types make it a versatile choice for various investment goals and preferences.

However, it’s essential to consider potential downsides, such as account fees for full transfers and short-term trading fees for certain mutual funds.

As TD Ameritrade integrates with Charles Schwab, investors can anticipate even more opportunities in the future. Ultimately, the choice of a brokerage depends on your specific needs and goals, but TD Ameritrade’s track record of excellence makes it a strong contender in the online brokerage landscape.

FAQs

What sets TD Ameritrade apart from other online brokerages?

TD Ameritrade stands out due to its robust trading platform, Thinkorswim, extensive range of tradable securities, and a commitment to research and education.

Does TD Ameritrade charge any account maintenance fees?

TD Ameritrade does not charge inactivity fees. However, there is a $75 transfer-out fee for full account transfers, and certain mutual funds may have short-term trading fees.

Can I trade cryptocurrency on TD Ameritrade’s platform?

While TD Ameritrade offers futures contracts for cryptocurrency, direct trading of cryptocurrencies is not available. However, you can invest in publicly traded funds that hold cryptocurrency.

What types of accounts can I open with TD Ameritrade?

TD Ameritrade offers a wide range of account types, including individual and joint taxable accounts, custodial accounts, 529 accounts, education savings accounts, trusts, and various retirement accounts like traditional and Roth IRAs.

Is there a simulator for practicing trading strategies on TD Ameritrade?

Yes, TD Ameritrade provides a trading simulator called paperMoney. It offers $100,000 in virtual cash for practice trading and is a valuable tool for honing your trading skills.

In other article, Mitigating Risk in Option Trading: A Comprehensive Guide